Smith has 300000 shares of common stock outstanding with a p

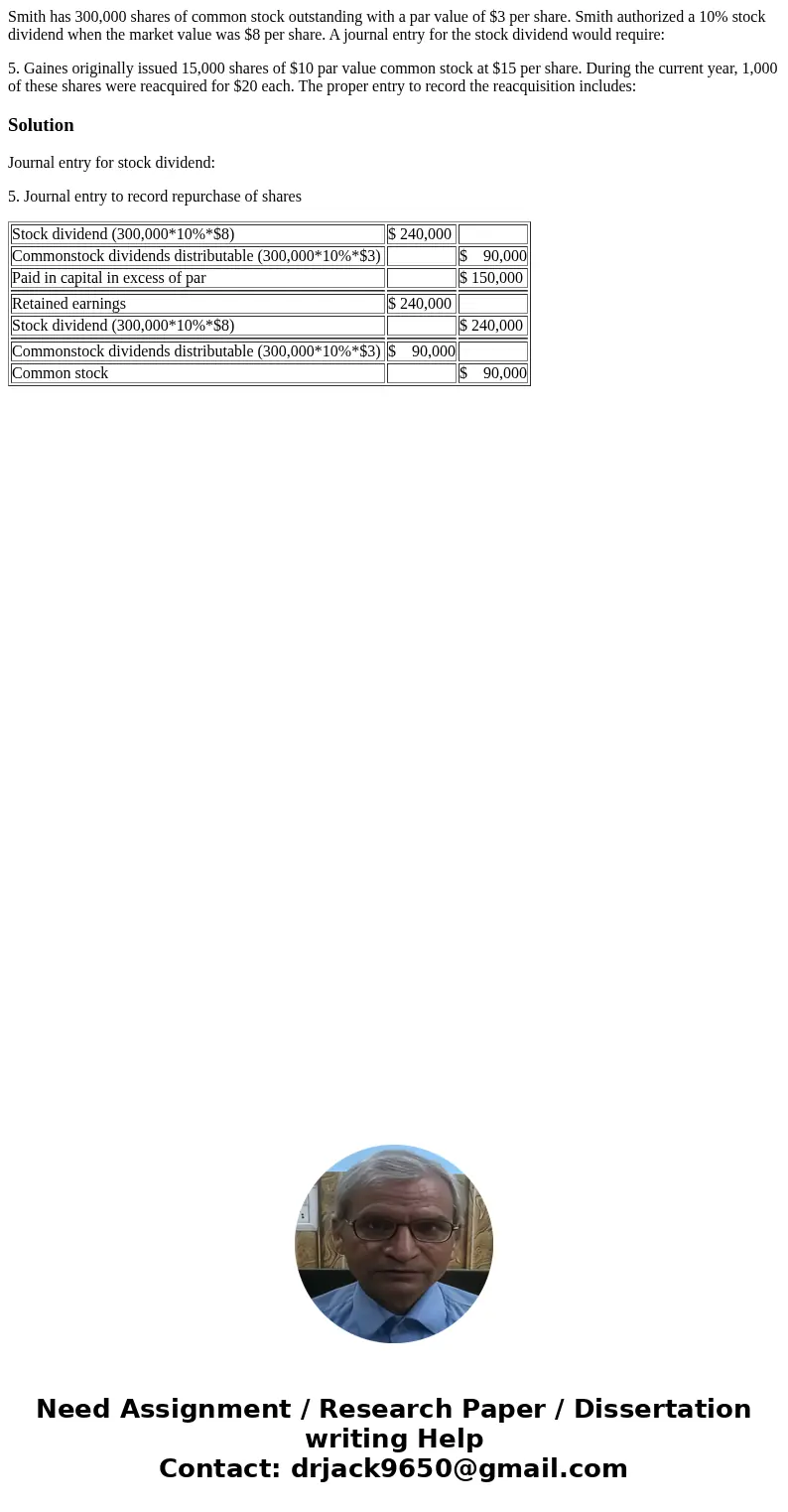

Smith has 300,000 shares of common stock outstanding with a par value of $3 per share. Smith authorized a 10% stock dividend when the market value was $8 per share. A journal entry for the stock dividend would require:

5. Gaines originally issued 15,000 shares of $10 par value common stock at $15 per share. During the current year, 1,000 of these shares were reacquired for $20 each. The proper entry to record the reacquisition includes:

Solution

Journal entry for stock dividend:

5. Journal entry to record repurchase of shares

| Stock dividend (300,000*10%*$8) | $ 240,000 | |

| Commonstock dividends distributable (300,000*10%*$3) | $ 90,000 | |

| Paid in capital in excess of par | $ 150,000 | |

| Retained earnings | $ 240,000 | |

| Stock dividend (300,000*10%*$8) | $ 240,000 | |

| Commonstock dividends distributable (300,000*10%*$3) | $ 90,000 | |

| Common stock | $ 90,000 |

Homework Sourse

Homework Sourse