EAST COAST YACHTS 2017 Income Statement Sales Cost of goods

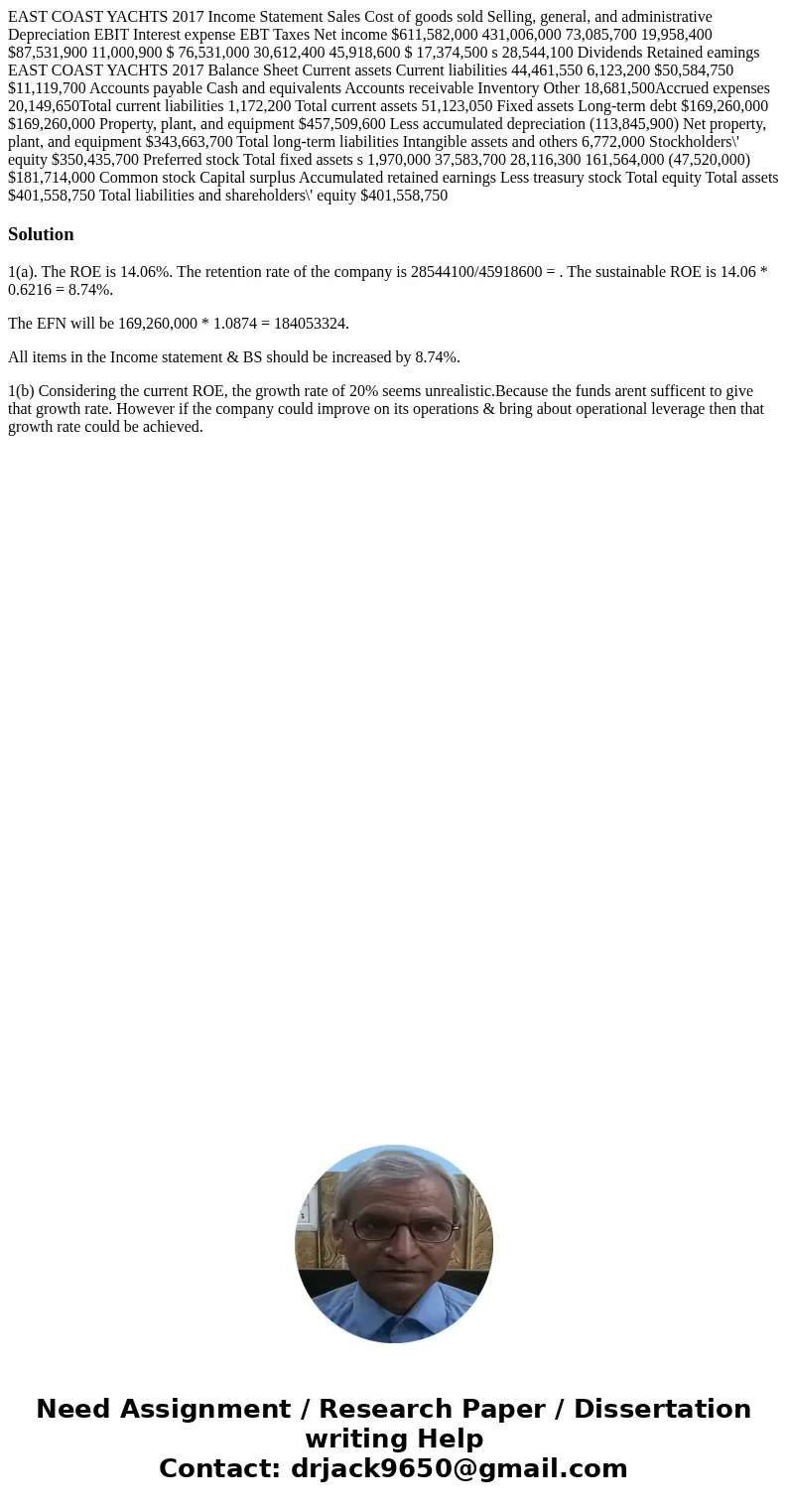

EAST COAST YACHTS 2017 Income Statement Sales Cost of goods sold Selling, general, and administrative Depreciation EBIT Interest expense EBT Taxes Net income $611,582,000 431,006,000 73,085,700 19,958,400 $87,531,900 11,000,900 $ 76,531,000 30,612,400 45,918,600 $ 17,374,500 s 28,544,100 Dividends Retained eamings EAST COAST YACHTS 2017 Balance Sheet Current assets Current liabilities 44,461,550 6,123,200 $50,584,750 $11,119,700 Accounts payable Cash and equivalents Accounts receivable Inventory Other 18,681,500Accrued expenses 20,149,650Total current liabilities 1,172,200 Total current assets 51,123,050 Fixed assets Long-term debt $169,260,000 $169,260,000 Property, plant, and equipment $457,509,600 Less accumulated depreciation (113,845,900) Net property, plant, and equipment $343,663,700 Total long-term liabilities Intangible assets and others 6,772,000 Stockholders\' equity $350,435,700 Preferred stock Total fixed assets s 1,970,000 37,583,700 28,116,300 161,564,000 (47,520,000) $181,714,000 Common stock Capital surplus Accumulated retained earnings Less treasury stock Total equity Total assets $401,558,750 Total liabilities and shareholders\' equity $401,558,750

Solution

1(a). The ROE is 14.06%. The retention rate of the company is 28544100/45918600 = . The sustainable ROE is 14.06 * 0.6216 = 8.74%.

The EFN will be 169,260,000 * 1.0874 = 184053324.

All items in the Income statement & BS should be increased by 8.74%.

1(b) Considering the current ROE, the growth rate of 20% seems unrealistic.Because the funds arent sufficent to give that growth rate. However if the company could improve on its operations & bring about operational leverage then that growth rate could be achieved.

Homework Sourse

Homework Sourse