For the following calculate the companys net income EAT use

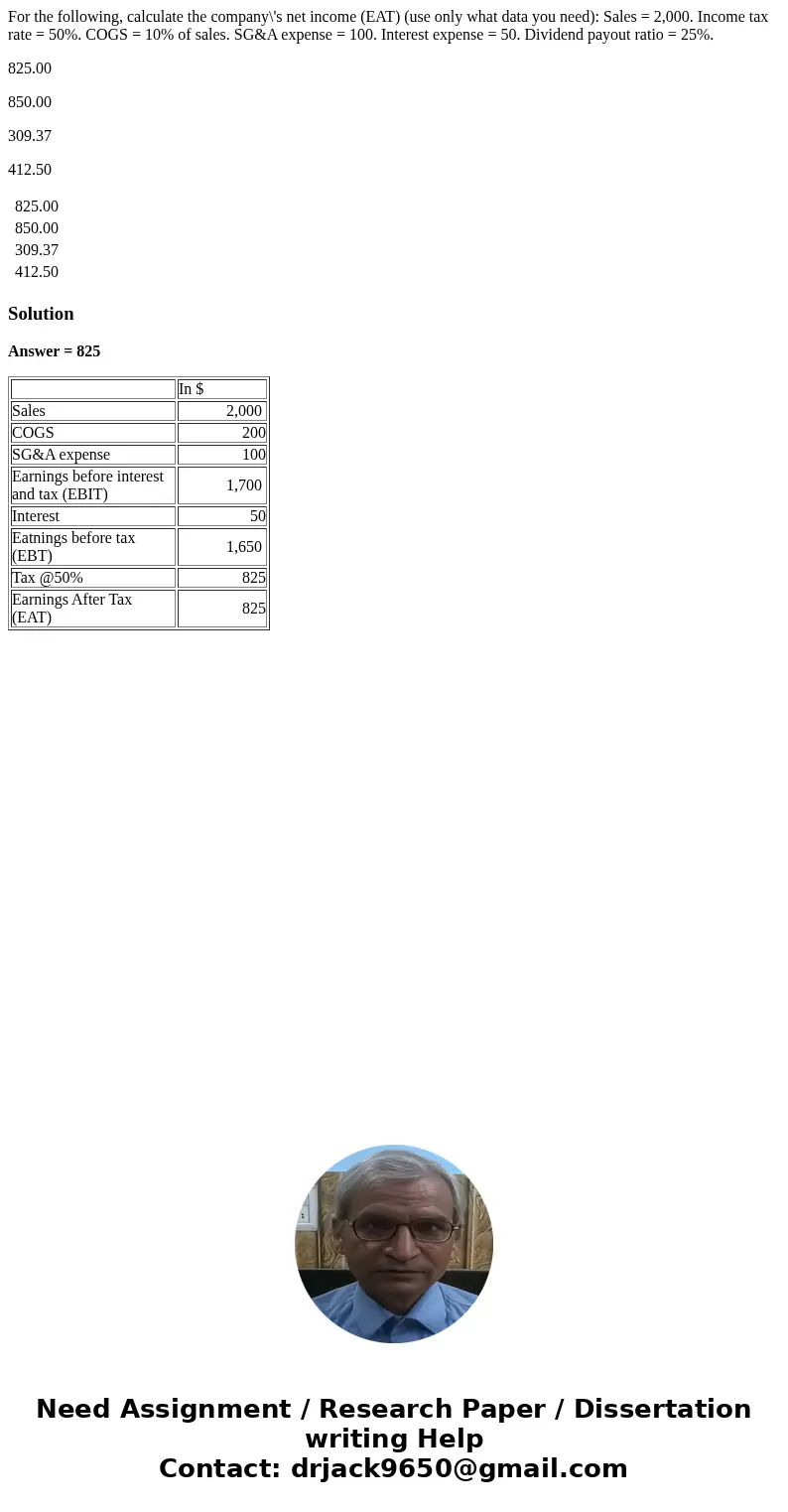

For the following, calculate the company\'s net income (EAT) (use only what data you need): Sales = 2,000. Income tax rate = 50%. COGS = 10% of sales. SG&A expense = 100. Interest expense = 50. Dividend payout ratio = 25%.

825.00

850.00

309.37

412.50

| 825.00 | |

| 850.00 | |

| 309.37 | |

| 412.50 |

Solution

Answer = 825

| In $ | |

| Sales | 2,000 |

| COGS | 200 |

| SG&A expense | 100 |

| Earnings before interest and tax (EBIT) | 1,700 |

| Interest | 50 |

| Eatnings before tax (EBT) | 1,650 |

| Tax @50% | 825 |

| Earnings After Tax (EAT) | 825 |

Homework Sourse

Homework Sourse