Bearings Manufacturing Company Inc purchased a new machine o

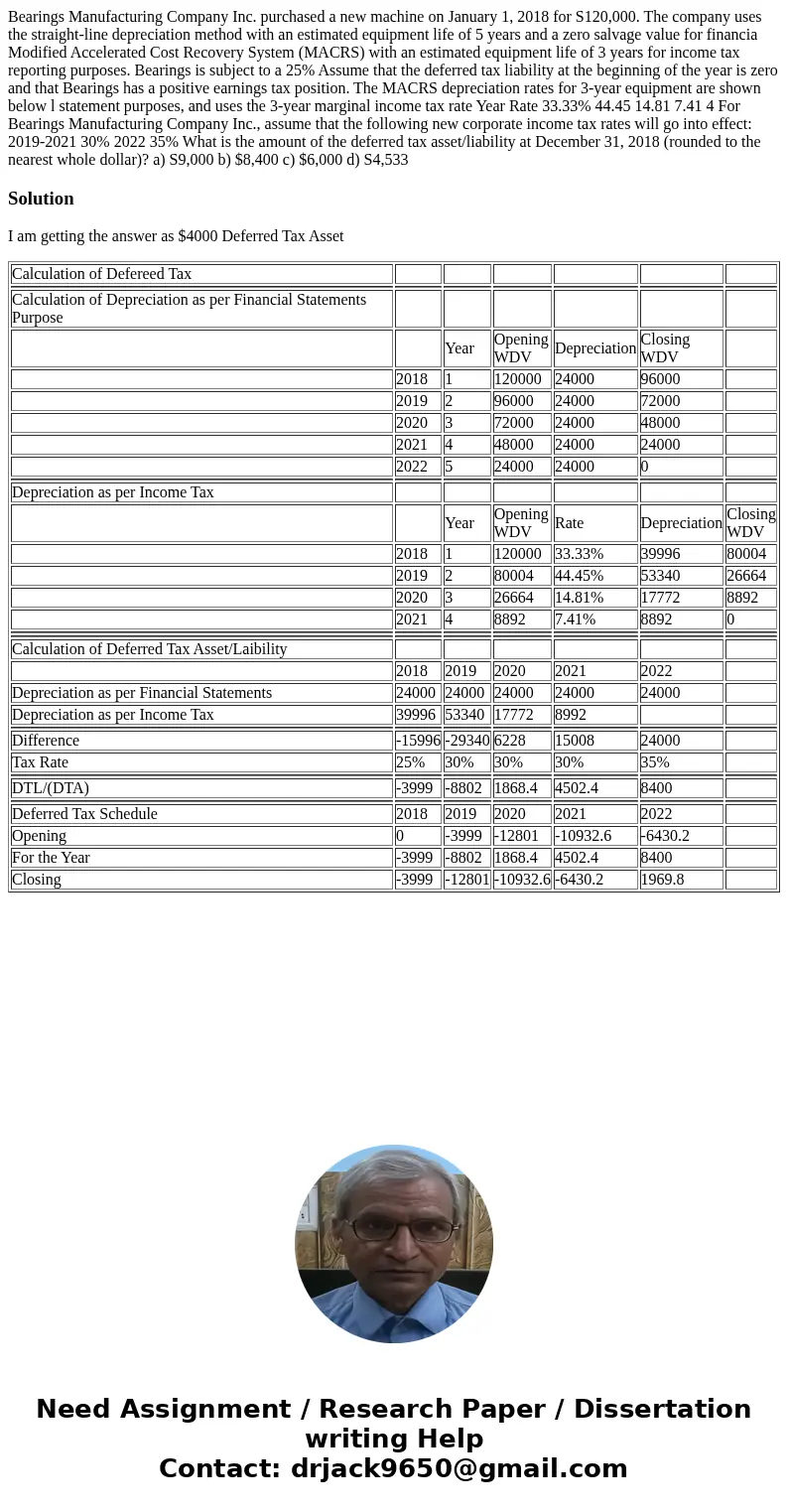

Bearings Manufacturing Company Inc. purchased a new machine on January 1, 2018 for S120,000. The company uses the straight-line depreciation method with an estimated equipment life of 5 years and a zero salvage value for financia Modified Accelerated Cost Recovery System (MACRS) with an estimated equipment life of 3 years for income tax reporting purposes. Bearings is subject to a 25% Assume that the deferred tax liability at the beginning of the year is zero and that Bearings has a positive earnings tax position. The MACRS depreciation rates for 3-year equipment are shown below l statement purposes, and uses the 3-year marginal income tax rate Year Rate 33.33% 44.45 14.81 7.41 4 For Bearings Manufacturing Company Inc., assume that the following new corporate income tax rates will go into effect: 2019-2021 30% 2022 35% What is the amount of the deferred tax asset/liability at December 31, 2018 (rounded to the nearest whole dollar)? a) S9,000 b) $8,400 c) $6,000 d) S4,533

Solution

I am getting the answer as $4000 Deferred Tax Asset

| Calculation of Defereed Tax | ||||||

| Calculation of Depreciation as per Financial Statements Purpose | ||||||

| Year | Opening WDV | Depreciation | Closing WDV | |||

| 2018 | 1 | 120000 | 24000 | 96000 | ||

| 2019 | 2 | 96000 | 24000 | 72000 | ||

| 2020 | 3 | 72000 | 24000 | 48000 | ||

| 2021 | 4 | 48000 | 24000 | 24000 | ||

| 2022 | 5 | 24000 | 24000 | 0 | ||

| Depreciation as per Income Tax | ||||||

| Year | Opening WDV | Rate | Depreciation | Closing WDV | ||

| 2018 | 1 | 120000 | 33.33% | 39996 | 80004 | |

| 2019 | 2 | 80004 | 44.45% | 53340 | 26664 | |

| 2020 | 3 | 26664 | 14.81% | 17772 | 8892 | |

| 2021 | 4 | 8892 | 7.41% | 8892 | 0 | |

| Calculation of Deferred Tax Asset/Laibility | ||||||

| 2018 | 2019 | 2020 | 2021 | 2022 | ||

| Depreciation as per Financial Statements | 24000 | 24000 | 24000 | 24000 | 24000 | |

| Depreciation as per Income Tax | 39996 | 53340 | 17772 | 8992 | ||

| Difference | -15996 | -29340 | 6228 | 15008 | 24000 | |

| Tax Rate | 25% | 30% | 30% | 30% | 35% | |

| DTL/(DTA) | -3999 | -8802 | 1868.4 | 4502.4 | 8400 | |

| Deferred Tax Schedule | 2018 | 2019 | 2020 | 2021 | 2022 | |

| Opening | 0 | -3999 | -12801 | -10932.6 | -6430.2 | |

| For the Year | -3999 | -8802 | 1868.4 | 4502.4 | 8400 | |

| Closing | -3999 | -12801 | -10932.6 | -6430.2 | 1969.8 |

Homework Sourse

Homework Sourse