Please do adjustments Mar 1Stockholders invested 10000 cash

Please do adjustments.

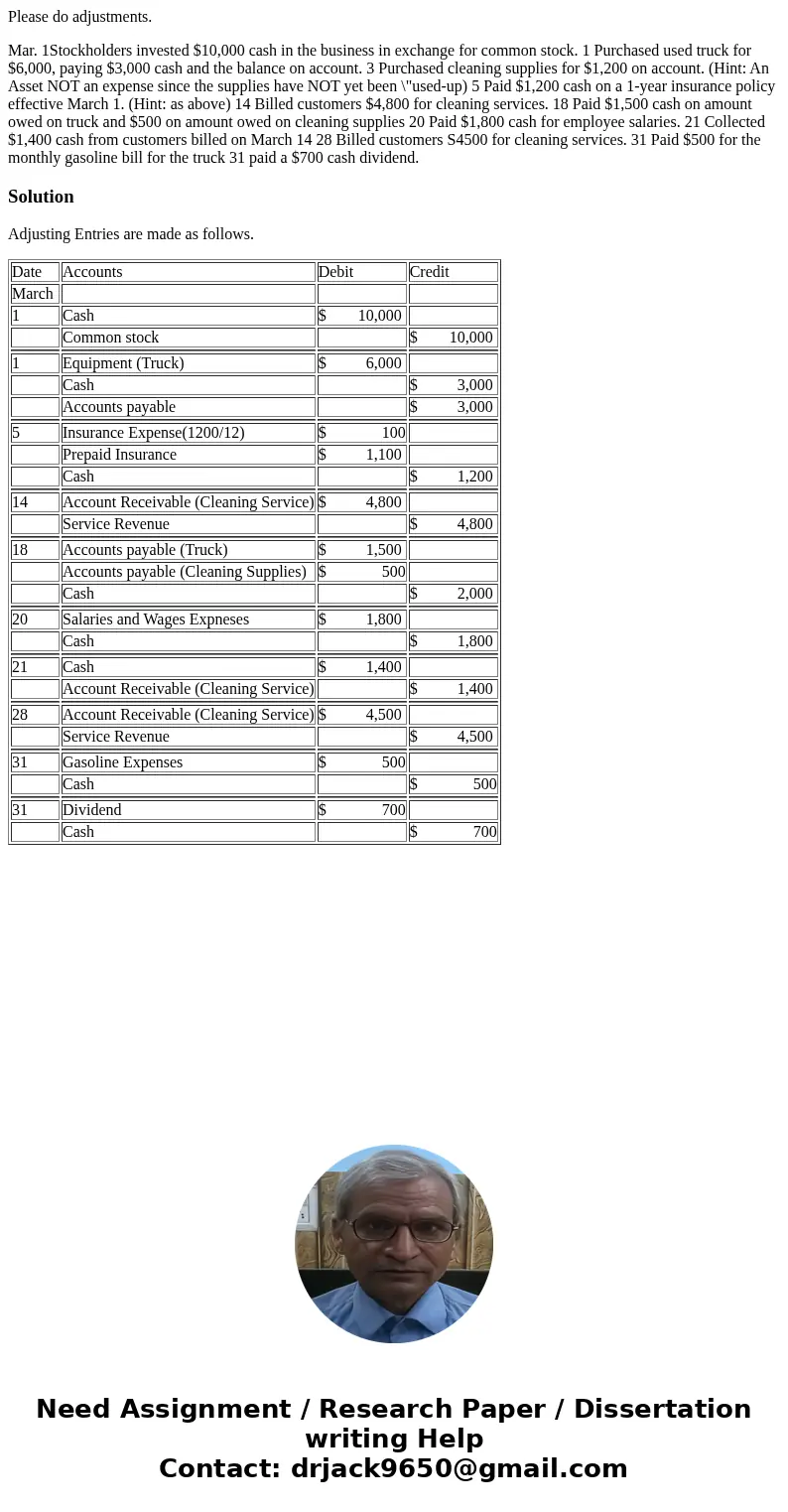

Mar. 1Stockholders invested $10,000 cash in the business in exchange for common stock. 1 Purchased used truck for $6,000, paying $3,000 cash and the balance on account. 3 Purchased cleaning supplies for $1,200 on account. (Hint: An Asset NOT an expense since the supplies have NOT yet been \"used-up) 5 Paid $1,200 cash on a 1-year insurance policy effective March 1. (Hint: as above) 14 Billed customers $4,800 for cleaning services. 18 Paid $1,500 cash on amount owed on truck and $500 on amount owed on cleaning supplies 20 Paid $1,800 cash for employee salaries. 21 Collected $1,400 cash from customers billed on March 14 28 Billed customers S4500 for cleaning services. 31 Paid $500 for the monthly gasoline bill for the truck 31 paid a $700 cash dividend.Solution

Adjusting Entries are made as follows.

| Date | Accounts | Debit | Credit |

| March | |||

| 1 | Cash | $ 10,000 | |

| Common stock | $ 10,000 | ||

| 1 | Equipment (Truck) | $ 6,000 | |

| Cash | $ 3,000 | ||

| Accounts payable | $ 3,000 | ||

| 5 | Insurance Expense(1200/12) | $ 100 | |

| Prepaid Insurance | $ 1,100 | ||

| Cash | $ 1,200 | ||

| 14 | Account Receivable (Cleaning Service) | $ 4,800 | |

| Service Revenue | $ 4,800 | ||

| 18 | Accounts payable (Truck) | $ 1,500 | |

| Accounts payable (Cleaning Supplies) | $ 500 | ||

| Cash | $ 2,000 | ||

| 20 | Salaries and Wages Expneses | $ 1,800 | |

| Cash | $ 1,800 | ||

| 21 | Cash | $ 1,400 | |

| Account Receivable (Cleaning Service) | $ 1,400 | ||

| 28 | Account Receivable (Cleaning Service) | $ 4,500 | |

| Service Revenue | $ 4,500 | ||

| 31 | Gasoline Expenses | $ 500 | |

| Cash | $ 500 | ||

| 31 | Dividend | $ 700 | |

| Cash | $ 700 |

Homework Sourse

Homework Sourse