JJ Industries will pay a regular dividend of 24 per share fo

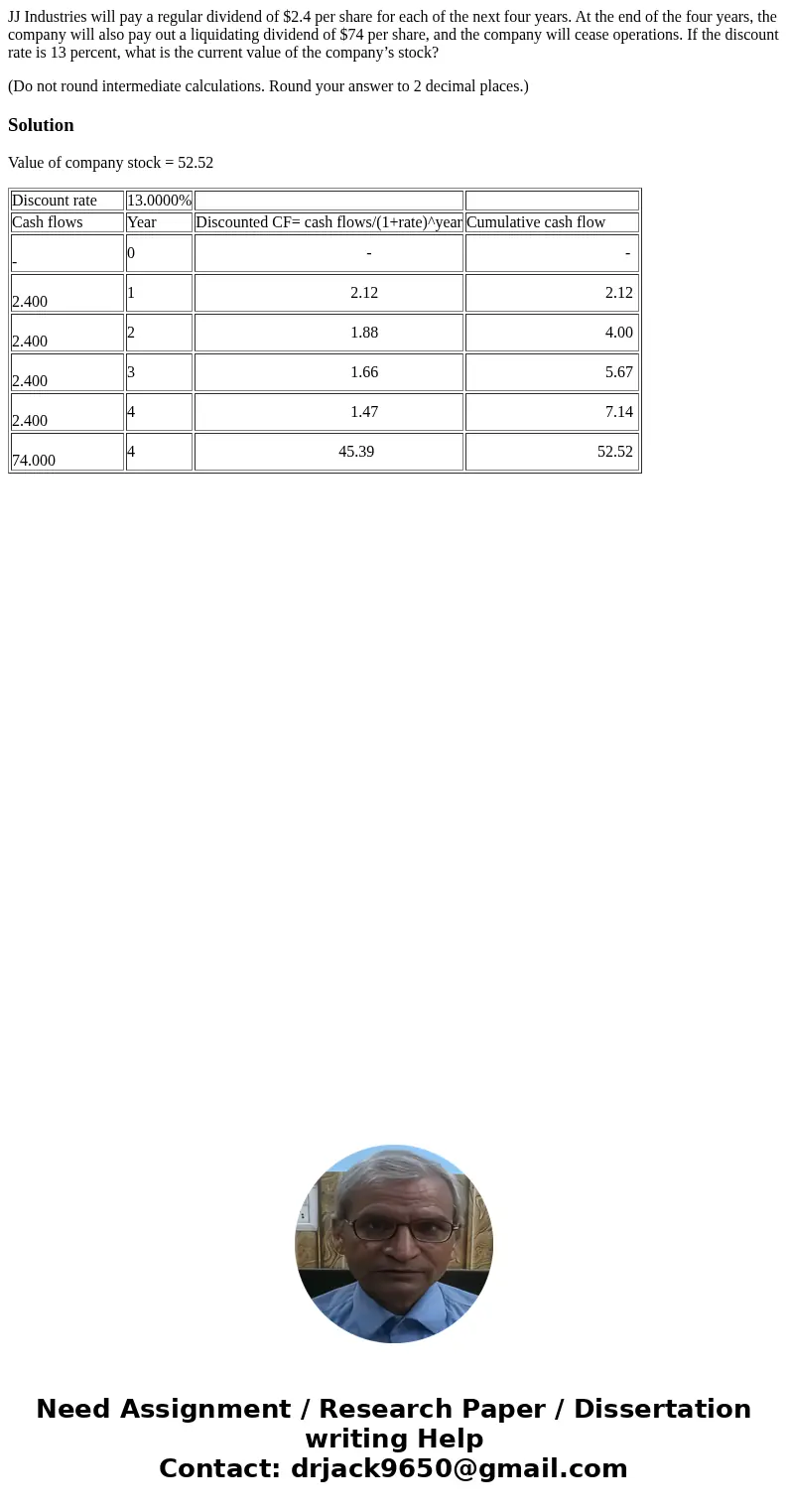

JJ Industries will pay a regular dividend of $2.4 per share for each of the next four years. At the end of the four years, the company will also pay out a liquidating dividend of $74 per share, and the company will cease operations. If the discount rate is 13 percent, what is the current value of the company’s stock?

(Do not round intermediate calculations. Round your answer to 2 decimal places.)

Solution

Value of company stock = 52.52

| Discount rate | 13.0000% | ||

| Cash flows | Year | Discounted CF= cash flows/(1+rate)^year | Cumulative cash flow |

| - | 0 | - | - |

| 2.400 | 1 | 2.12 | 2.12 |

| 2.400 | 2 | 1.88 | 4.00 |

| 2.400 | 3 | 1.66 | 5.67 |

| 2.400 | 4 | 1.47 | 7.14 |

| 74.000 | 4 | 45.39 | 52.52 |

Homework Sourse

Homework Sourse