Shamrock Crusher is a licensed CPA During the first month of

Shamrock Crusher is a licensed CPA. During the first month of operations of her business (a sole proprietorship), the following events and transactions occurred.

Journalize the transactions in the general journal.

| April 2 | Invested $27,070 cash and equipment valued at $12,900 in the business. | |

| 2 | Hired an administrative assistant at a salary of $255 per week payable monthly. | |

| 3 | Purchased supplies on account $833. (Debit an asset account.) | |

| 7 | Paid office rent of $546 for the month. | |

| 11 | Completed a tax assignment and billed client $1,160 for services rendered. (Use Service Revenue account.) | |

| 12 | Received $2,589 advance on a management consulting engagement. | |

| 17 | Received cash of $2,201 for services completed for Ferengi Co. | |

| 21 | Paid insurance expense $100. | |

| 30 | Paid administrative assistant $1,020 for the month. | |

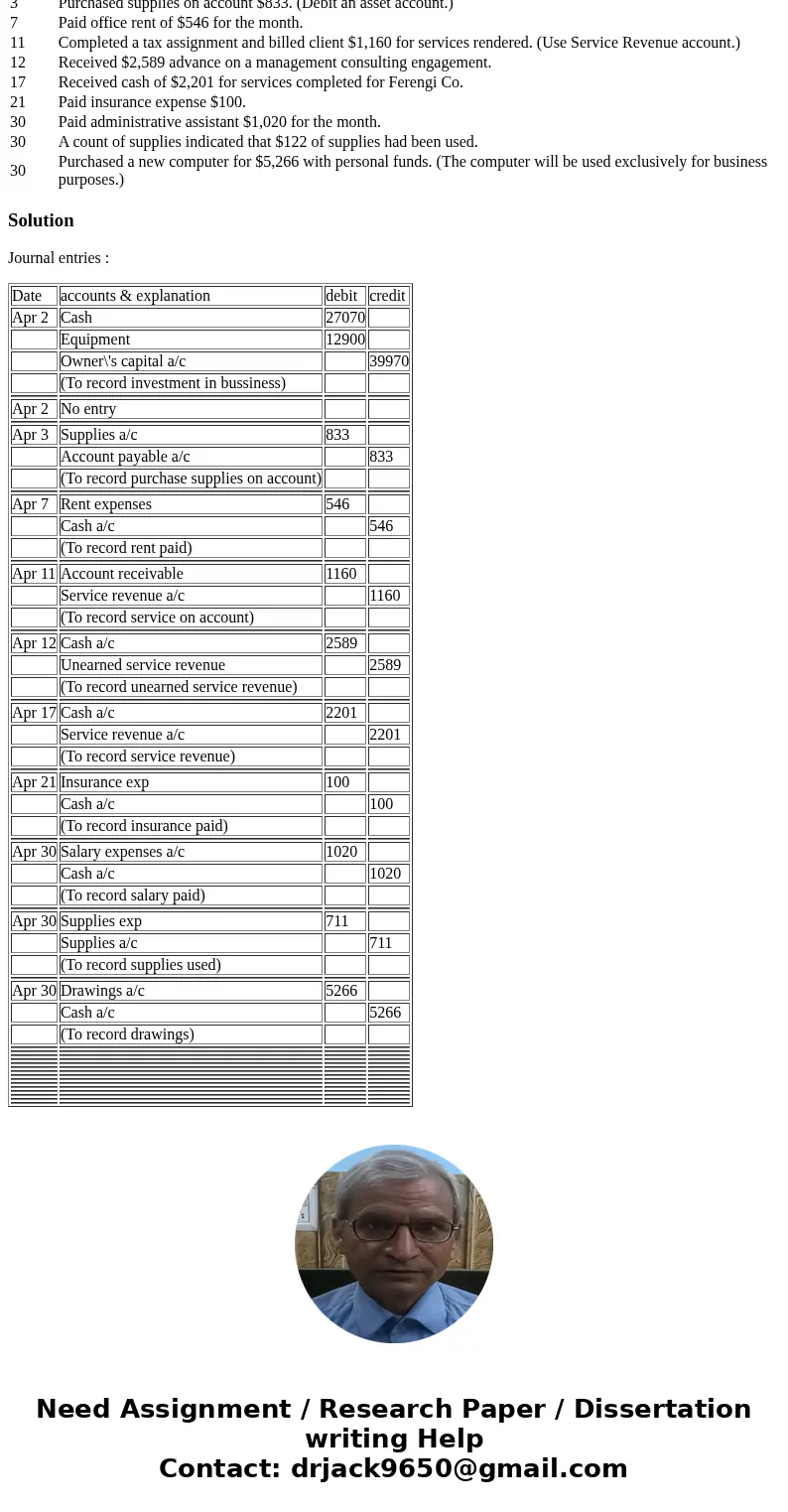

| 30 | A count of supplies indicated that $122 of supplies had been used. | |

| 30 | Purchased a new computer for $5,266 with personal funds. (The computer will be used exclusively for business purposes.) |

Solution

Journal entries :

| Date | accounts & explanation | debit | credit |

| Apr 2 | Cash | 27070 | |

| Equipment | 12900 | ||

| Owner\'s capital a/c | 39970 | ||

| (To record investment in bussiness) | |||

| Apr 2 | No entry | ||

| Apr 3 | Supplies a/c | 833 | |

| Account payable a/c | 833 | ||

| (To record purchase supplies on account) | |||

| Apr 7 | Rent expenses | 546 | |

| Cash a/c | 546 | ||

| (To record rent paid) | |||

| Apr 11 | Account receivable | 1160 | |

| Service revenue a/c | 1160 | ||

| (To record service on account) | |||

| Apr 12 | Cash a/c | 2589 | |

| Unearned service revenue | 2589 | ||

| (To record unearned service revenue) | |||

| Apr 17 | Cash a/c | 2201 | |

| Service revenue a/c | 2201 | ||

| (To record service revenue) | |||

| Apr 21 | Insurance exp | 100 | |

| Cash a/c | 100 | ||

| (To record insurance paid) | |||

| Apr 30 | Salary expenses a/c | 1020 | |

| Cash a/c | 1020 | ||

| (To record salary paid) | |||

| Apr 30 | Supplies exp | 711 | |

| Supplies a/c | 711 | ||

| (To record supplies used) | |||

| Apr 30 | Drawings a/c | 5266 | |

| Cash a/c | 5266 | ||

| (To record drawings) | |||

Homework Sourse

Homework Sourse