120 marks Acme Corporation is planning to open a new divisio

Solution

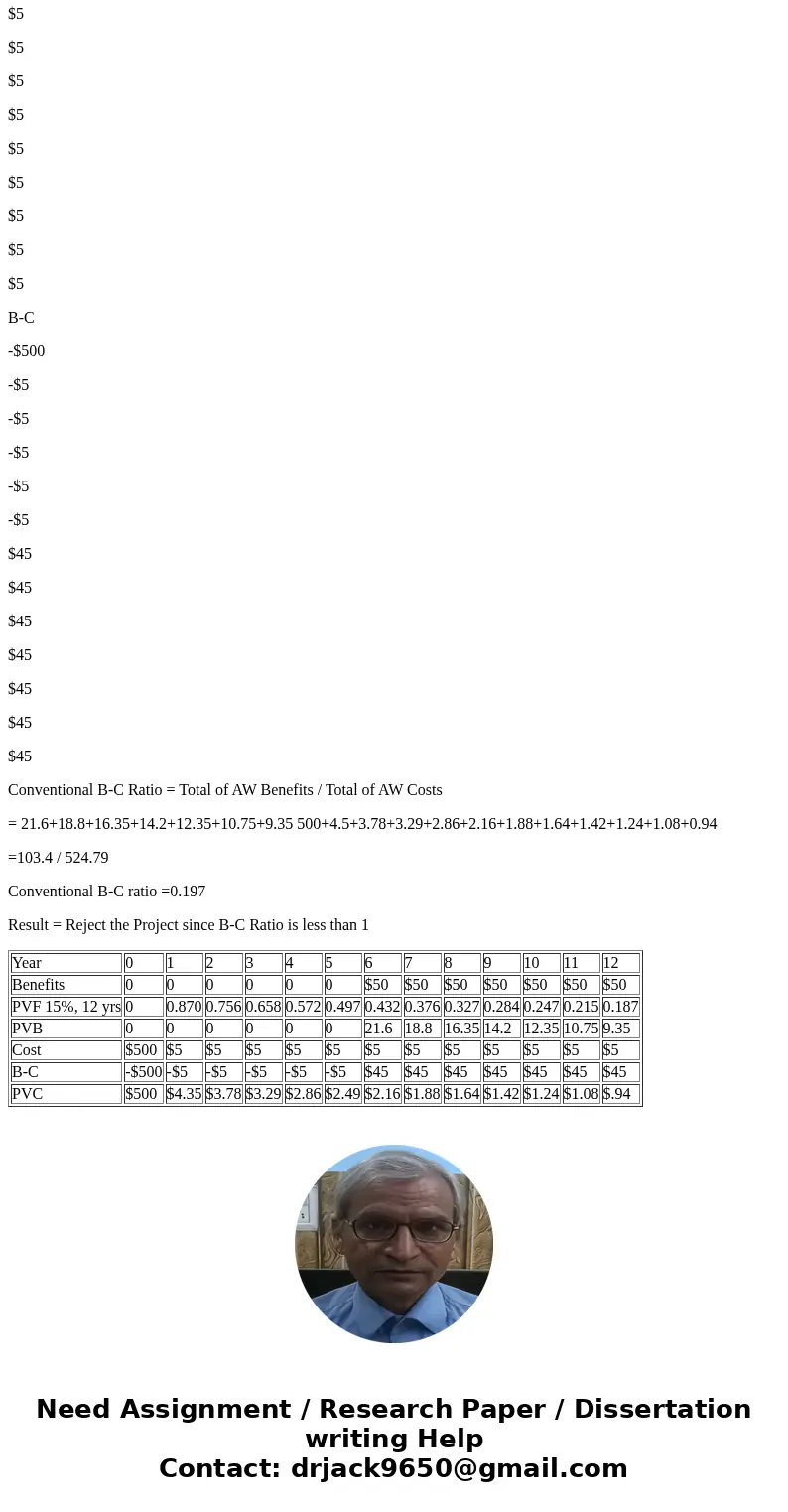

Computation of Conventional Benefit Cost Ratio using Annual Worth (AW)

Initial Set up Cost $100 million

Annual operating Expenses (for next 12 years) $5 million

Annual Revenue (beginning from 5th year) $50 million

Minimum Acceptable Rate of Return (MARR) 15%

Project Life in years 12 years

Annual Worth of Benefits - Annual Worth of Disbenefits

Conventional Benefit Cost Ratio = -----------------------------------------------------------------------------

Initial cost + Operating Cost - Salvage Value

(Amount in $ Million)

Year

0

1

2

3

4

5

6

7

8

9

10

11

12

Benefits

0

0

0

0

0

0

$50

$50

$50

$50

$50

$50

$50

PVF 15%, 12 yrs

0

0.870

0.756

0.658

0.572

0.497

0.432

0.376

0.327

0.284

0.247

0.215

0.187

PVB

0

0

0

0

0

0

21.6

18.8

16.35

14.2

12.35

10.75

9.35

Cost

$500

$5

$5

$5

$5

$5

$5

$5

$5

$5

$5

$5

$5

B-C

-$500

-$5

-$5

-$5

-$5

-$5

$45

$45

$45

$45

$45

$45

$45

Conventional B-C Ratio = Total of AW Benefits / Total of AW Costs

= 21.6+18.8+16.35+14.2+12.35+10.75+9.35 500+4.5+3.78+3.29+2.86+2.16+1.88+1.64+1.42+1.24+1.08+0.94

=103.4 / 524.79

Conventional B-C ratio =0.197

Result = Reject the Project since B-C Ratio is less than 1

| Year | 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| Benefits | 0 | 0 | 0 | 0 | 0 | 0 | $50 | $50 | $50 | $50 | $50 | $50 | $50 |

| PVF 15%, 12 yrs | 0 | 0.870 | 0.756 | 0.658 | 0.572 | 0.497 | 0.432 | 0.376 | 0.327 | 0.284 | 0.247 | 0.215 | 0.187 |

| PVB | 0 | 0 | 0 | 0 | 0 | 0 | 21.6 | 18.8 | 16.35 | 14.2 | 12.35 | 10.75 | 9.35 |

| Cost | $500 | $5 | $5 | $5 | $5 | $5 | $5 | $5 | $5 | $5 | $5 | $5 | $5 |

| B-C | -$500 | -$5 | -$5 | -$5 | -$5 | -$5 | $45 | $45 | $45 | $45 | $45 | $45 | $45 |

| PVC | $500 | $4.35 | $3.78 | $3.29 | $2.86 | $2.49 | $2.16 | $1.88 | $1.64 | $1.42 | $1.24 | $1.08 | $.94 |

Homework Sourse

Homework Sourse