An inexperienced accountant prepared this condensed income s

Solution

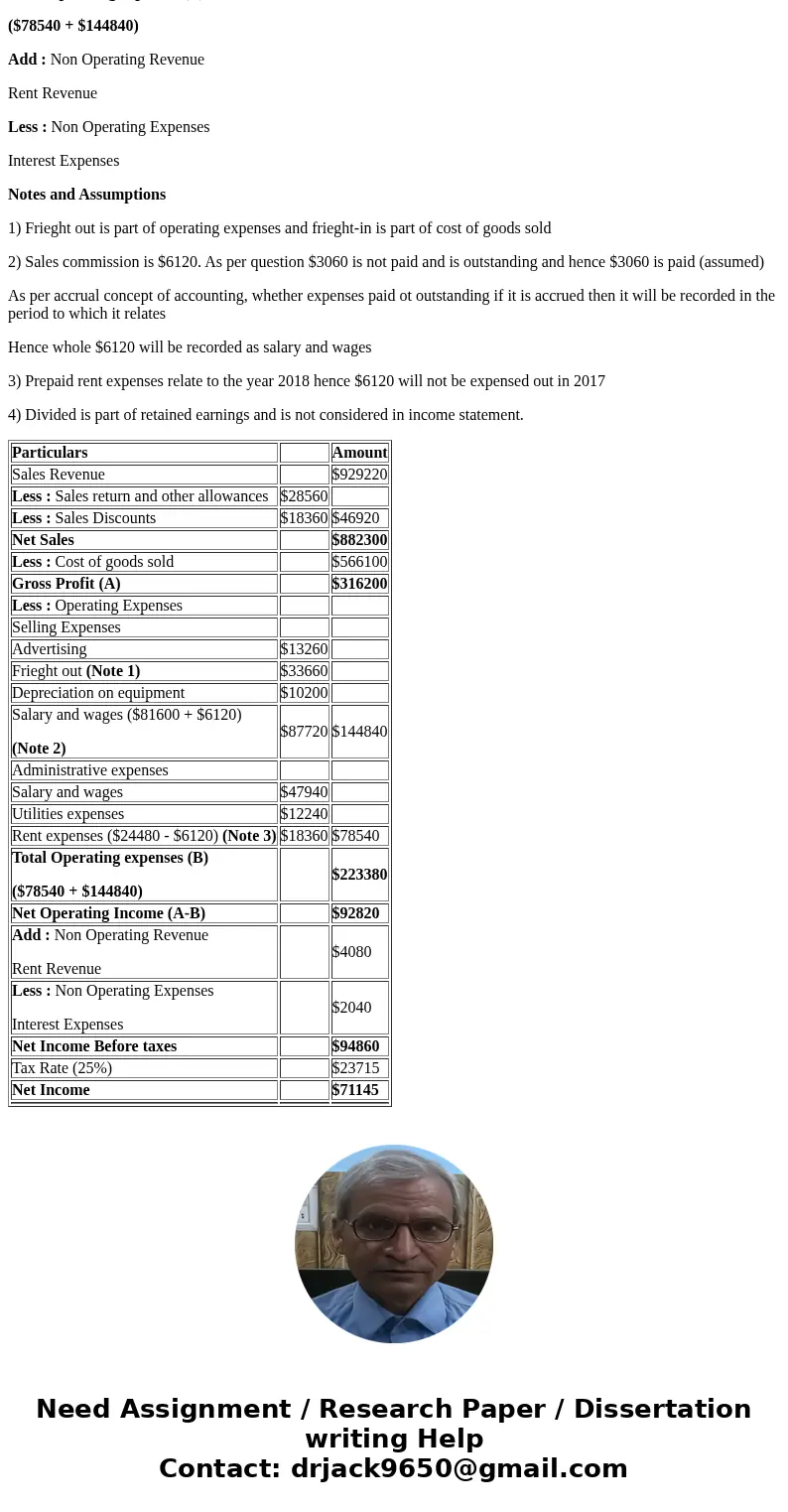

Solution - Presentation of Multiple Income statement

Blossom Company

Income statement

For the year Ended December 31, 2017

Salary and wages ($81600 + $6120)

(Note 2)

Total Operating expenses (B)

($78540 + $144840)

Add : Non Operating Revenue

Rent Revenue

Less : Non Operating Expenses

Interest Expenses

Notes and Assumptions

1) Frieght out is part of operating expenses and frieght-in is part of cost of goods sold

2) Sales commission is $6120. As per question $3060 is not paid and is outstanding and hence $3060 is paid (assumed)

As per accrual concept of accounting, whether expenses paid ot outstanding if it is accrued then it will be recorded in the period to which it relates

Hence whole $6120 will be recorded as salary and wages

3) Prepaid rent expenses relate to the year 2018 hence $6120 will not be expensed out in 2017

4) Divided is part of retained earnings and is not considered in income statement.

| Particulars | Amount | |

| Sales Revenue | $929220 | |

| Less : Sales return and other allowances | $28560 | |

| Less : Sales Discounts | $18360 | $46920 |

| Net Sales | $882300 | |

| Less : Cost of goods sold | $566100 | |

| Gross Profit (A) | $316200 | |

| Less : Operating Expenses | ||

| Selling Expenses | ||

| Advertising | $13260 | |

| Frieght out (Note 1) | $33660 | |

| Depreciation on equipment | $10200 | |

| Salary and wages ($81600 + $6120) (Note 2) | $87720 | $144840 |

| Administrative expenses | ||

| Salary and wages | $47940 | |

| Utilities expenses | $12240 | |

| Rent expenses ($24480 - $6120) (Note 3) | $18360 | $78540 |

| Total Operating expenses (B) ($78540 + $144840) | $223380 | |

| Net Operating Income (A-B) | $92820 | |

| Add : Non Operating Revenue Rent Revenue | $4080 | |

| Less : Non Operating Expenses Interest Expenses | $2040 | |

| Net Income Before taxes | $94860 | |

| Tax Rate (25%) | $23715 | |

| Net Income | $71145 | |

Homework Sourse

Homework Sourse