If MARR5 which alternative should be selected Year 22000 800

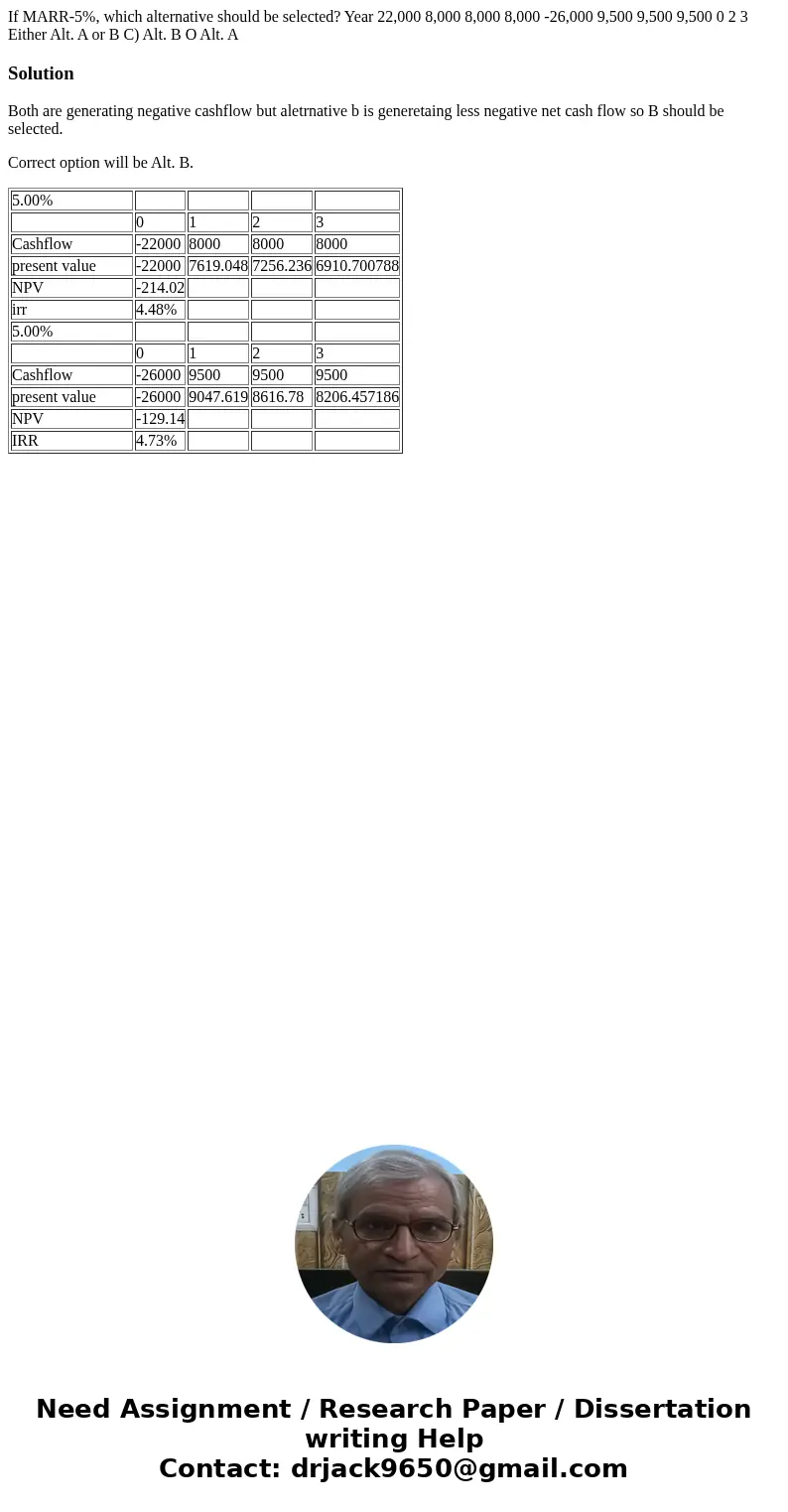

If MARR-5%, which alternative should be selected? Year 22,000 8,000 8,000 8,000 -26,000 9,500 9,500 9,500 0 2 3 Either Alt. A or B C) Alt. B O Alt. A

Solution

Both are generating negative cashflow but aletrnative b is generetaing less negative net cash flow so B should be selected.

Correct option will be Alt. B.

| 5.00% | ||||

| 0 | 1 | 2 | 3 | |

| Cashflow | -22000 | 8000 | 8000 | 8000 |

| present value | -22000 | 7619.048 | 7256.236 | 6910.700788 |

| NPV | -214.02 | |||

| irr | 4.48% | |||

| 5.00% | ||||

| 0 | 1 | 2 | 3 | |

| Cashflow | -26000 | 9500 | 9500 | 9500 |

| present value | -26000 | 9047.619 | 8616.78 | 8206.457186 |

| NPV | -129.14 | |||

| IRR | 4.73% |

Homework Sourse

Homework Sourse