Taussig Technologies Corporation TTC has been growing at a r

Taussig Technologies Corporation (TTC) has been growing at a rate of 19% per year in recent years. This same growth rate is expected to last for another 2 years, then decline to gn = 8%.

If D0 = $1.00 and rs = 9.00%, what is TTC\'s stock worth today? Round your answer to the nearest cent. Do not round your intermediate calculations.

$

What is its expected dividend yield at this time, that is, during Year 1? Round your answer to two decimal places. Do not round your intermediate calculations.

%

What is its capital gains yields at this time, that is, during Year 1? Round your answer to two decimal places. Do not round your intermediate calculations.

%

What will TTC\'s dividend and capital gains yields be once its period of supernormal growth ends? (Hint: These values will be the same regardless of whether you examine the case of 2 or 5 years of supernormal growth; the calculations are very easy.)

Round your answers to two decimal places.

Dividend yield

%

Capital gains yield

%

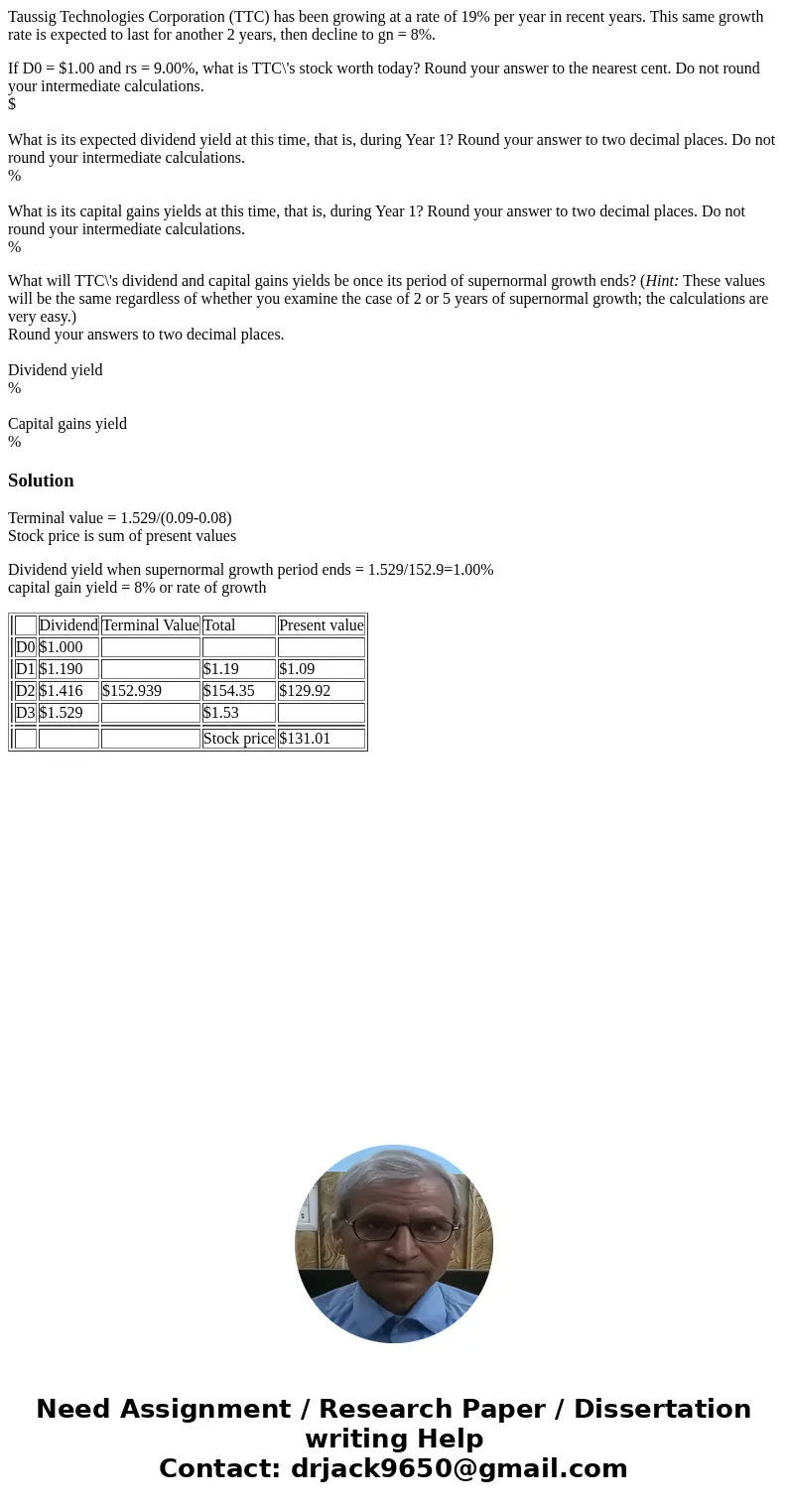

Solution

Terminal value = 1.529/(0.09-0.08)

Stock price is sum of present values

Dividend yield when supernormal growth period ends = 1.529/152.9=1.00%

capital gain yield = 8% or rate of growth

| Dividend | Terminal Value | Total | Present value | ||

| D0 | $1.000 | ||||

| D1 | $1.190 | $1.19 | $1.09 | ||

| D2 | $1.416 | $152.939 | $154.35 | $129.92 | |

| D3 | $1.529 | $1.53 | |||

| Stock price | $131.01 |

Homework Sourse

Homework Sourse