Delia Landscaping is considering a new 4year project The nec

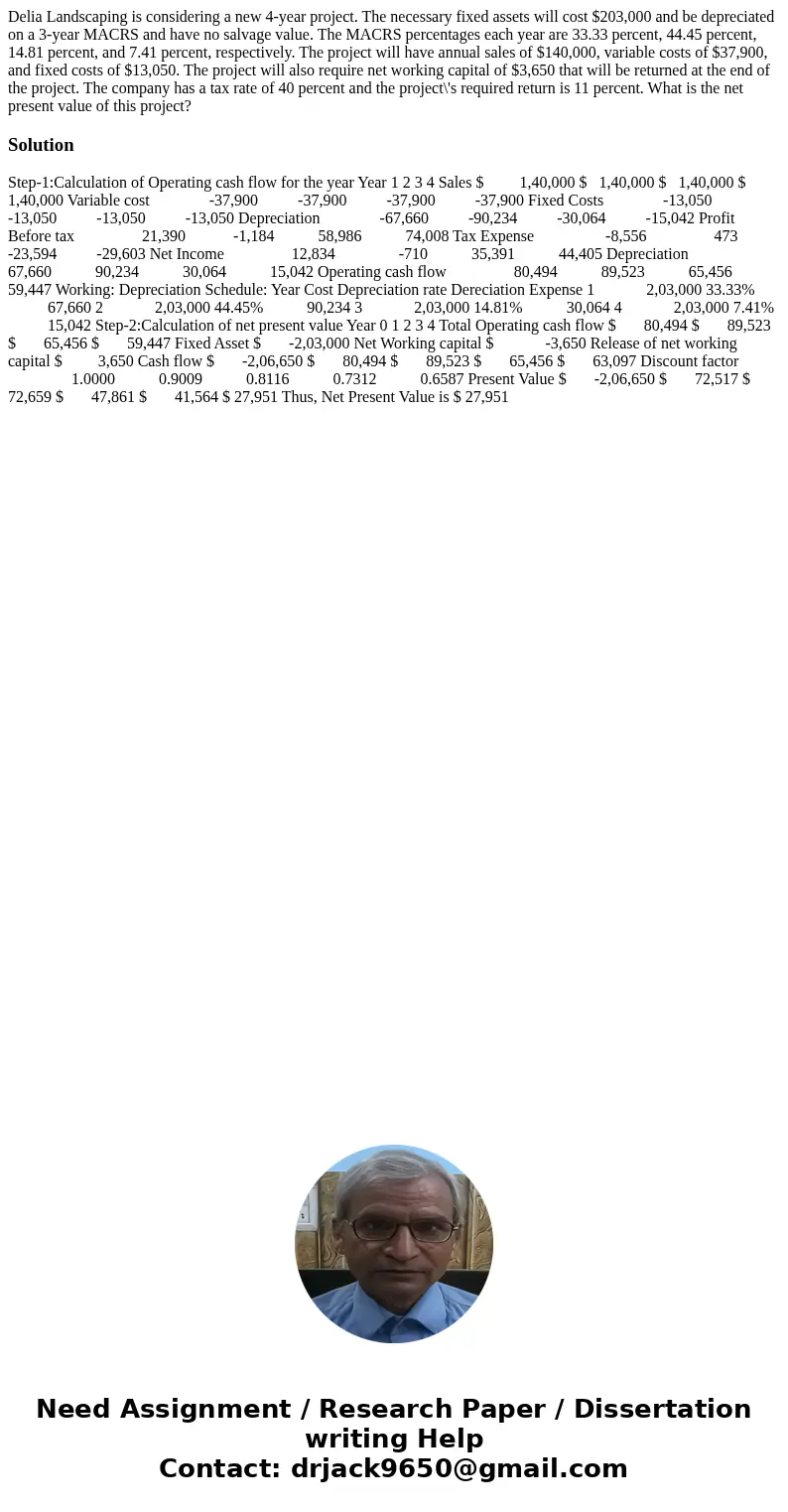

Delia Landscaping is considering a new 4-year project. The necessary fixed assets will cost $203,000 and be depreciated on a 3-year MACRS and have no salvage value. The MACRS percentages each year are 33.33 percent, 44.45 percent, 14.81 percent, and 7.41 percent, respectively. The project will have annual sales of $140,000, variable costs of $37,900, and fixed costs of $13,050. The project will also require net working capital of $3,650 that will be returned at the end of the project. The company has a tax rate of 40 percent and the project\'s required return is 11 percent. What is the net present value of this project?

Solution

Step-1:Calculation of Operating cash flow for the year Year 1 2 3 4 Sales $ 1,40,000 $ 1,40,000 $ 1,40,000 $ 1,40,000 Variable cost -37,900 -37,900 -37,900 -37,900 Fixed Costs -13,050 -13,050 -13,050 -13,050 Depreciation -67,660 -90,234 -30,064 -15,042 Profit Before tax 21,390 -1,184 58,986 74,008 Tax Expense -8,556 473 -23,594 -29,603 Net Income 12,834 -710 35,391 44,405 Depreciation 67,660 90,234 30,064 15,042 Operating cash flow 80,494 89,523 65,456 59,447 Working: Depreciation Schedule: Year Cost Depreciation rate Dereciation Expense 1 2,03,000 33.33% 67,660 2 2,03,000 44.45% 90,234 3 2,03,000 14.81% 30,064 4 2,03,000 7.41% 15,042 Step-2:Calculation of net present value Year 0 1 2 3 4 Total Operating cash flow $ 80,494 $ 89,523 $ 65,456 $ 59,447 Fixed Asset $ -2,03,000 Net Working capital $ -3,650 Release of net working capital $ 3,650 Cash flow $ -2,06,650 $ 80,494 $ 89,523 $ 65,456 $ 63,097 Discount factor 1.0000 0.9009 0.8116 0.7312 0.6587 Present Value $ -2,06,650 $ 72,517 $ 72,659 $ 47,861 $ 41,564 $ 27,951 Thus, Net Present Value is $ 27,951

Homework Sourse

Homework Sourse