Question 1 Cullumber Company reported the following amounts

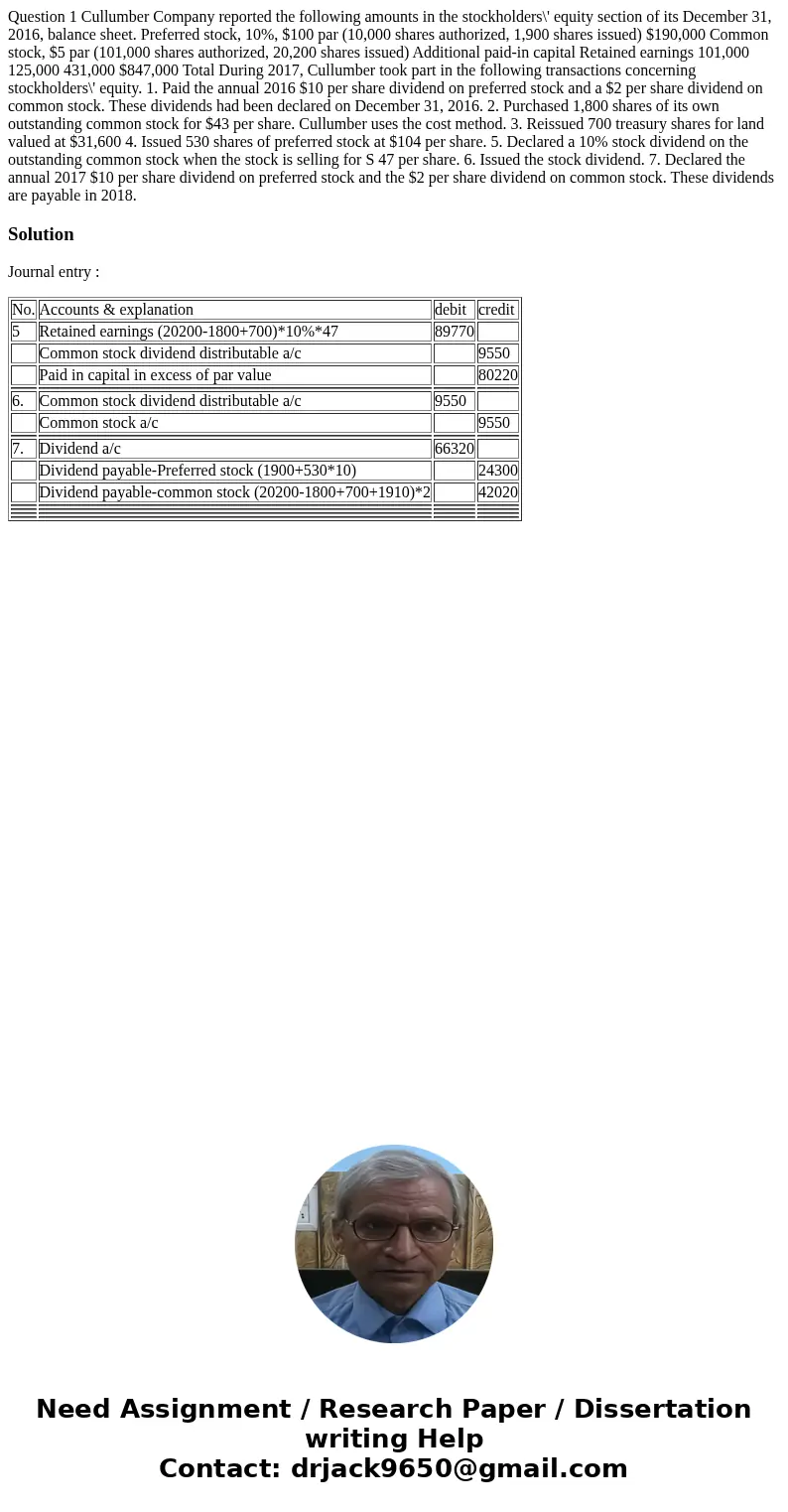

Question 1 Cullumber Company reported the following amounts in the stockholders\' equity section of its December 31, 2016, balance sheet. Preferred stock, 10%, $100 par (10,000 shares authorized, 1,900 shares issued) $190,000 Common stock, $5 par (101,000 shares authorized, 20,200 shares issued) Additional paid-in capital Retained earnings 101,000 125,000 431,000 $847,000 Total During 2017, Cullumber took part in the following transactions concerning stockholders\' equity. 1. Paid the annual 2016 $10 per share dividend on preferred stock and a $2 per share dividend on common stock. These dividends had been declared on December 31, 2016. 2. Purchased 1,800 shares of its own outstanding common stock for $43 per share. Cullumber uses the cost method. 3. Reissued 700 treasury shares for land valued at $31,600 4. Issued 530 shares of preferred stock at $104 per share. 5. Declared a 10% stock dividend on the outstanding common stock when the stock is selling for S 47 per share. 6. Issued the stock dividend. 7. Declared the annual 2017 $10 per share dividend on preferred stock and the $2 per share dividend on common stock. These dividends are payable in 2018.

Solution

Journal entry :

| No. | Accounts & explanation | debit | credit |

| 5 | Retained earnings (20200-1800+700)*10%*47 | 89770 | |

| Common stock dividend distributable a/c | 9550 | ||

| Paid in capital in excess of par value | 80220 | ||

| 6. | Common stock dividend distributable a/c | 9550 | |

| Common stock a/c | 9550 | ||

| 7. | Dividend a/c | 66320 | |

| Dividend payable-Preferred stock (1900+530*10) | 24300 | ||

| Dividend payable-common stock (20200-1800+700+1910)*2 | 42020 | ||

Homework Sourse

Homework Sourse