Answer in excel format please Consider firm B as an unlevere

Answer in excel format please!

Consider firm B as an unlevered firm and firm C as a levered firm with target debt-to-equity ratio (D/E)*= 1. Both firms have exactly the same perpetual net operating income (EBIT) of $180, before taxes. The before-tax cost of debt is the same as the risk-free rate. The corporate tax rate is 50%. Given the following market information,

E(Rm) = 12% s(Rm) = 0.12 Rf = 6%

Beta (B)= 1 Beta (C)= 1.5 sis the standard deviation of returns.

a)Find the cost of capital and value for each firm.

b)Evaluate the following four projects (I, II, III, & IV) to determine their acceptance (or rejection) by firms B andC. [Note:Beta of each project can be computed by Correlation*[(R)/(Rm)], where is the standard deviation of returns.

Projects

Initial Costs

Expected

(EBIT)

Standard

Deviation s(R)

Correlations

I

100

9

0.10

0.6

II

120

11

0.11

0.7

III

80

9

0.12

0.8

IV

150

18

0.20

0.9

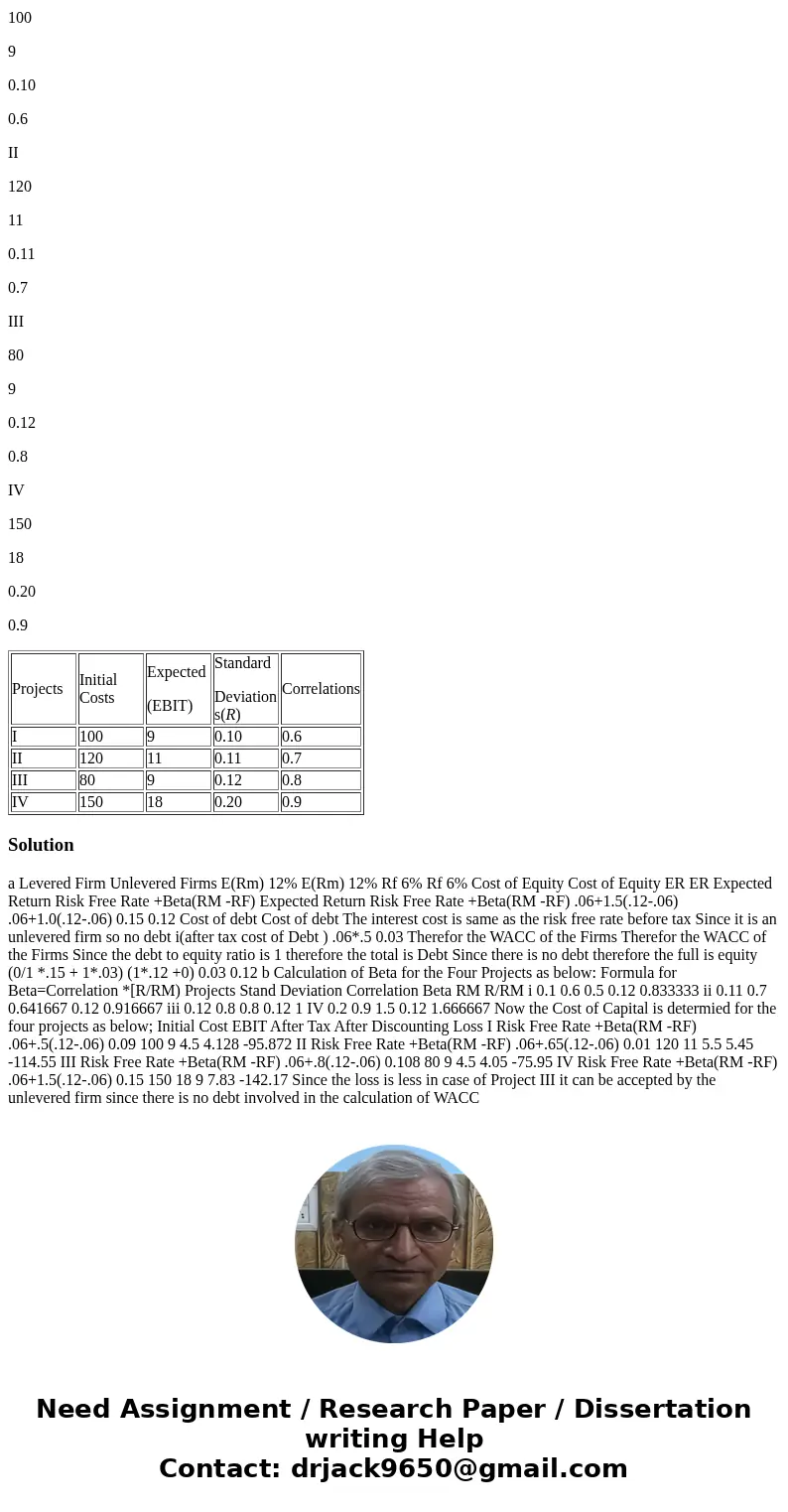

| Projects | Initial Costs | Expected (EBIT) | Standard Deviation s(R) | Correlations |

| I | 100 | 9 | 0.10 | 0.6 |

| II | 120 | 11 | 0.11 | 0.7 |

| III | 80 | 9 | 0.12 | 0.8 |

| IV | 150 | 18 | 0.20 | 0.9 |

Solution

a Levered Firm Unlevered Firms E(Rm) 12% E(Rm) 12% Rf 6% Rf 6% Cost of Equity Cost of Equity ER ER Expected Return Risk Free Rate +Beta(RM -RF) Expected Return Risk Free Rate +Beta(RM -RF) .06+1.5(.12-.06) .06+1.0(.12-.06) 0.15 0.12 Cost of debt Cost of debt The interest cost is same as the risk free rate before tax Since it is an unlevered firm so no debt i(after tax cost of Debt ) .06*.5 0.03 Therefor the WACC of the Firms Therefor the WACC of the Firms Since the debt to equity ratio is 1 therefore the total is Debt Since there is no debt therefore the full is equity (0/1 *.15 + 1*.03) (1*.12 +0) 0.03 0.12 b Calculation of Beta for the Four Projects as below: Formula for Beta=Correlation *[R/RM) Projects Stand Deviation Correlation Beta RM R/RM i 0.1 0.6 0.5 0.12 0.833333 ii 0.11 0.7 0.641667 0.12 0.916667 iii 0.12 0.8 0.8 0.12 1 IV 0.2 0.9 1.5 0.12 1.666667 Now the Cost of Capital is determied for the four projects as below; Initial Cost EBIT After Tax After Discounting Loss I Risk Free Rate +Beta(RM -RF) .06+.5(.12-.06) 0.09 100 9 4.5 4.128 -95.872 II Risk Free Rate +Beta(RM -RF) .06+.65(.12-.06) 0.01 120 11 5.5 5.45 -114.55 III Risk Free Rate +Beta(RM -RF) .06+.8(.12-.06) 0.108 80 9 4.5 4.05 -75.95 IV Risk Free Rate +Beta(RM -RF) .06+1.5(.12-.06) 0.15 150 18 9 7.83 -142.17 Since the loss is less in case of Project III it can be accepted by the unlevered firm since there is no debt involved in the calculation of WACC

Homework Sourse

Homework Sourse