If you started today and borrowed S6000 every 6 MONTH until

Solution

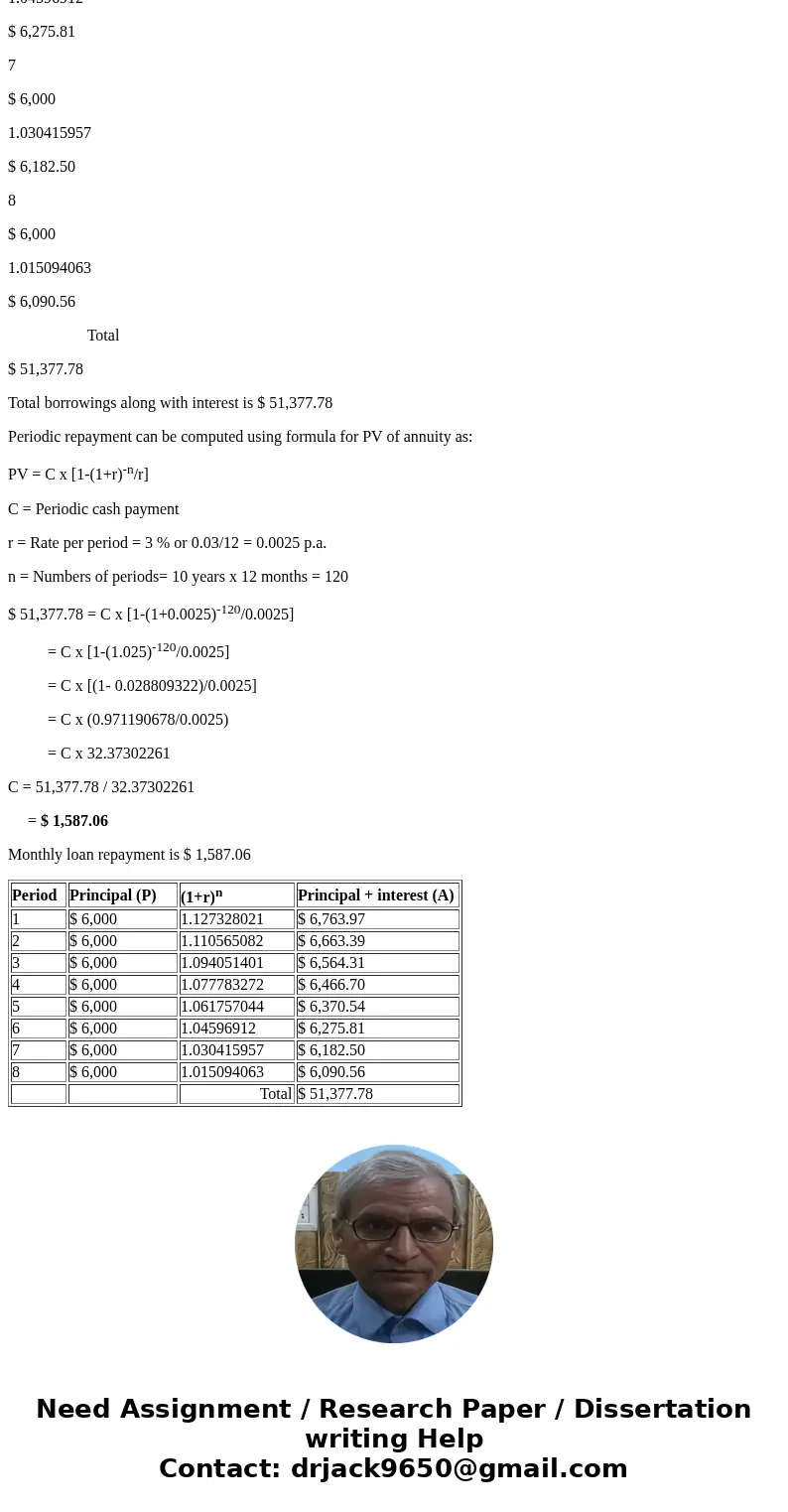

As the compounding frequency and borrowing frequency are different, we can calculate each period’s interest and principal separately and then add to get the total borrowed amount along with interest.

Formula for compound interest is:

A = P x (1 +r) n

A = Principal + interest

P = Principal = $ 6,000 per period

r = rate of interest 3 % p.a. or 0.03/12 = 0.0025 monthly

n = No. of compounding periods = 48 for 1st borrowing, 42 for 2nd borrowing, 36 for 3rd borrowing etc.

Period

Principal (P)

(1+r)n

Principal + interest (A)

1

$ 6,000

1.127328021

$ 6,763.97

2

$ 6,000

1.110565082

$ 6,663.39

3

$ 6,000

1.094051401

$ 6,564.31

4

$ 6,000

1.077783272

$ 6,466.70

5

$ 6,000

1.061757044

$ 6,370.54

6

$ 6,000

1.04596912

$ 6,275.81

7

$ 6,000

1.030415957

$ 6,182.50

8

$ 6,000

1.015094063

$ 6,090.56

Total

$ 51,377.78

Total borrowings along with interest is $ 51,377.78

Periodic repayment can be computed using formula for PV of annuity as:

PV = C x [1-(1+r)-n/r]

C = Periodic cash payment

r = Rate per period = 3 % or 0.03/12 = 0.0025 p.a.

n = Numbers of periods= 10 years x 12 months = 120

$ 51,377.78 = C x [1-(1+0.0025)-120/0.0025]

= C x [1-(1.025)-120/0.0025]

= C x [(1- 0.028809322)/0.0025]

= C x (0.971190678/0.0025)

= C x 32.37302261

C = 51,377.78 / 32.37302261

= $ 1,587.06

Monthly loan repayment is $ 1,587.06

| Period | Principal (P) | (1+r)n | Principal + interest (A) |

| 1 | $ 6,000 | 1.127328021 | $ 6,763.97 |

| 2 | $ 6,000 | 1.110565082 | $ 6,663.39 |

| 3 | $ 6,000 | 1.094051401 | $ 6,564.31 |

| 4 | $ 6,000 | 1.077783272 | $ 6,466.70 |

| 5 | $ 6,000 | 1.061757044 | $ 6,370.54 |

| 6 | $ 6,000 | 1.04596912 | $ 6,275.81 |

| 7 | $ 6,000 | 1.030415957 | $ 6,182.50 |

| 8 | $ 6,000 | 1.015094063 | $ 6,090.56 |

| Total | $ 51,377.78 |

Homework Sourse

Homework Sourse