Kana is a single wage earner with no dependents and taxable

Kana is a single wage earner with no dependents and taxable income of $155,000 in 2017. Her 2017 withholding was $32,000. Her 2016 taxable income was $151,000 and tax liability was $35,317.

Calculate Kana’s 2017 income tax liability and the minimum required 2017 annual payment necessary to avoid any penalty. Round your answers to two decimal places.

Click here to access the tax rate schedules.

1. Kana’s 2017 income tax liability: $

2. Kana’s minimum required 2017 annual payment necessary to avoid any penalty:

Solution

1.

2. If minimum 90% of the Tax liability is paid, Kana can avoid penalty

Therefore, Minimum Tax to be paid to avoid the penalty is 28,744.65

Dear Student,

Best effort has been made to give quality and correct answer. But if you find any issues please comment your concern. I will definitely resolve your query.

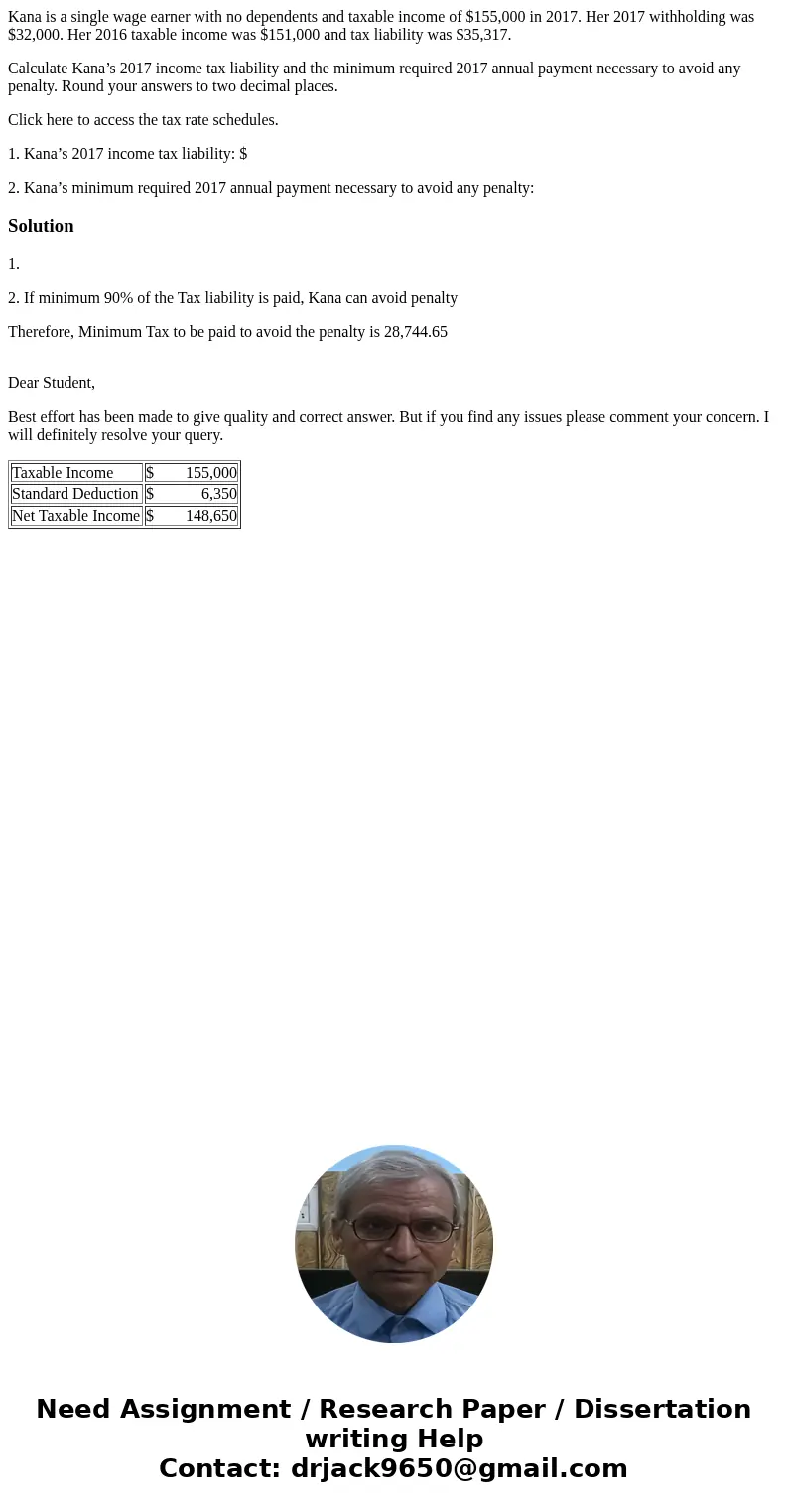

| Taxable Income | $ 155,000 |

| Standard Deduction | $ 6,350 |

| Net Taxable Income | $ 148,650 |

Homework Sourse

Homework Sourse