D Virginia Community College Sy xConnect Secure httpsnewcon

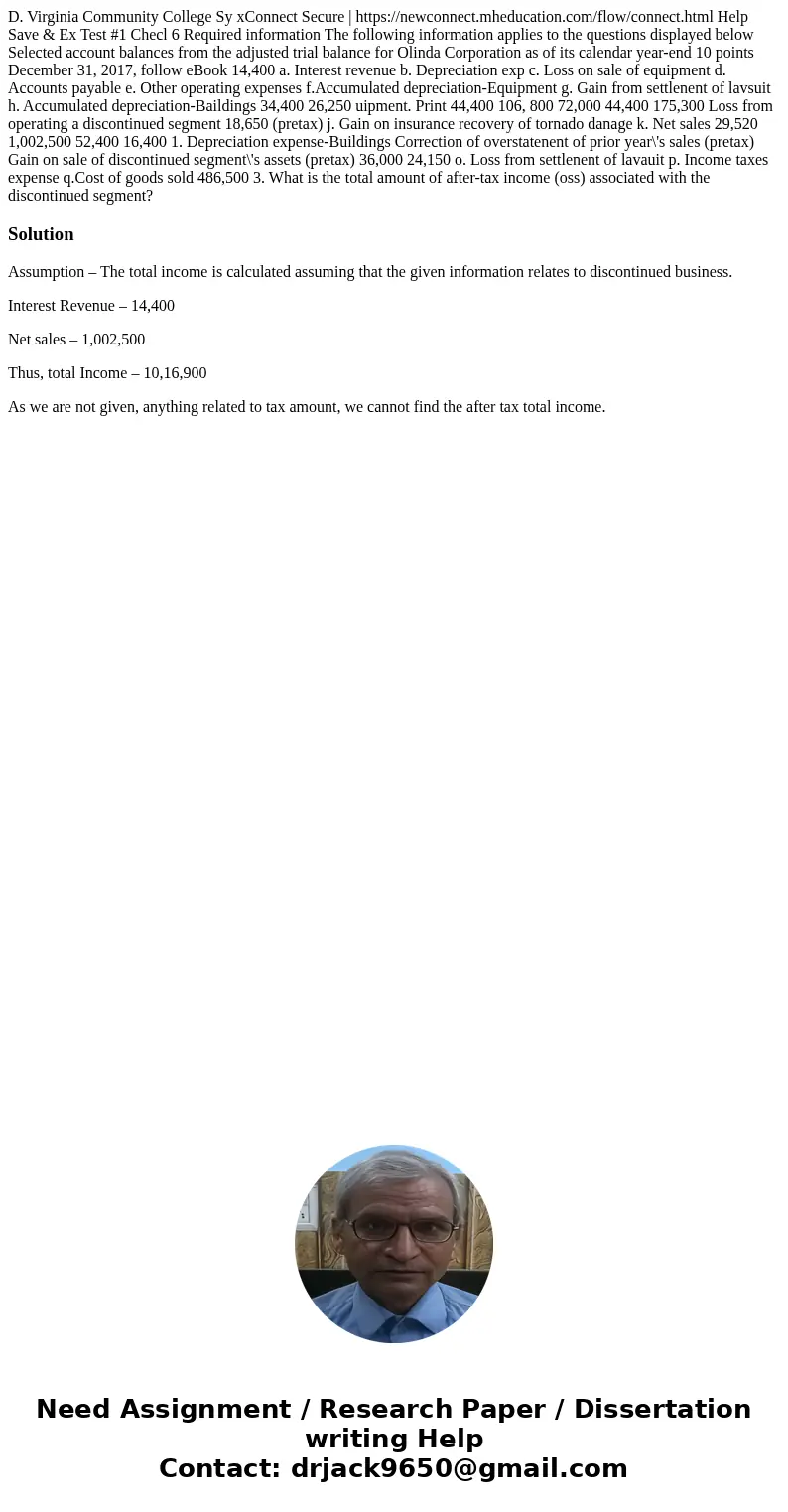

D. Virginia Community College Sy xConnect Secure | https://newconnect.mheducation.com/flow/connect.html Help Save & Ex Test #1 Checl 6 Required information The following information applies to the questions displayed below Selected account balances from the adjusted trial balance for Olinda Corporation as of its calendar year-end 10 points December 31, 2017, follow eBook 14,400 a. Interest revenue b. Depreciation exp c. Loss on sale of equipment d. Accounts payable e. Other operating expenses f.Accumulated depreciation-Equipment g. Gain from settlenent of lavsuit h. Accumulated depreciation-Baildings 34,400 26,250 uipment. Print 44,400 106, 800 72,000 44,400 175,300 Loss from operating a discontinued segment 18,650 (pretax) j. Gain on insurance recovery of tornado danage k. Net sales 29,520 1,002,500 52,400 16,400 1. Depreciation expense-Buildings Correction of overstatenent of prior year\'s sales (pretax) Gain on sale of discontinued segment\'s assets (pretax) 36,000 24,150 o. Loss from settlenent of lavauit p. Income taxes expense q.Cost of goods sold 486,500 3. What is the total amount of after-tax income (oss) associated with the discontinued segment?

Solution

Assumption – The total income is calculated assuming that the given information relates to discontinued business.

Interest Revenue – 14,400

Net sales – 1,002,500

Thus, total Income – 10,16,900

As we are not given, anything related to tax amount, we cannot find the after tax total income.

Homework Sourse

Homework Sourse