Exercise 125 Your answer is partially correct Try again The

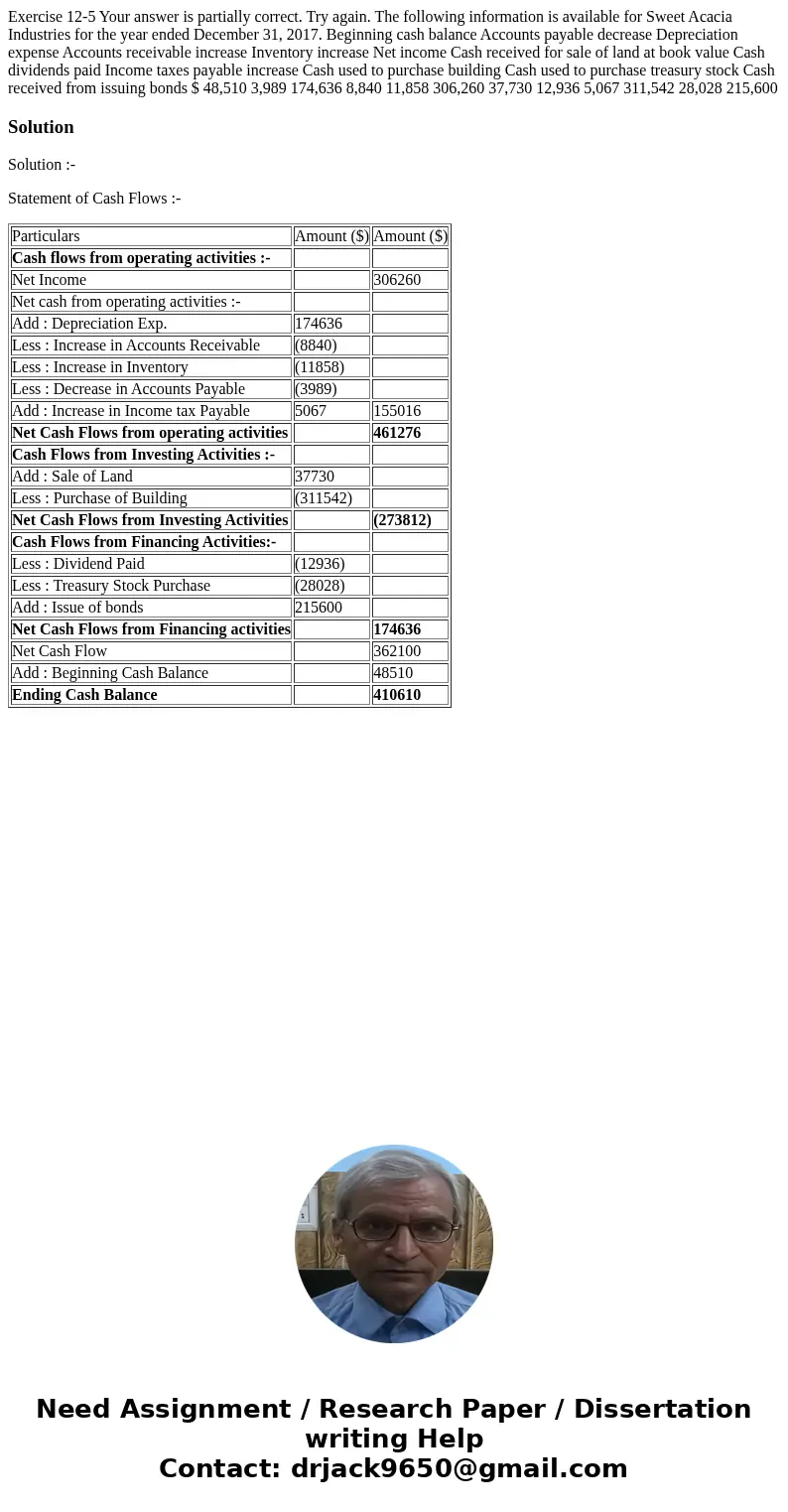

Exercise 12-5 Your answer is partially correct. Try again. The following information is available for Sweet Acacia Industries for the year ended December 31, 2017. Beginning cash balance Accounts payable decrease Depreciation expense Accounts receivable increase Inventory increase Net income Cash received for sale of land at book value Cash dividends paid Income taxes payable increase Cash used to purchase building Cash used to purchase treasury stock Cash received from issuing bonds $ 48,510 3,989 174,636 8,840 11,858 306,260 37,730 12,936 5,067 311,542 28,028 215,600

Solution

Solution :-

Statement of Cash Flows :-

| Particulars | Amount ($) | Amount ($) |

| Cash flows from operating activities :- | ||

| Net Income | 306260 | |

| Net cash from operating activities :- | ||

| Add : Depreciation Exp. | 174636 | |

| Less : Increase in Accounts Receivable | (8840) | |

| Less : Increase in Inventory | (11858) | |

| Less : Decrease in Accounts Payable | (3989) | |

| Add : Increase in Income tax Payable | 5067 | 155016 |

| Net Cash Flows from operating activities | 461276 | |

| Cash Flows from Investing Activities :- | ||

| Add : Sale of Land | 37730 | |

| Less : Purchase of Building | (311542) | |

| Net Cash Flows from Investing Activities | (273812) | |

| Cash Flows from Financing Activities:- | ||

| Less : Dividend Paid | (12936) | |

| Less : Treasury Stock Purchase | (28028) | |

| Add : Issue of bonds | 215600 | |

| Net Cash Flows from Financing activities | 174636 | |

| Net Cash Flow | 362100 | |

| Add : Beginning Cash Balance | 48510 | |

| Ending Cash Balance | 410610 |

Homework Sourse

Homework Sourse