A particular countrys treasury issued a 35year bond on Febru

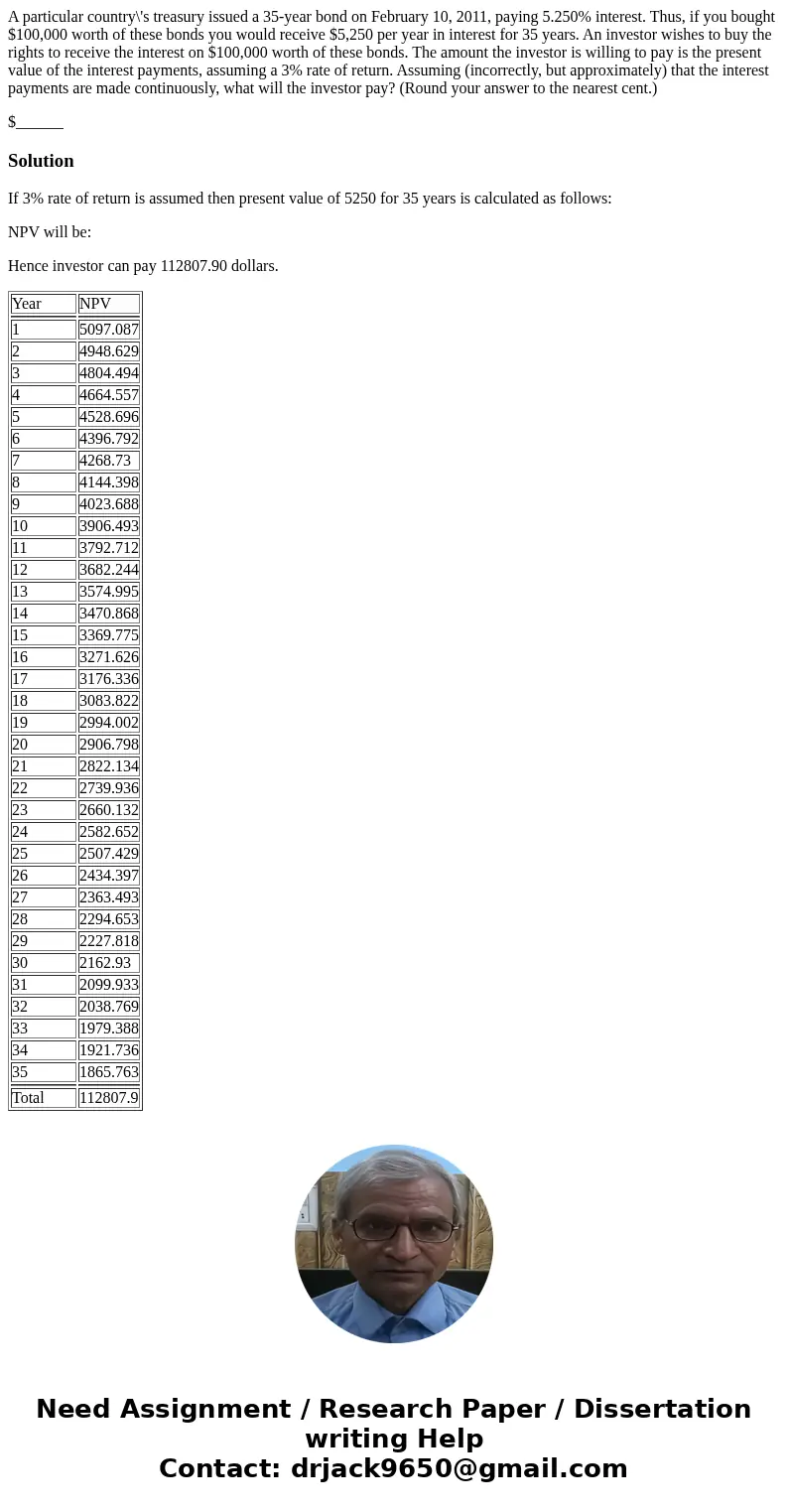

A particular country\'s treasury issued a 35-year bond on February 10, 2011, paying 5.250% interest. Thus, if you bought $100,000 worth of these bonds you would receive $5,250 per year in interest for 35 years. An investor wishes to buy the rights to receive the interest on $100,000 worth of these bonds. The amount the investor is willing to pay is the present value of the interest payments, assuming a 3% rate of return. Assuming (incorrectly, but approximately) that the interest payments are made continuously, what will the investor pay? (Round your answer to the nearest cent.)

$______

Solution

If 3% rate of return is assumed then present value of 5250 for 35 years is calculated as follows:

NPV will be:

Hence investor can pay 112807.90 dollars.

| Year | NPV |

| 1 | 5097.087 |

| 2 | 4948.629 |

| 3 | 4804.494 |

| 4 | 4664.557 |

| 5 | 4528.696 |

| 6 | 4396.792 |

| 7 | 4268.73 |

| 8 | 4144.398 |

| 9 | 4023.688 |

| 10 | 3906.493 |

| 11 | 3792.712 |

| 12 | 3682.244 |

| 13 | 3574.995 |

| 14 | 3470.868 |

| 15 | 3369.775 |

| 16 | 3271.626 |

| 17 | 3176.336 |

| 18 | 3083.822 |

| 19 | 2994.002 |

| 20 | 2906.798 |

| 21 | 2822.134 |

| 22 | 2739.936 |

| 23 | 2660.132 |

| 24 | 2582.652 |

| 25 | 2507.429 |

| 26 | 2434.397 |

| 27 | 2363.493 |

| 28 | 2294.653 |

| 29 | 2227.818 |

| 30 | 2162.93 |

| 31 | 2099.933 |

| 32 | 2038.769 |

| 33 | 1979.388 |

| 34 | 1921.736 |

| 35 | 1865.763 |

| Total | 112807.9 |

Homework Sourse

Homework Sourse