To please be done in excel Based on a market survey which co

To please be done in excel: Based on a market survey (which cost $100 000), the probable demand for “Tab” in the first year has been estimated. New plant with a maximum annual capacity of 10 000 units can be purchased for $3.5 million. The plant has an estimated useful life for four years, at the end of which the residual value is expected to be $350 000. Variable production costs are estimated at $1 000 per unit, while additional fixed costs, based on a capacity of 10 000 units and before allowing for depreciation, are expected to amount to $250 per unit. These fixed costs will be avoidable if local manufacture does not take place. The “Tab” would sell for $1 700 each, some $500 less than the selling price of the cheap imported tablets currently sold by ABC. This would mean that the current sales of 7 000 units per annum of the cheap imported machines would cease. The contribution generated by sale of these imported machines amounts to $250 per unit. Existing fixed costs amount to $1,75 million per annum, and will still be incurred if local manufacture takes place. The new plant would be written off over 5 years on a straight-line basis for tax purposes. The corporate tax rate is 30% and ABC uses a discount rate of 18% for all projects of this type. There are no expected changes to the working capital of the business. Question: Assuming that all four years have the same net incremental cash flows as calculated, and taking into account any other relevant cash flows, show that the NPV, IRR and Payback Period of the project as a whole are: $274 805.27, 21.8% and 2.66 years respectively.

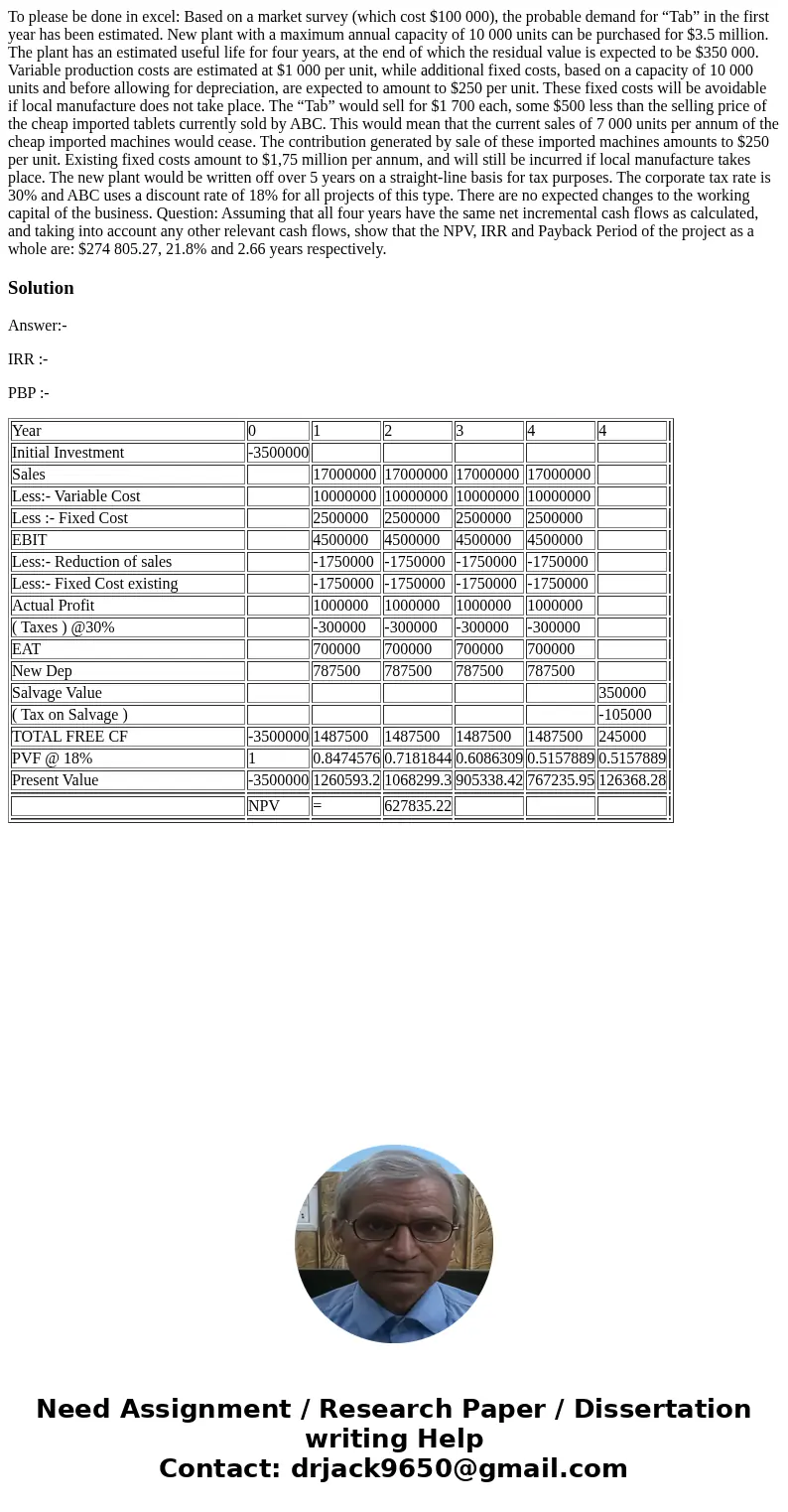

Solution

Answer:-

IRR :-

PBP :-

| Year | 0 | 1 | 2 | 3 | 4 | 4 | |

| Initial Investment | -3500000 | ||||||

| Sales | 17000000 | 17000000 | 17000000 | 17000000 | |||

| Less:- Variable Cost | 10000000 | 10000000 | 10000000 | 10000000 | |||

| Less :- Fixed Cost | 2500000 | 2500000 | 2500000 | 2500000 | |||

| EBIT | 4500000 | 4500000 | 4500000 | 4500000 | |||

| Less:- Reduction of sales | -1750000 | -1750000 | -1750000 | -1750000 | |||

| Less:- Fixed Cost existing | -1750000 | -1750000 | -1750000 | -1750000 | |||

| Actual Profit | 1000000 | 1000000 | 1000000 | 1000000 | |||

| ( Taxes ) @30% | -300000 | -300000 | -300000 | -300000 | |||

| EAT | 700000 | 700000 | 700000 | 700000 | |||

| New Dep | 787500 | 787500 | 787500 | 787500 | |||

| Salvage Value | 350000 | ||||||

| ( Tax on Salvage ) | -105000 | ||||||

| TOTAL FREE CF | -3500000 | 1487500 | 1487500 | 1487500 | 1487500 | 245000 | |

| PVF @ 18% | 1 | 0.8474576 | 0.7181844 | 0.6086309 | 0.5157889 | 0.5157889 | |

| Present Value | -3500000 | 1260593.2 | 1068299.3 | 905338.42 | 767235.95 | 126368.28 | |

| NPV | = | 627835.22 | |||||

Homework Sourse

Homework Sourse