Question 1 1 pts Suppose your expectations regarding the sto

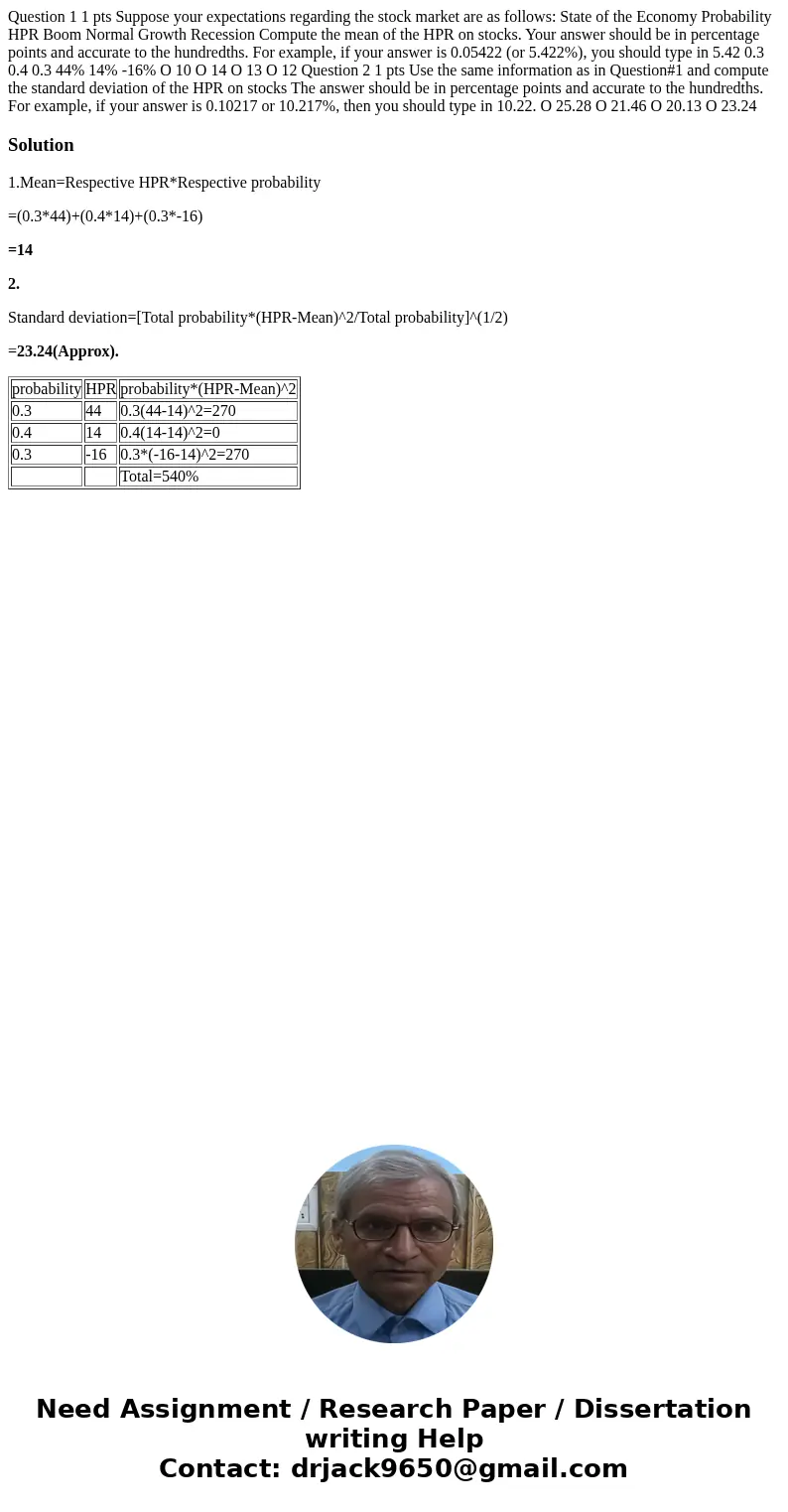

Question 1 1 pts Suppose your expectations regarding the stock market are as follows: State of the Economy Probability HPR Boom Normal Growth Recession Compute the mean of the HPR on stocks. Your answer should be in percentage points and accurate to the hundredths. For example, if your answer is 0.05422 (or 5.422%), you should type in 5.42 0.3 0.4 0.3 44% 14% -16% O 10 O 14 O 13 O 12 Question 2 1 pts Use the same information as in Question#1 and compute the standard deviation of the HPR on stocks The answer should be in percentage points and accurate to the hundredths. For example, if your answer is 0.10217 or 10.217%, then you should type in 10.22. O 25.28 O 21.46 O 20.13 O 23.24

Solution

1.Mean=Respective HPR*Respective probability

=(0.3*44)+(0.4*14)+(0.3*-16)

=14

2.

Standard deviation=[Total probability*(HPR-Mean)^2/Total probability]^(1/2)

=23.24(Approx).

| probability | HPR | probability*(HPR-Mean)^2 |

| 0.3 | 44 | 0.3(44-14)^2=270 |

| 0.4 | 14 | 0.4(14-14)^2=0 |

| 0.3 | -16 | 0.3*(-16-14)^2=270 |

| Total=540% |

Homework Sourse

Homework Sourse