55 1110PM SHOW ME HOW STRAIGHTLINE DECLININGHALANCE AND 5UMO

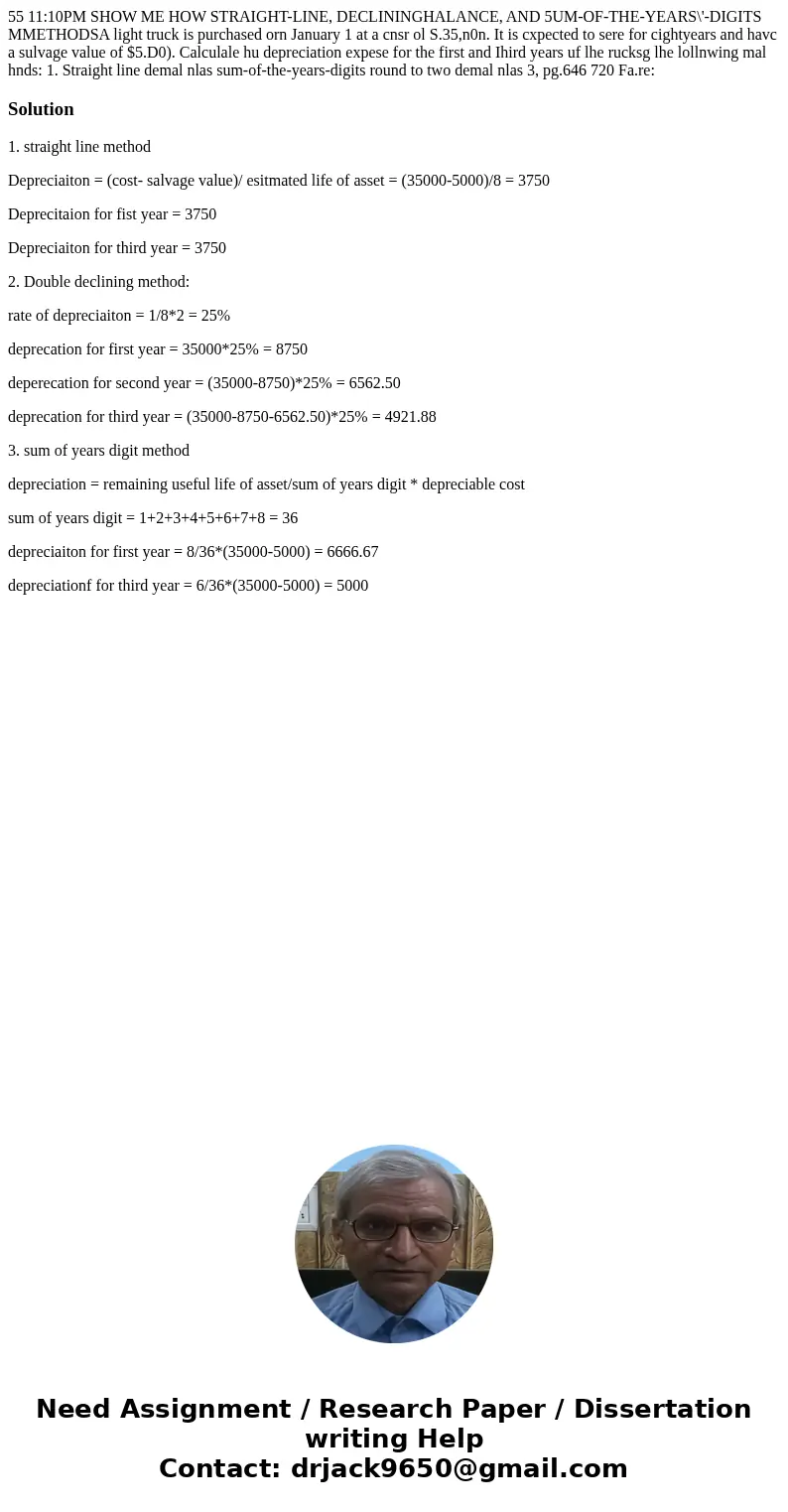

55 11:10PM SHOW ME HOW STRAIGHT-LINE, DECLININGHALANCE, AND 5UM-OF-THE-YEARS\'-DIGITS MMETHODSA light truck is purchased orn January 1 at a cnsr ol S.35,n0n. It is cxpected to sere for cightyears and havc a sulvage value of $5.D0). Calculale hu depreciation expese for the first and Ihird years uf lhe rucksg lhe lollnwing mal hnds: 1. Straight line demal nlas sum-of-the-years-digits round to two demal nlas 3, pg.646 720 Fa.re:

Solution

1. straight line method

Depreciaiton = (cost- salvage value)/ esitmated life of asset = (35000-5000)/8 = 3750

Deprecitaion for fist year = 3750

Depreciaiton for third year = 3750

2. Double declining method:

rate of depreciaiton = 1/8*2 = 25%

deprecation for first year = 35000*25% = 8750

deperecation for second year = (35000-8750)*25% = 6562.50

deprecation for third year = (35000-8750-6562.50)*25% = 4921.88

3. sum of years digit method

depreciation = remaining useful life of asset/sum of years digit * depreciable cost

sum of years digit = 1+2+3+4+5+6+7+8 = 36

depreciaiton for first year = 8/36*(35000-5000) = 6666.67

depreciationf for third year = 6/36*(35000-5000) = 5000

Homework Sourse

Homework Sourse