Exercise 1513 The common stock of Coronado Inc is currently

Exercise 15-13

The common stock of Coronado Inc. is currently selling at $114 per share. The directors wish to reduce the share price and increase share volume prior to a new issue. The per share par value is $10; book value is $63 per share. 8.70 million shares are issued and outstanding.

Prepare the necessary journal entries assuming the following. (Enter amounts in dollars. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select \"No Entry\" for the account titles and enter 0 for the amounts.)

No.

Account Titles and Explanation

Debit

Credit

(To record the declaration)

(To record the distribution)

Open Show Work

| (a) | The board votes a 2-for-1 stock split. | |

| (b) | The board votes a 100% stock dividend. |

Solution

(a).

No

Account Titles and Explanation

Debit

Credit

(a).

No entry

0

No entry

0

(b).

Retained Earnings

$87000000

Common Stock Dividend Distributable

$87000000

(To record the declaration)

Common Stock Dividend Distributable

$87000000

Common Stock

$87000000

(To record the distribution)

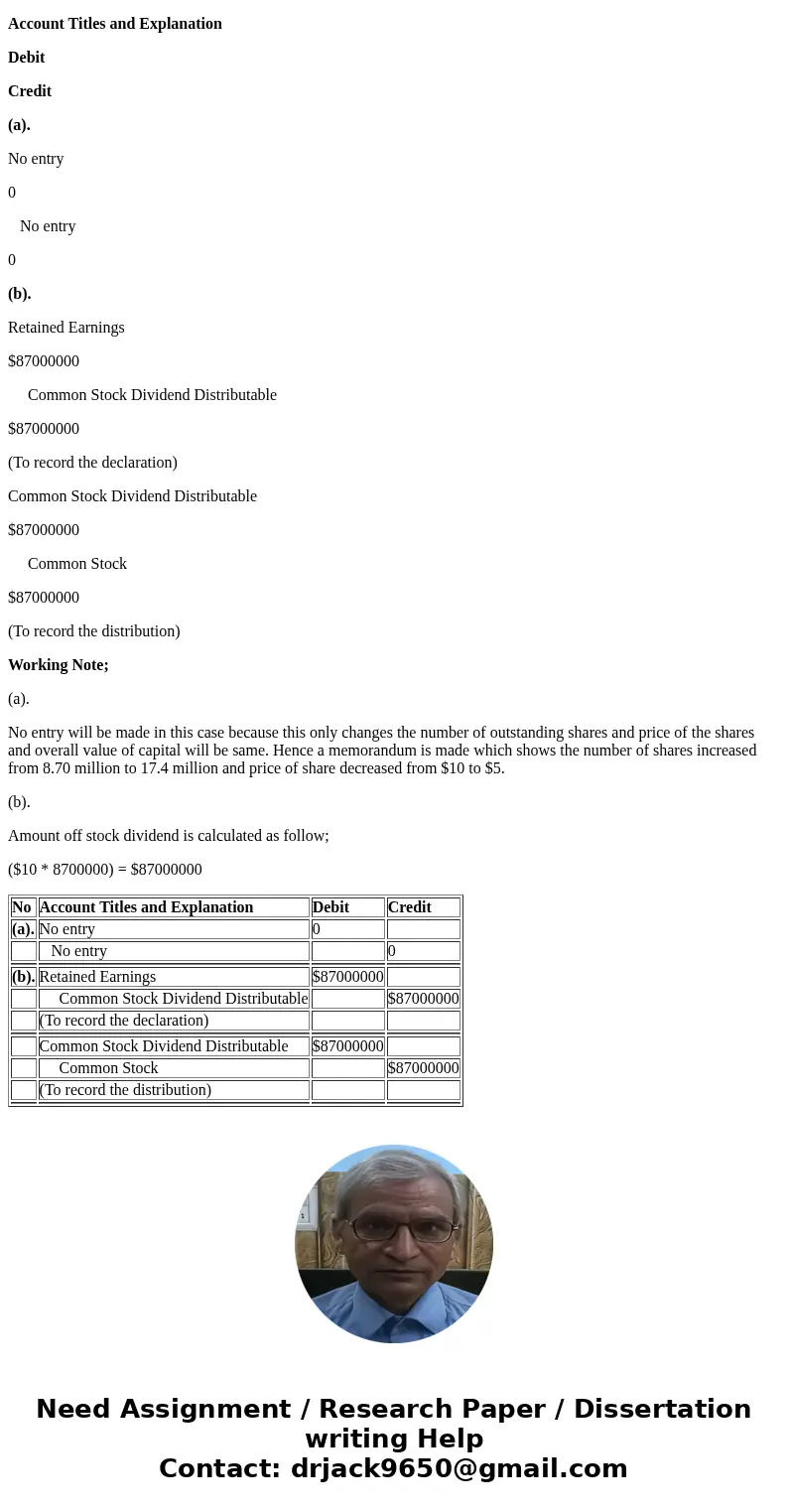

Working Note;

(a).

No entry will be made in this case because this only changes the number of outstanding shares and price of the shares and overall value of capital will be same. Hence a memorandum is made which shows the number of shares increased from 8.70 million to 17.4 million and price of share decreased from $10 to $5.

(b).

Amount off stock dividend is calculated as follow;

($10 * 8700000) = $87000000

| No | Account Titles and Explanation | Debit | Credit |

| (a). | No entry | 0 | |

| No entry | 0 | ||

| (b). | Retained Earnings | $87000000 | |

| Common Stock Dividend Distributable | $87000000 | ||

| (To record the declaration) | |||

| Common Stock Dividend Distributable | $87000000 | ||

| Common Stock | $87000000 | ||

| (To record the distribution) | |||

Homework Sourse

Homework Sourse