Mortgage Extra Credit Problem 15 points Due Last day of clas

Solution

Answer

A.

Number of payment=5

Interest rate =10%

loan amount=$300000

annual installment payment =300000/3.7908=79139.25

(Factor @ 10% for 5 Years (1/1.10, 5times))

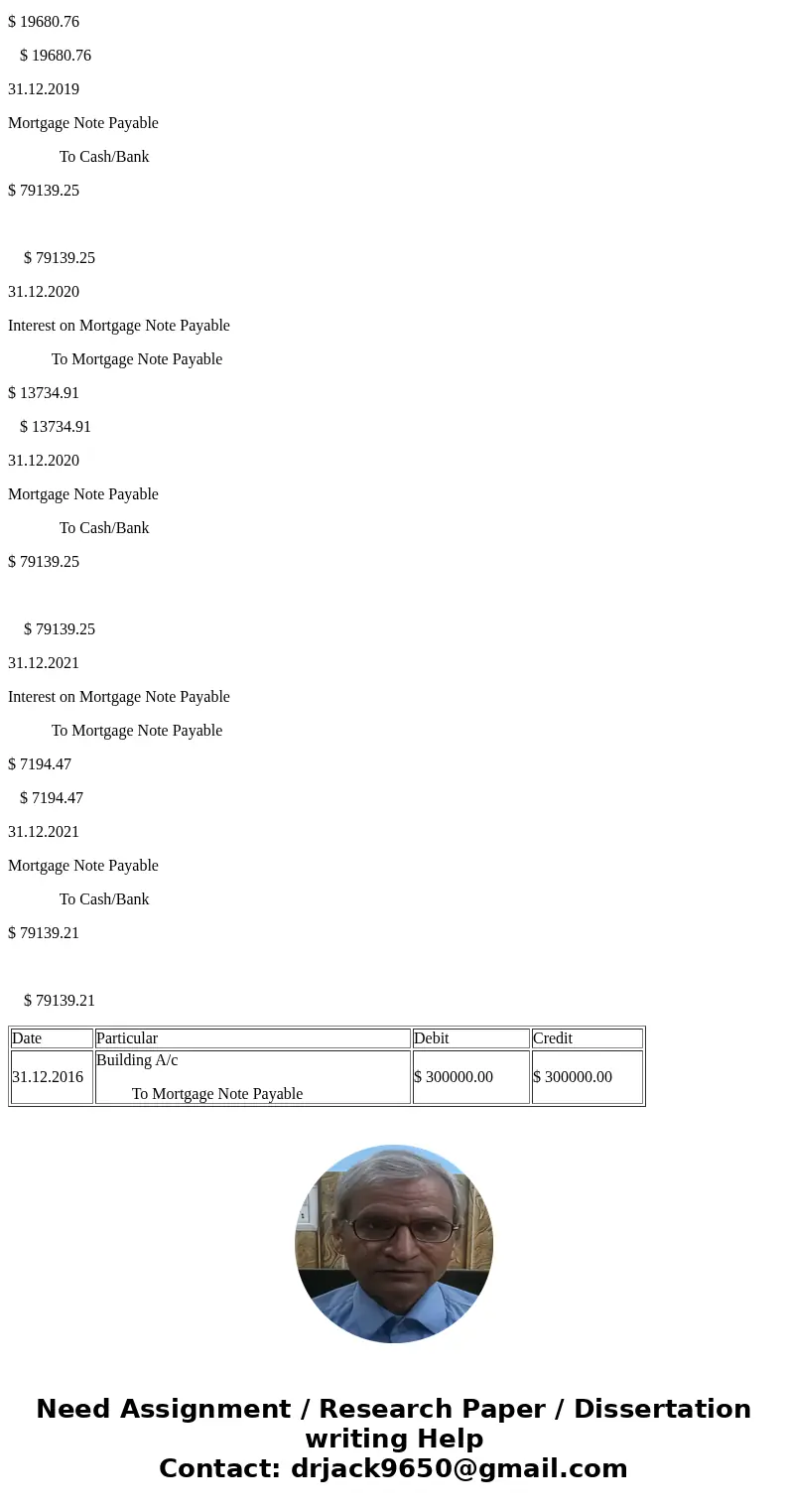

B.

General Journal Entries

Date

Particular

Debit

Credit

31.12.2016

Building A/c

To Mortgage Note Payable

$ 300000.00

$ 300000.00

C.

Mortgage Loan payment schedule(effective interest amortization table)

Year

Opening Outstanding

Installment

Principal

Interest

Balance

2011

300000.00

79139.25

49139.25

30000.00

250860.75

2012

250860.75

79139.25

54053.18

25086.08

196807.58

2013

196807.58

79139.25

59458.49

19680.76

137349.08

2014

137349.08

79139.25

65404.34

13734.91

71944.74

2015

71944.74

79139.21

71944.74

7194.47

0.00

D.

General Journal Entries

Date

Particular

Debit

Credit

31.12.2017

Interest on Mortgage Note Payable

To Mortgage Note Payable

$ 30000.00

$ 30000.00

31.12.2017

Mortgage Note Payable

To Cash/Bank

$ 79139.25

$ 79139.25

31.12.2018

Interest on Mortgage Note Payable

To Mortgage Note Payable

$ 25086.075

$ 25086.075

31.12.2018

Mortgage Note Payable

To Cash/Bank

$ 79139.25

$ 79139.25

31.12.2019

Interest on Mortgage Note Payable

To Mortgage Note Payable

$ 19680.76

$ 19680.76

31.12.2019

Mortgage Note Payable

To Cash/Bank

$ 79139.25

$ 79139.25

31.12.2020

Interest on Mortgage Note Payable

To Mortgage Note Payable

$ 13734.91

$ 13734.91

31.12.2020

Mortgage Note Payable

To Cash/Bank

$ 79139.25

$ 79139.25

31.12.2021

Interest on Mortgage Note Payable

To Mortgage Note Payable

$ 7194.47

$ 7194.47

31.12.2021

Mortgage Note Payable

To Cash/Bank

$ 79139.21

$ 79139.21

| Date | Particular | Debit | Credit |

| 31.12.2016 | Building A/c To Mortgage Note Payable | $ 300000.00 | $ 300000.00 |

Homework Sourse

Homework Sourse