P62A Glee Distribution markets CDs of the performing artist

Solution

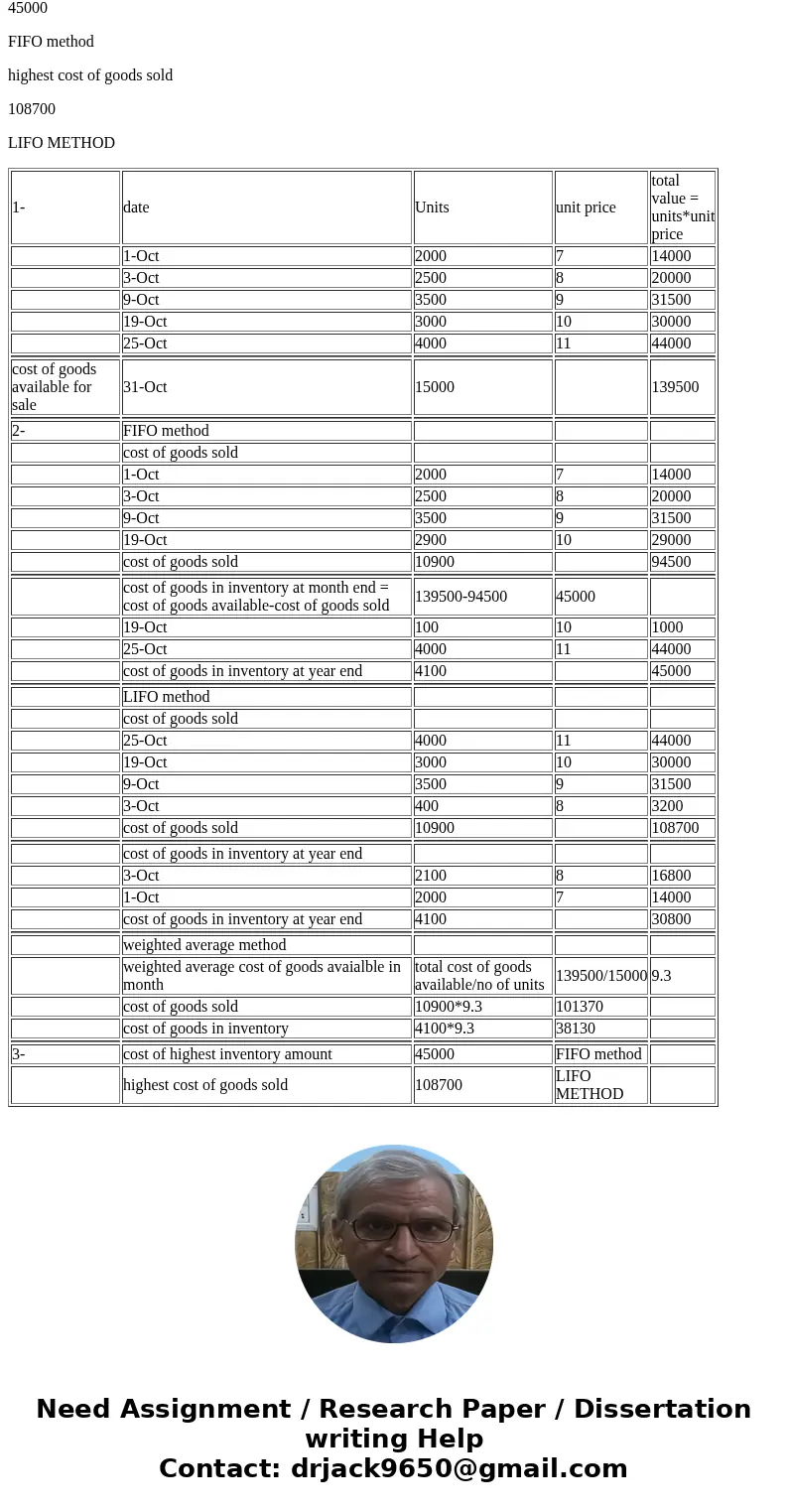

1-

date

Units

unit price

total value = units*unit price

1-Oct

2000

7

14000

3-Oct

2500

8

20000

9-Oct

3500

9

31500

19-Oct

3000

10

30000

25-Oct

4000

11

44000

cost of goods available for sale

31-Oct

15000

139500

2-

FIFO method

cost of goods sold

1-Oct

2000

7

14000

3-Oct

2500

8

20000

9-Oct

3500

9

31500

19-Oct

2900

10

29000

cost of goods sold

10900

94500

cost of goods in inventory at month end = cost of goods available-cost of goods sold

139500-94500

45000

19-Oct

100

10

1000

25-Oct

4000

11

44000

cost of goods in inventory at year end

4100

45000

LIFO method

cost of goods sold

25-Oct

4000

11

44000

19-Oct

3000

10

30000

9-Oct

3500

9

31500

3-Oct

400

8

3200

cost of goods sold

10900

108700

cost of goods in inventory at year end

3-Oct

2100

8

16800

1-Oct

2000

7

14000

cost of goods in inventory at year end

4100

30800

weighted average method

weighted average cost of goods avaialble in month

total cost of goods available/no of units

139500/15000

9.3

cost of goods sold

10900*9.3

101370

cost of goods in inventory

4100*9.3

38130

3-

cost of highest inventory amount

45000

FIFO method

highest cost of goods sold

108700

LIFO METHOD

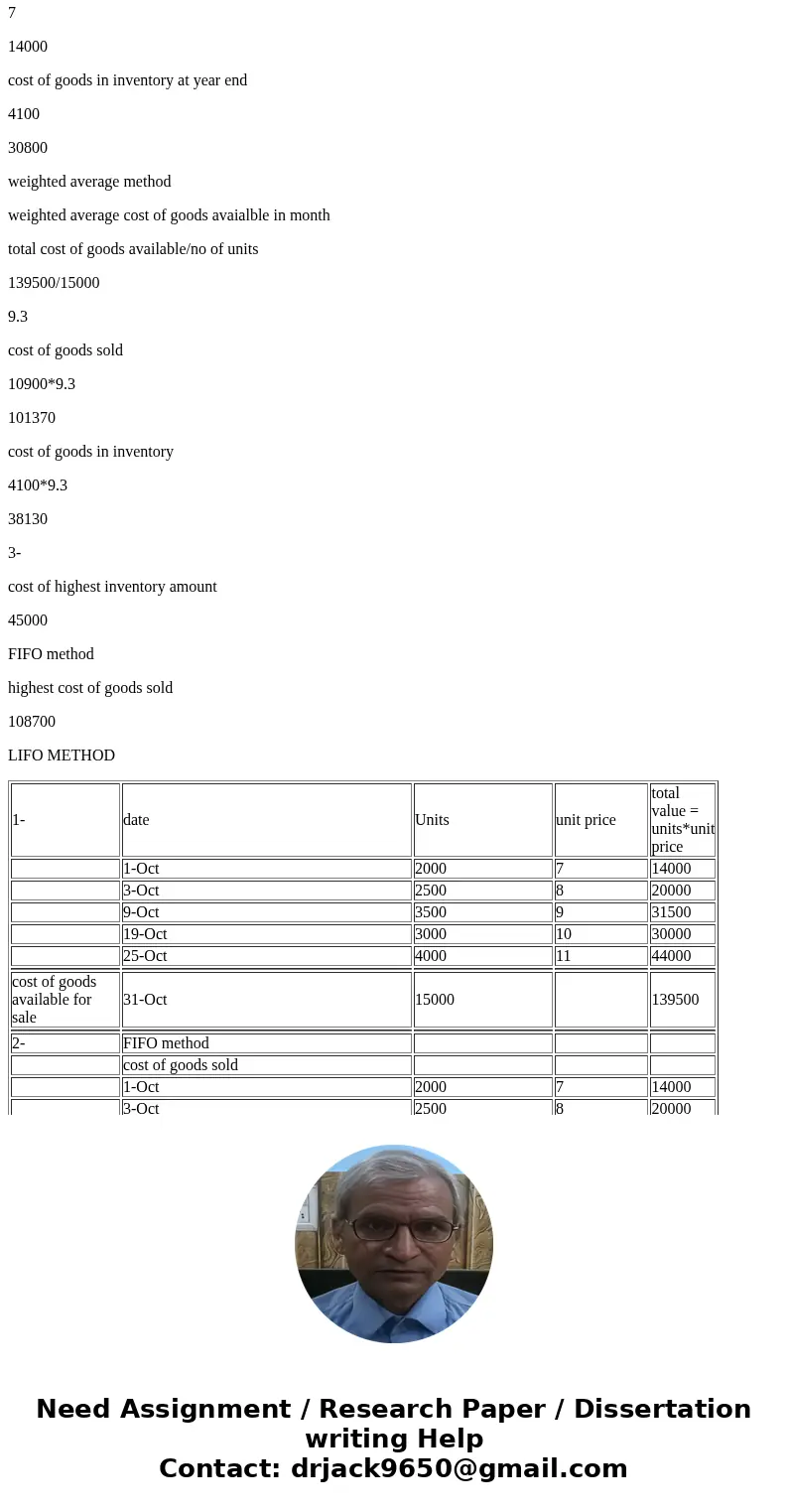

| 1- | date | Units | unit price | total value = units*unit price |

| 1-Oct | 2000 | 7 | 14000 | |

| 3-Oct | 2500 | 8 | 20000 | |

| 9-Oct | 3500 | 9 | 31500 | |

| 19-Oct | 3000 | 10 | 30000 | |

| 25-Oct | 4000 | 11 | 44000 | |

| cost of goods available for sale | 31-Oct | 15000 | 139500 | |

| 2- | FIFO method | |||

| cost of goods sold | ||||

| 1-Oct | 2000 | 7 | 14000 | |

| 3-Oct | 2500 | 8 | 20000 | |

| 9-Oct | 3500 | 9 | 31500 | |

| 19-Oct | 2900 | 10 | 29000 | |

| cost of goods sold | 10900 | 94500 | ||

| cost of goods in inventory at month end = cost of goods available-cost of goods sold | 139500-94500 | 45000 | ||

| 19-Oct | 100 | 10 | 1000 | |

| 25-Oct | 4000 | 11 | 44000 | |

| cost of goods in inventory at year end | 4100 | 45000 | ||

| LIFO method | ||||

| cost of goods sold | ||||

| 25-Oct | 4000 | 11 | 44000 | |

| 19-Oct | 3000 | 10 | 30000 | |

| 9-Oct | 3500 | 9 | 31500 | |

| 3-Oct | 400 | 8 | 3200 | |

| cost of goods sold | 10900 | 108700 | ||

| cost of goods in inventory at year end | ||||

| 3-Oct | 2100 | 8 | 16800 | |

| 1-Oct | 2000 | 7 | 14000 | |

| cost of goods in inventory at year end | 4100 | 30800 | ||

| weighted average method | ||||

| weighted average cost of goods avaialble in month | total cost of goods available/no of units | 139500/15000 | 9.3 | |

| cost of goods sold | 10900*9.3 | 101370 | ||

| cost of goods in inventory | 4100*9.3 | 38130 | ||

| 3- | cost of highest inventory amount | 45000 | FIFO method | |

| highest cost of goods sold | 108700 | LIFO METHOD |

Homework Sourse

Homework Sourse