Problem 98 Preferred stock valuation Ezzell Corporation issu

Solution

Problem 9-8

a --- Stock Value = Annual dividend / yield

Annual dividend = 100*10% = 10

Yield =0.07

Stock Value = 10/0.07 = $142.86

b --- Stock Value = Annual dividend / yield

Annual dividend = 100*10% = 10

Yield =0.13

Stock Value = 10/0.13 = $76.92

Problem 9-10

Stock Value = D0*(1+g) / Ke – g

Where D0 = Dividend on year 0 =5

G = growth rate = -0.07

Ke = Cost of capital = 0.10

Stock value = 5*(1+-0.07)/0.10- -0.07

= 5*(0.93)/0.17

Stock value = $27.35

Problem 9-11

Stock Value on year 5= D6(1+g)/ Ke – g

Where D6 = Dividend on year 6 = D1(1+g)^ = 0.50(1.04)^5 = 0.50*1.2167 = 0.61

G = growth rate = 0.04

Ke = Cost of capital = 0.12

Stock value = 0.61/0.12-0.04

= 0.61/0.08 = $7.63

Stock value = $7.63

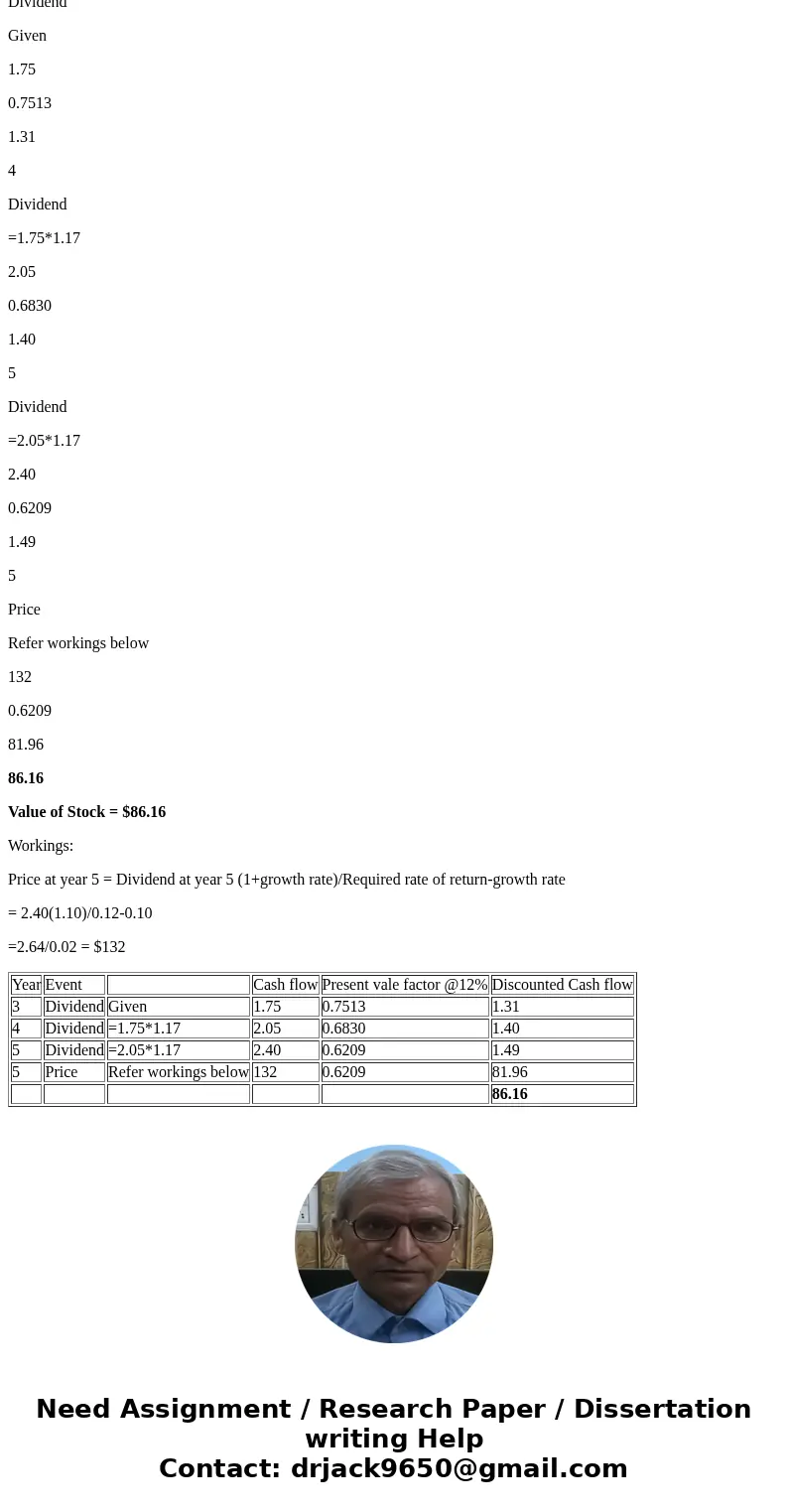

Problem 9-14

D3= dividend on year 3 =1.75

Growth (g) rate during year 4 and 5 =0.17

Growth (g) rate after year 5 = 0.10

Required rate = Ke = 0.12

Year

Event

Cash flow

Present vale factor @12%

Discounted Cash flow

3

Dividend

Given

1.75

0.7513

1.31

4

Dividend

=1.75*1.17

2.05

0.6830

1.40

5

Dividend

=2.05*1.17

2.40

0.6209

1.49

5

Price

Refer workings below

132

0.6209

81.96

86.16

Value of Stock = $86.16

Workings:

Price at year 5 = Dividend at year 5 (1+growth rate)/Required rate of return-growth rate

= 2.40(1.10)/0.12-0.10

=2.64/0.02 = $132

| Year | Event | Cash flow | Present vale factor @12% | Discounted Cash flow | |

| 3 | Dividend | Given | 1.75 | 0.7513 | 1.31 |

| 4 | Dividend | =1.75*1.17 | 2.05 | 0.6830 | 1.40 |

| 5 | Dividend | =2.05*1.17 | 2.40 | 0.6209 | 1.49 |

| 5 | Price | Refer workings below | 132 | 0.6209 | 81.96 |

| 86.16 |

Homework Sourse

Homework Sourse