P 207A L03 e Dr Building 140000 STATED VALUE COMMON AND PREF

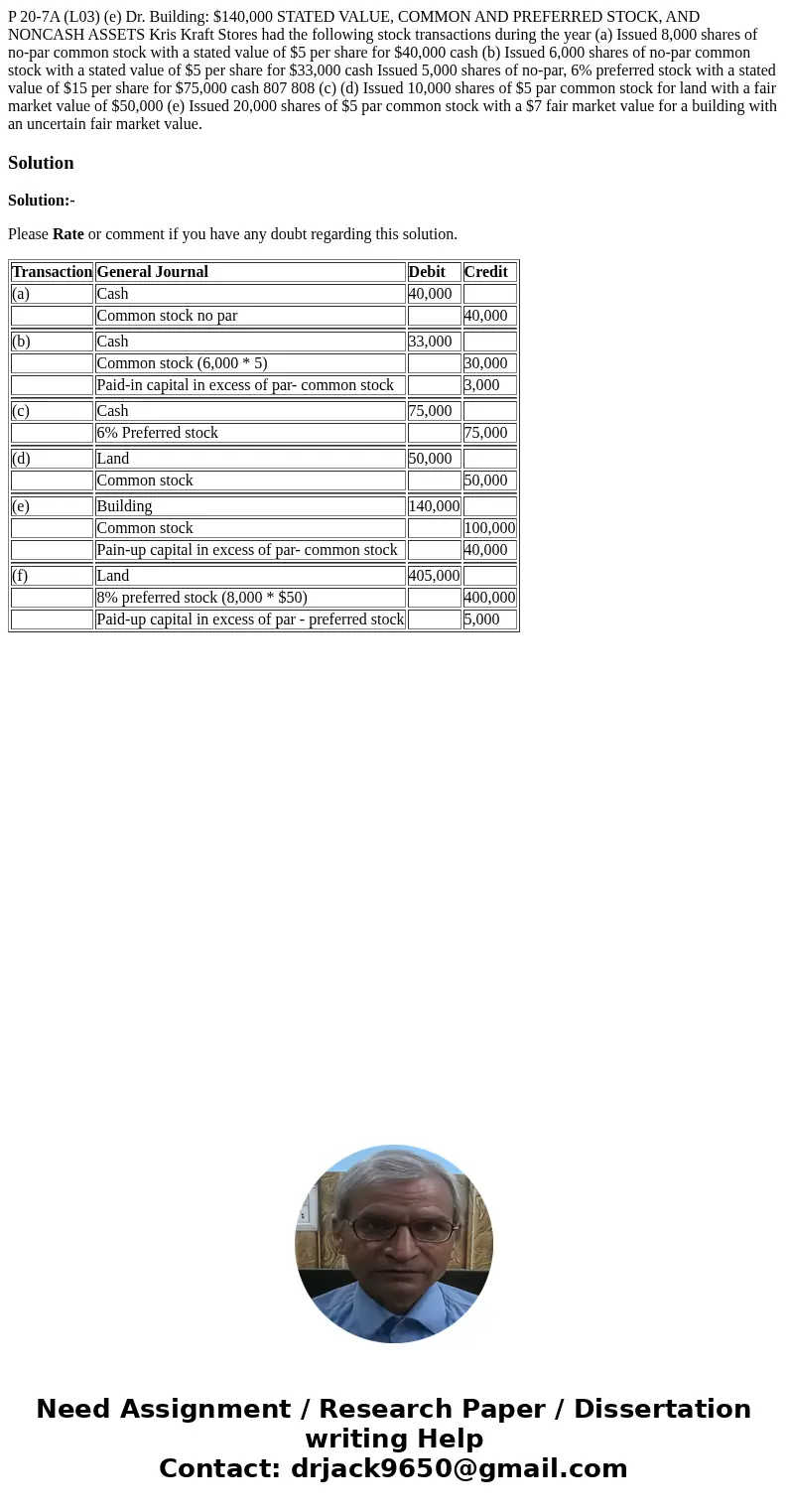

P 20-7A (L03) (e) Dr. Building: $140,000 STATED VALUE, COMMON AND PREFERRED STOCK, AND NONCASH ASSETS Kris Kraft Stores had the following stock transactions during the year (a) Issued 8,000 shares of no-par common stock with a stated value of $5 per share for $40,000 cash (b) Issued 6,000 shares of no-par common stock with a stated value of $5 per share for $33,000 cash Issued 5,000 shares of no-par, 6% preferred stock with a stated value of $15 per share for $75,000 cash 807 808 (c) (d) Issued 10,000 shares of $5 par common stock for land with a fair market value of $50,000 (e) Issued 20,000 shares of $5 par common stock with a $7 fair market value for a building with an uncertain fair market value.

Solution

Solution:-

Please Rate or comment if you have any doubt regarding this solution.

| Transaction | General Journal | Debit | Credit |

| (a) | Cash | 40,000 | |

| Common stock no par | 40,000 | ||

| (b) | Cash | 33,000 | |

| Common stock (6,000 * 5) | 30,000 | ||

| Paid-in capital in excess of par- common stock | 3,000 | ||

| (c) | Cash | 75,000 | |

| 6% Preferred stock | 75,000 | ||

| (d) | Land | 50,000 | |

| Common stock | 50,000 | ||

| (e) | Building | 140,000 | |

| Common stock | 100,000 | ||

| Pain-up capital in excess of par- common stock | 40,000 | ||

| (f) | Land | 405,000 | |

| 8% preferred stock (8,000 * $50) | 400,000 | ||

| Paid-up capital in excess of par - preferred stock | 5,000 |

Homework Sourse

Homework Sourse