A firm begins the year with 25000 in assets of which 10000 i

A firm begins the year with $25,000 in assets, of which $10,000 is depreciable equipment, and $16,000 in owners\' equity. Its debt carries an interest rate of 5%. Revenue Total operating costs 22,500 Deprecation rate 10% Investment in new equipment2,200 (this does not get depreciated this year) Profits tax rate Dividend payout ratio 40% 30,000 25% What is the coverage ratio? What are its before- and after-tax profits for the year and ROE? How much does it pay in dividends? What are retained earnings? How much cash is added to the balance sheet at the end of the year? Can you see the difficulty with the new balance sheet?

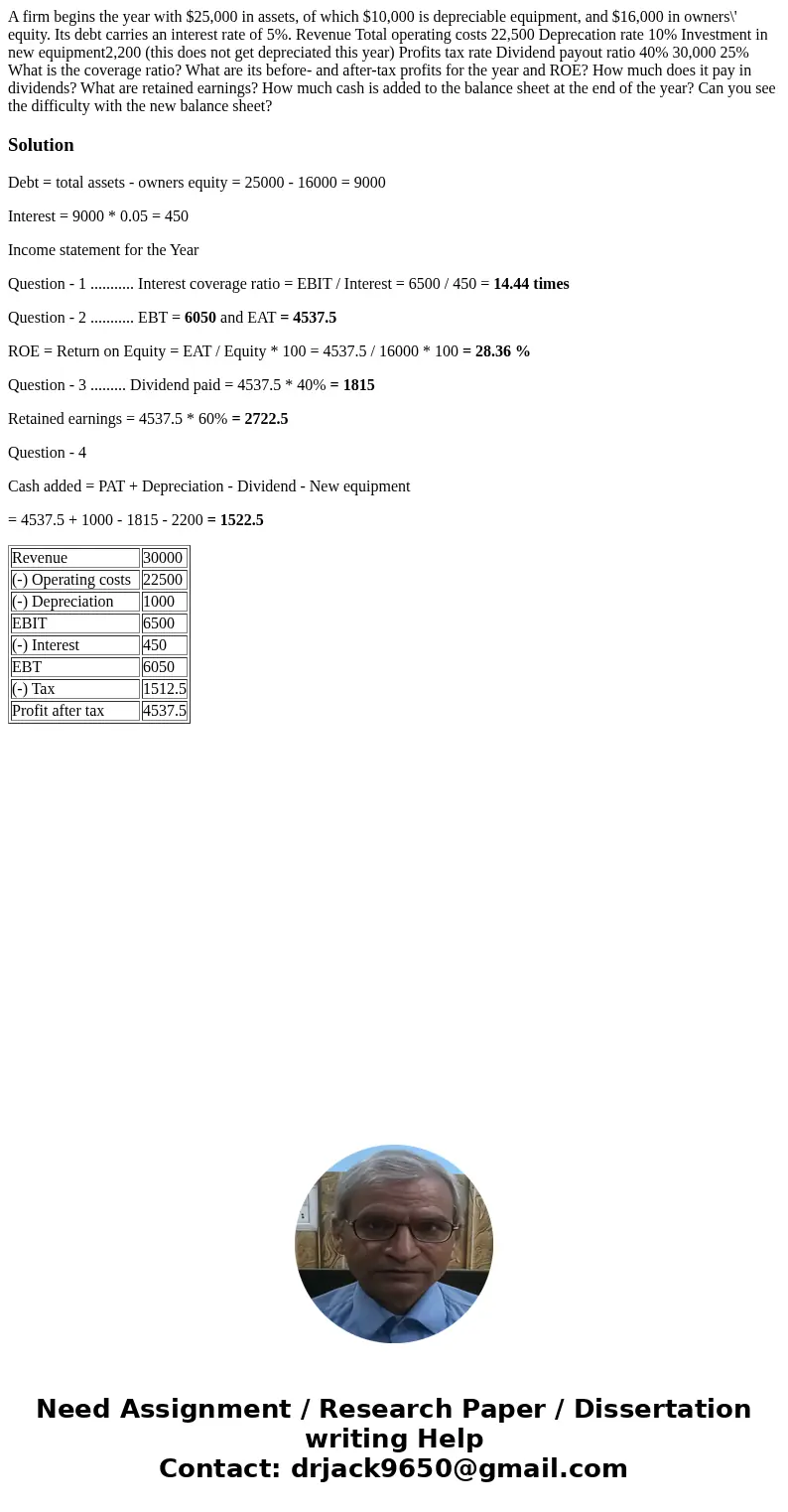

Solution

Debt = total assets - owners equity = 25000 - 16000 = 9000

Interest = 9000 * 0.05 = 450

Income statement for the Year

Question - 1 ........... Interest coverage ratio = EBIT / Interest = 6500 / 450 = 14.44 times

Question - 2 ........... EBT = 6050 and EAT = 4537.5

ROE = Return on Equity = EAT / Equity * 100 = 4537.5 / 16000 * 100 = 28.36 %

Question - 3 ......... Dividend paid = 4537.5 * 40% = 1815

Retained earnings = 4537.5 * 60% = 2722.5

Question - 4

Cash added = PAT + Depreciation - Dividend - New equipment

= 4537.5 + 1000 - 1815 - 2200 = 1522.5

| Revenue | 30000 |

| (-) Operating costs | 22500 |

| (-) Depreciation | 1000 |

| EBIT | 6500 |

| (-) Interest | 450 |

| EBT | 6050 |

| (-) Tax | 1512.5 |

| Profit after tax | 4537.5 |

Homework Sourse

Homework Sourse