e I httpsfmewconnect mheducationcom flawconnecthtml work Hel

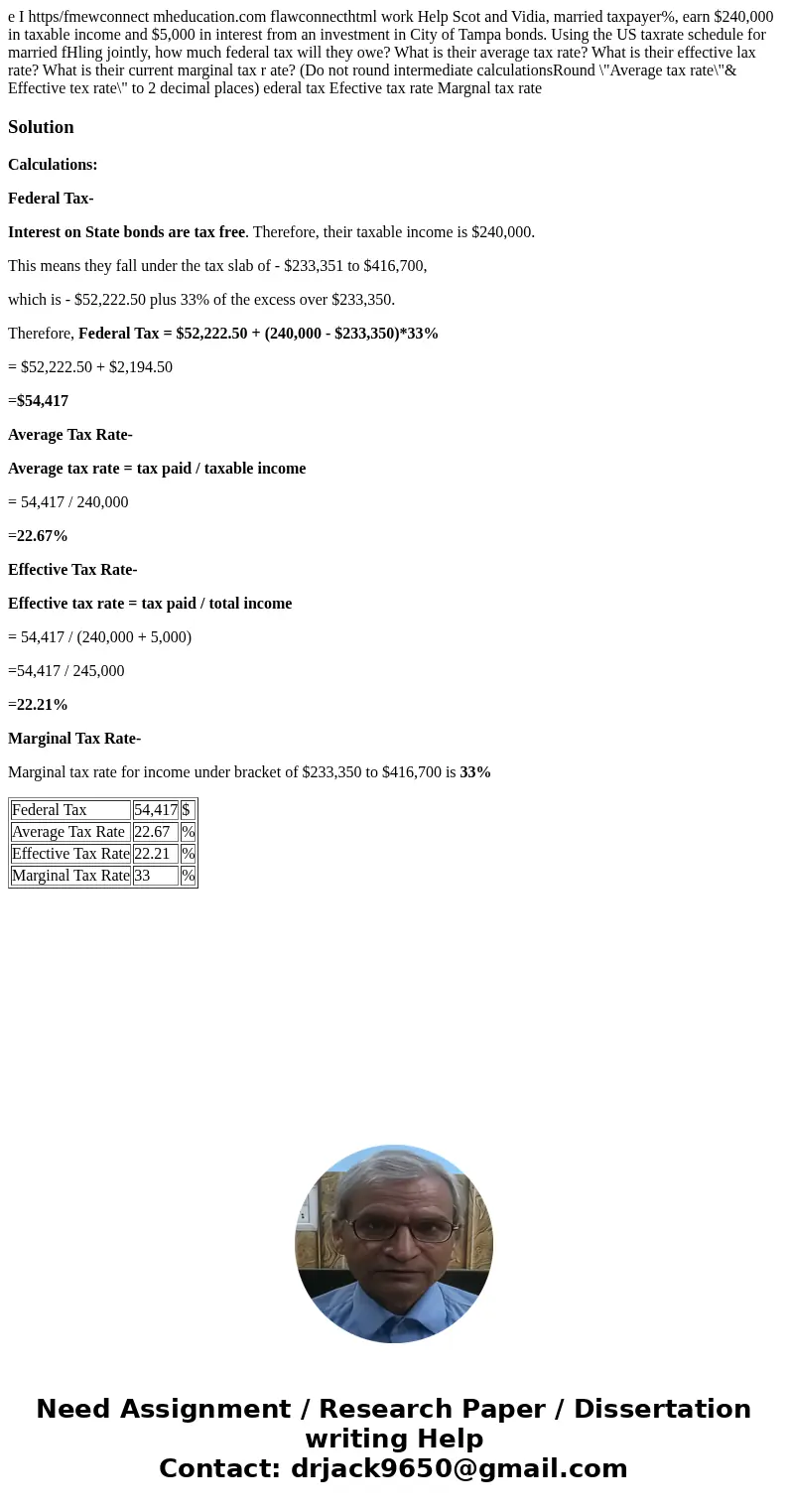

e I https/fmewconnect mheducation.com flawconnecthtml work Help Scot and Vidia, married taxpayer%, earn $240,000 in taxable income and $5,000 in interest from an investment in City of Tampa bonds. Using the US taxrate schedule for married fHling jointly, how much federal tax will they owe? What is their average tax rate? What is their effective lax rate? What is their current marginal tax r ate? (Do not round intermediate calculationsRound \"Average tax rate\"& Effective tex rate\" to 2 decimal places) ederal tax Efective tax rate Margnal tax rate

Solution

Calculations:

Federal Tax-

Interest on State bonds are tax free. Therefore, their taxable income is $240,000.

This means they fall under the tax slab of - $233,351 to $416,700,

which is - $52,222.50 plus 33% of the excess over $233,350.

Therefore, Federal Tax = $52,222.50 + (240,000 - $233,350)*33%

= $52,222.50 + $2,194.50

=$54,417

Average Tax Rate-

Average tax rate = tax paid / taxable income

= 54,417 / 240,000

=22.67%

Effective Tax Rate-

Effective tax rate = tax paid / total income

= 54,417 / (240,000 + 5,000)

=54,417 / 245,000

=22.21%

Marginal Tax Rate-

Marginal tax rate for income under bracket of $233,350 to $416,700 is 33%

| Federal Tax | 54,417 | $ |

| Average Tax Rate | 22.67 | % |

| Effective Tax Rate | 22.21 | % |

| Marginal Tax Rate | 33 | % |

Homework Sourse

Homework Sourse