8 During 2015 George receives a 60000 salary and has no dedu

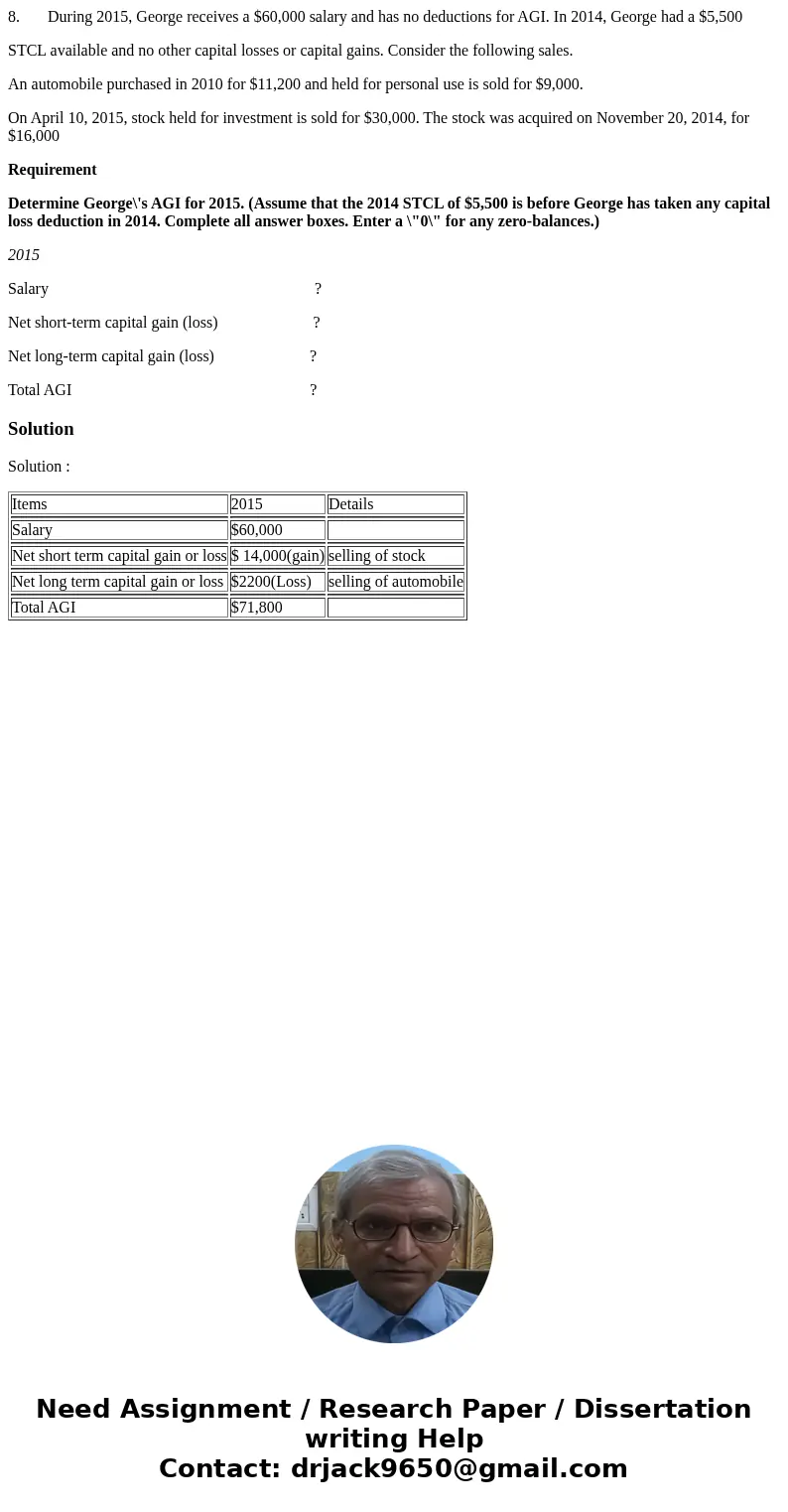

8. During 2015, George receives a $60,000 salary and has no deductions for AGI. In 2014, George had a $5,500

STCL available and no other capital losses or capital gains. Consider the following sales.

An automobile purchased in 2010 for $11,200 and held for personal use is sold for $9,000.

On April 10, 2015, stock held for investment is sold for $30,000. The stock was acquired on November 20, 2014, for $16,000

Requirement

Determine George\'s AGI for 2015. (Assume that the 2014 STCL of $5,500 is before George has taken any capital loss deduction in 2014. Complete all answer boxes. Enter a \"0\" for any zero-balances.)

2015

Salary ?

Net short-term capital gain (loss) ?

Net long-term capital gain (loss) ?

Total AGI ?

Solution

Solution :

| Items | 2015 | Details |

| Salary | $60,000 | |

| Net short term capital gain or loss | $ 14,000(gain) | selling of stock |

| Net long term capital gain or loss | $2200(Loss) | selling of automobile |

| Total AGI | $71,800 |

Homework Sourse

Homework Sourse