Balance Sheets Assets Cash Accounts receivable Inventories 2

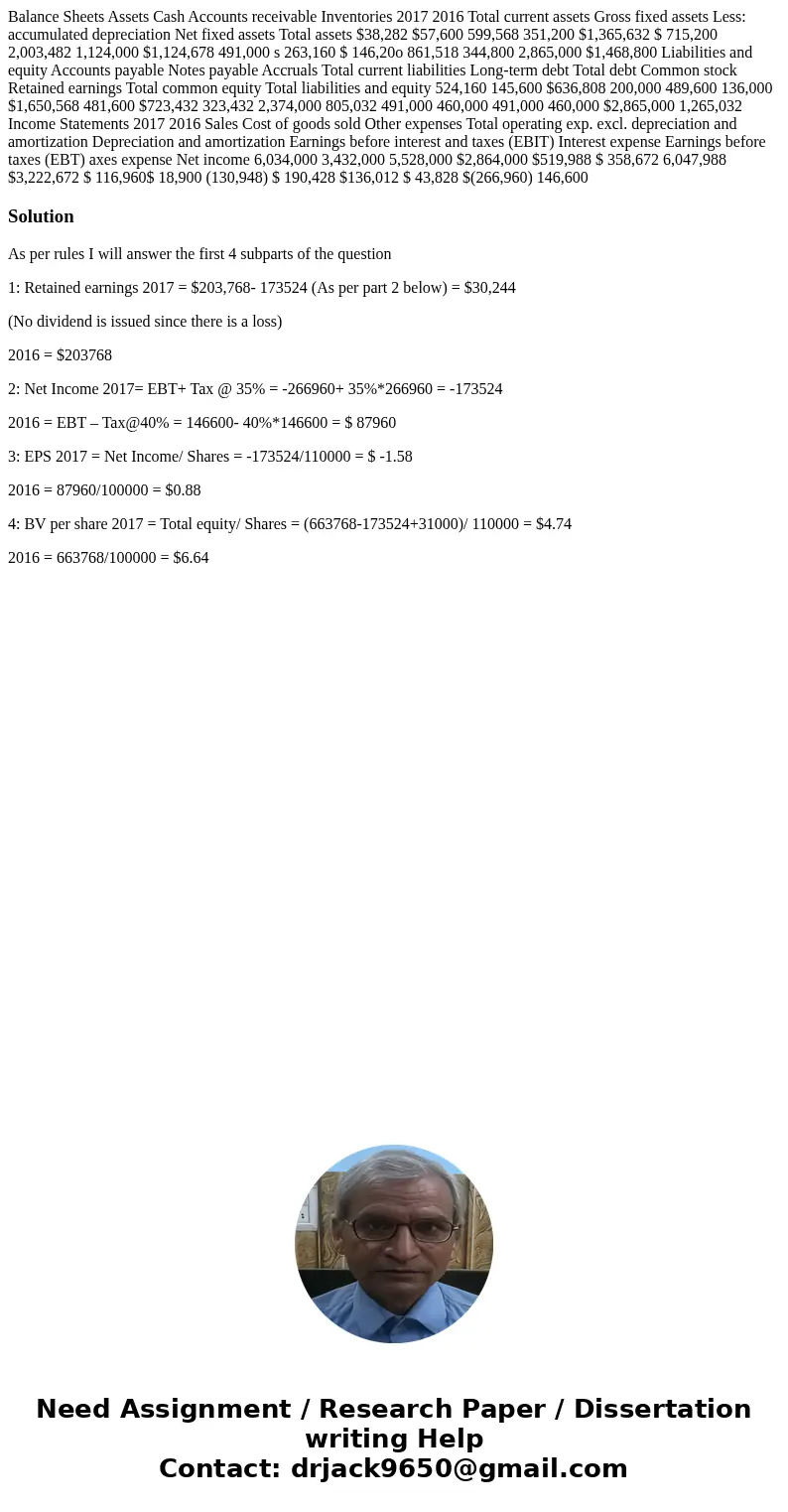

Balance Sheets Assets Cash Accounts receivable Inventories 2017 2016 Total current assets Gross fixed assets Less: accumulated depreciation Net fixed assets Total assets $38,282 $57,600 599,568 351,200 $1,365,632 $ 715,200 2,003,482 1,124,000 $1,124,678 491,000 s 263,160 $ 146,20o 861,518 344,800 2,865,000 $1,468,800 Liabilities and equity Accounts payable Notes payable Accruals Total current liabilities Long-term debt Total debt Common stock Retained earnings Total common equity Total liabilities and equity 524,160 145,600 $636,808 200,000 489,600 136,000 $1,650,568 481,600 $723,432 323,432 2,374,000 805,032 491,000 460,000 491,000 460,000 $2,865,000 1,265,032 Income Statements 2017 2016 Sales Cost of goods sold Other expenses Total operating exp. excl. depreciation and amortization Depreciation and amortization Earnings before interest and taxes (EBIT) Interest expense Earnings before taxes (EBT) axes expense Net income 6,034,000 3,432,000 5,528,000 $2,864,000 $519,988 $ 358,672 6,047,988 $3,222,672 $ 116,960$ 18,900 (130,948) $ 190,428 $136,012 $ 43,828 $(266,960) 146,600

Solution

As per rules I will answer the first 4 subparts of the question

1: Retained earnings 2017 = $203,768- 173524 (As per part 2 below) = $30,244

(No dividend is issued since there is a loss)

2016 = $203768

2: Net Income 2017= EBT+ Tax @ 35% = -266960+ 35%*266960 = -173524

2016 = EBT – Tax@40% = 146600- 40%*146600 = $ 87960

3: EPS 2017 = Net Income/ Shares = -173524/110000 = $ -1.58

2016 = 87960/100000 = $0.88

4: BV per share 2017 = Total equity/ Shares = (663768-173524+31000)/ 110000 = $4.74

2016 = 663768/100000 = $6.64

Homework Sourse

Homework Sourse