2 Which of the following bonds would be cheapest to deliver

2) Which of the following bonds would be cheapest to deliver given a T-note futures price of 90.4697? (Assume that all bonds have semiannual coupon payments based on a par value of $100.)

Answers: a. 9.5-year bond with 4.5% coupons and a yield of 3.5%

b. 7.5-year bond with 6.5% coupons and a yield of 7.5%

c. 6.5-year bond with 8.5% coupons and a yield of 8%

Please explain with steps, thank you!

Solution

Correct option is > b. 7.5-year bond with 6.5% coupons and a yield of 7.5%

The lowest price can be noted for bond (b). Lowest price is always cheapest to deliver.

Working below:

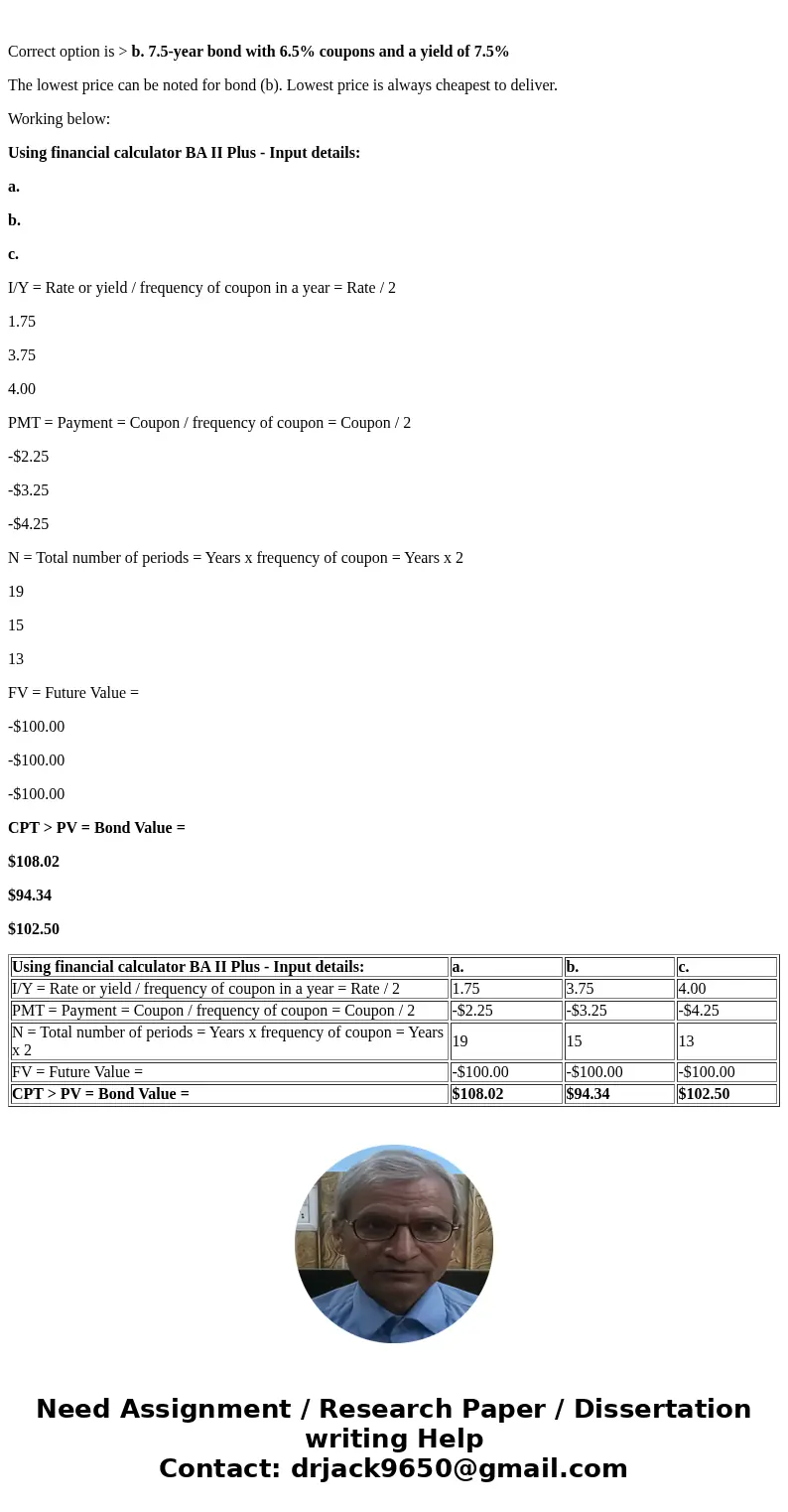

Using financial calculator BA II Plus - Input details:

a.

b.

c.

I/Y = Rate or yield / frequency of coupon in a year = Rate / 2

1.75

3.75

4.00

PMT = Payment = Coupon / frequency of coupon = Coupon / 2

-$2.25

-$3.25

-$4.25

N = Total number of periods = Years x frequency of coupon = Years x 2

19

15

13

FV = Future Value =

-$100.00

-$100.00

-$100.00

CPT > PV = Bond Value =

$108.02

$94.34

$102.50

| Using financial calculator BA II Plus - Input details: | a. | b. | c. |

| I/Y = Rate or yield / frequency of coupon in a year = Rate / 2 | 1.75 | 3.75 | 4.00 |

| PMT = Payment = Coupon / frequency of coupon = Coupon / 2 | -$2.25 | -$3.25 | -$4.25 |

| N = Total number of periods = Years x frequency of coupon = Years x 2 | 19 | 15 | 13 |

| FV = Future Value = | -$100.00 | -$100.00 | -$100.00 |

| CPT > PV = Bond Value = | $108.02 | $94.34 | $102.50 |

Homework Sourse

Homework Sourse