Questions 14 are based on Table 1 below which lists the annu

Questions 1-4 are based on Table 1 below, which lists the annual return for a $1,000 investment in stock X under four different economic conditions, with associated probabilities for each condition. The distribution in Table 1 is a probability distribution. discrete continuous discrete and continuous neither discrete nor continuous The probability for stock X to have an annual return less than $80 is 0.1 0.3 0.4 0.8 The probability for stock X to have a positive annual return is 0.1 0.3 0.7 0.9 The expected value of annual return for stock X is $55 62.5 $85 $100

Solution

1. OPTION A: Discrete

2.

P(X<80) = P(-100) + P(50) = 0.1 + 0.3 = 0.4 [ANSWER, C]

****************

3)

P(X>0) = P(50) + P(100) + P(200) = 0.3 + 0.4 +0.2 = 0.9 [ANSWER, D]

*******************

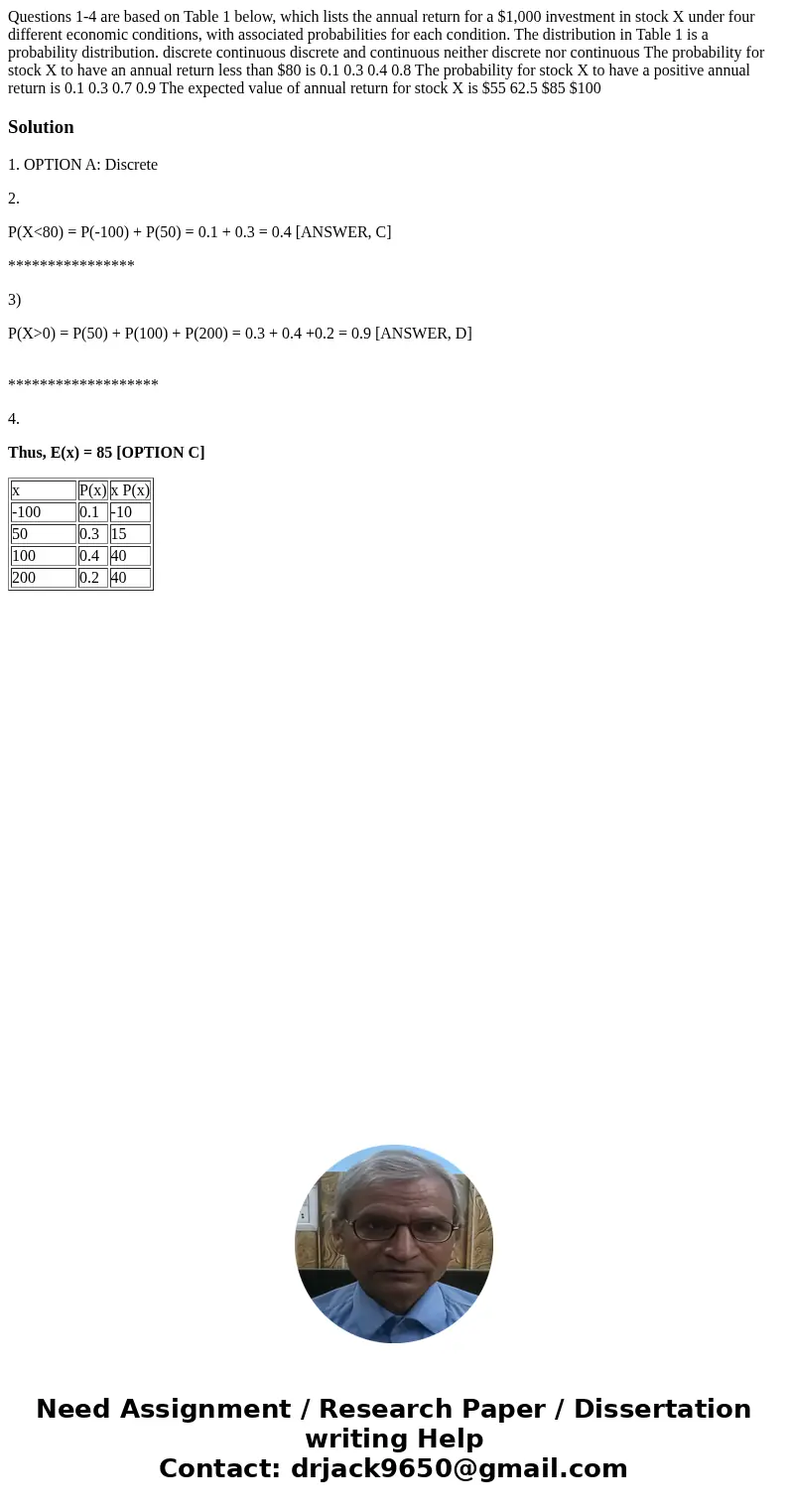

4.

Thus, E(x) = 85 [OPTION C]

| x | P(x) | x P(x) |

| -100 | 0.1 | -10 |

| 50 | 0.3 | 15 |

| 100 | 0.4 | 40 |

| 200 | 0.2 | 40 |

Homework Sourse

Homework Sourse