HW Ch 1416 Help Save Exit Submit Check my work 4 The fisca

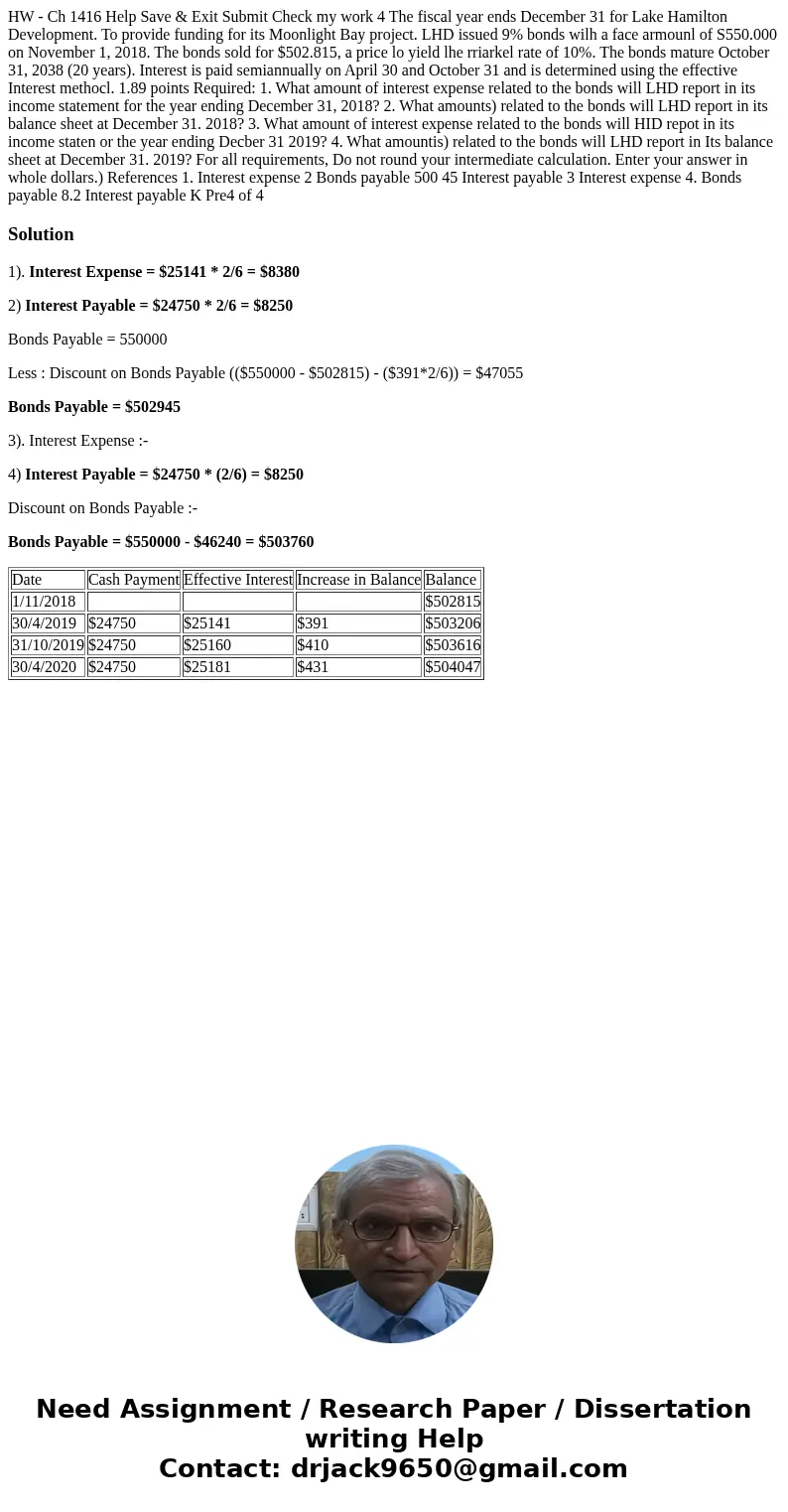

HW - Ch 1416 Help Save & Exit Submit Check my work 4 The fiscal year ends December 31 for Lake Hamilton Development. To provide funding for its Moonlight Bay project. LHD issued 9% bonds wilh a face armounl of S550.000 on November 1, 2018. The bonds sold for $502.815, a price lo yield lhe rriarkel rate of 10%. The bonds mature October 31, 2038 (20 years). Interest is paid semiannually on April 30 and October 31 and is determined using the effective Interest methocl. 1.89 points Required: 1. What amount of interest expense related to the bonds will LHD report in its income statement for the year ending December 31, 2018? 2. What amounts) related to the bonds will LHD report in its balance sheet at December 31. 2018? 3. What amount of interest expense related to the bonds will HID repot in its income staten or the year ending Decber 31 2019? 4. What amountis) related to the bonds will LHD report in Its balance sheet at December 31. 2019? For all requirements, Do not round your intermediate calculation. Enter your answer in whole dollars.) References 1. Interest expense 2 Bonds payable 500 45 Interest payable 3 Interest expense 4. Bonds payable 8.2 Interest payable K Pre4 of 4

Solution

1). Interest Expense = $25141 * 2/6 = $8380

2) Interest Payable = $24750 * 2/6 = $8250

Bonds Payable = 550000

Less : Discount on Bonds Payable (($550000 - $502815) - ($391*2/6)) = $47055

Bonds Payable = $502945

3). Interest Expense :-

4) Interest Payable = $24750 * (2/6) = $8250

Discount on Bonds Payable :-

Bonds Payable = $550000 - $46240 = $503760

| Date | Cash Payment | Effective Interest | Increase in Balance | Balance |

| 1/11/2018 | $502815 | |||

| 30/4/2019 | $24750 | $25141 | $391 | $503206 |

| 31/10/2019 | $24750 | $25160 | $410 | $503616 |

| 30/4/2020 | $24750 | $25181 | $431 | $504047 |

Homework Sourse

Homework Sourse