Capital rati na NPV approach A firm with a 132 cost of capit

Solution

The present value of the cash inflows for the project A is $288,000

The present value of the cash inflows for the project B is $215,000

The present value of the cash inflows for the project C is $234,000

The present value of the cash inflows for the project D is $791,000

The present value of the cash inflows for the project E is $562,000

The present value of the cash inflows for the project F is $359,000

The present value of the cash inflows for the project G is $768,000

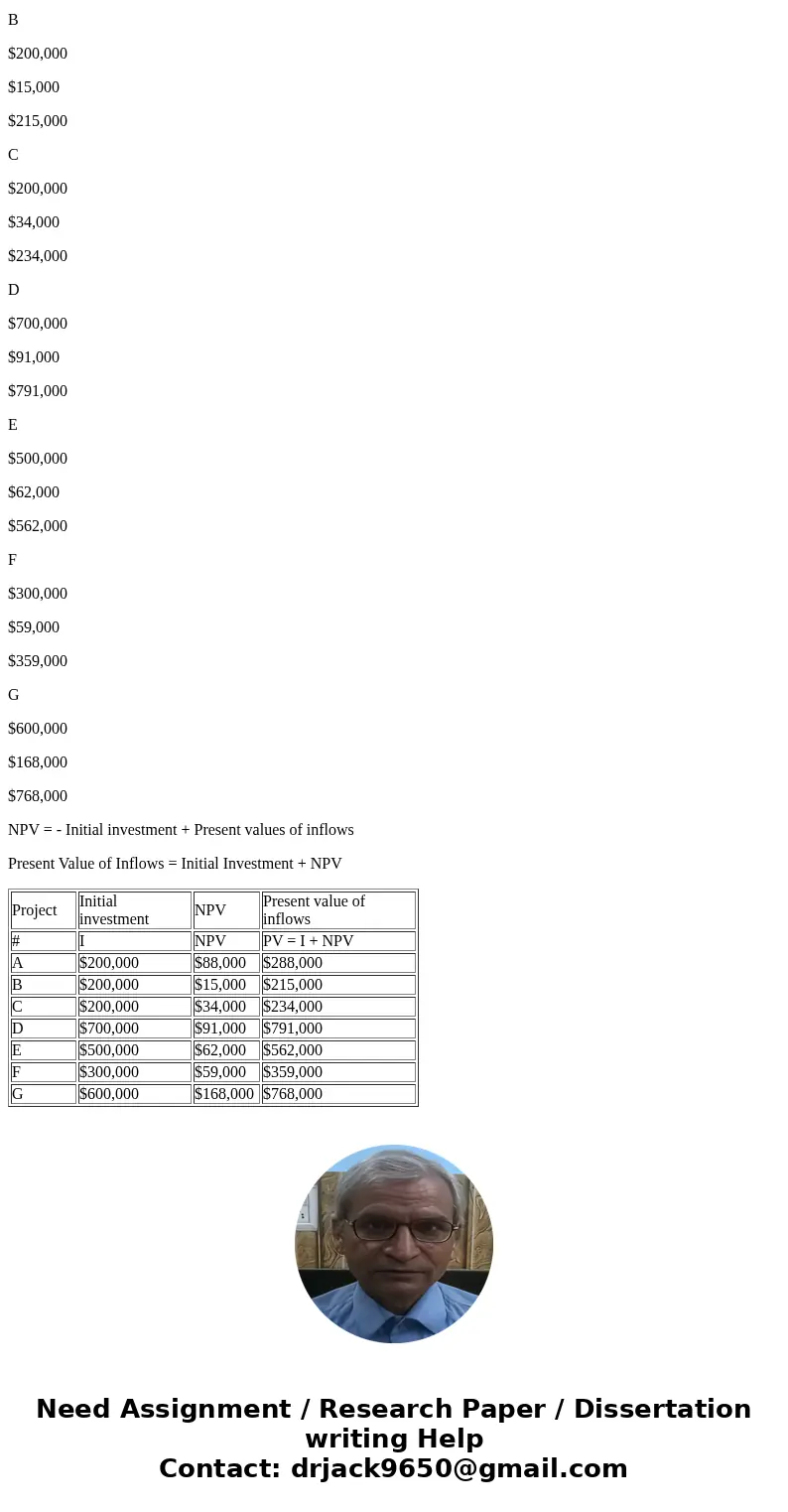

Working:

Project

Initial investment

NPV

Present value of inflows

#

I

NPV

PV = I + NPV

A

$200,000

$88,000

$288,000

B

$200,000

$15,000

$215,000

C

$200,000

$34,000

$234,000

D

$700,000

$91,000

$791,000

E

$500,000

$62,000

$562,000

F

$300,000

$59,000

$359,000

G

$600,000

$168,000

$768,000

NPV = - Initial investment + Present values of inflows

Present Value of Inflows = Initial Investment + NPV

| Project | Initial investment | NPV | Present value of inflows |

| # | I | NPV | PV = I + NPV |

| A | $200,000 | $88,000 | $288,000 |

| B | $200,000 | $15,000 | $215,000 |

| C | $200,000 | $34,000 | $234,000 |

| D | $700,000 | $91,000 | $791,000 |

| E | $500,000 | $62,000 | $562,000 |

| F | $300,000 | $59,000 | $359,000 |

| G | $600,000 | $168,000 | $768,000 |

Homework Sourse

Homework Sourse