Exercise 231 Prepare Statements for a Manufacturing Company

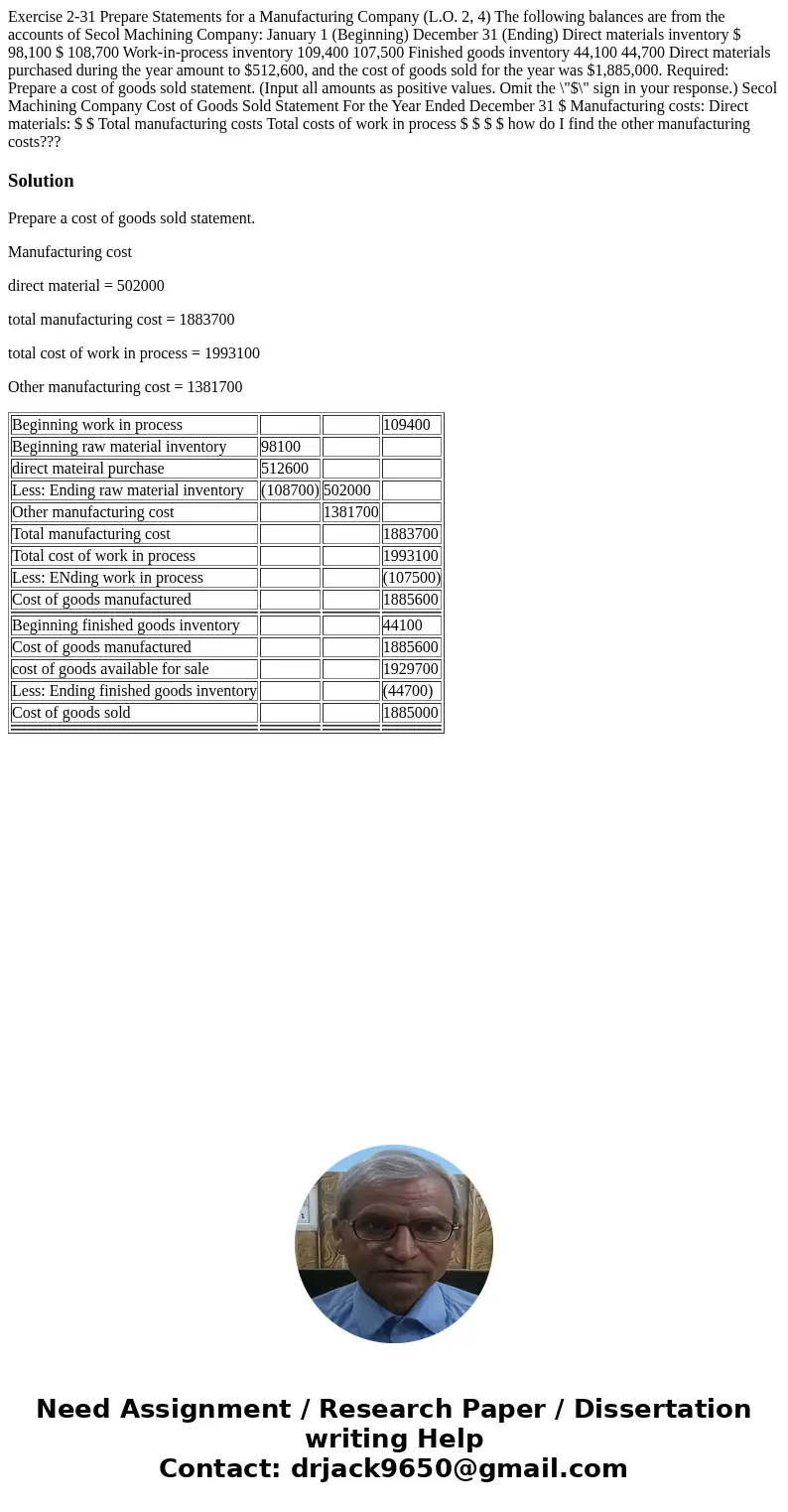

Exercise 2-31 Prepare Statements for a Manufacturing Company (L.O. 2, 4) The following balances are from the accounts of Secol Machining Company: January 1 (Beginning) December 31 (Ending) Direct materials inventory $ 98,100 $ 108,700 Work-in-process inventory 109,400 107,500 Finished goods inventory 44,100 44,700 Direct materials purchased during the year amount to $512,600, and the cost of goods sold for the year was $1,885,000. Required: Prepare a cost of goods sold statement. (Input all amounts as positive values. Omit the \"$\" sign in your response.) Secol Machining Company Cost of Goods Sold Statement For the Year Ended December 31 $ Manufacturing costs: Direct materials: $ $ Total manufacturing costs Total costs of work in process $ $ $ $ how do I find the other manufacturing costs???

Solution

Prepare a cost of goods sold statement.

Manufacturing cost

direct material = 502000

total manufacturing cost = 1883700

total cost of work in process = 1993100

Other manufacturing cost = 1381700

| Beginning work in process | 109400 | ||

| Beginning raw material inventory | 98100 | ||

| direct mateiral purchase | 512600 | ||

| Less: Ending raw material inventory | (108700) | 502000 | |

| Other manufacturing cost | 1381700 | ||

| Total manufacturing cost | 1883700 | ||

| Total cost of work in process | 1993100 | ||

| Less: ENding work in process | (107500) | ||

| Cost of goods manufactured | 1885600 | ||

| Beginning finished goods inventory | 44100 | ||

| Cost of goods manufactured | 1885600 | ||

| cost of goods available for sale | 1929700 | ||

| Less: Ending finished goods inventory | (44700) | ||

| Cost of goods sold | 1885000 | ||

Homework Sourse

Homework Sourse