Recording Business Transactions 101 Journalizing transaction

Recording Business Transactions 101 Journalizing transactions, posting journal entries to four-column accounts, and preparing a trial balance P2-32A Learning Objectives 3, 4 rial balance of Shawn Merry, CPA, is dated March 31, 2018 3. Cash Balance $12,500 The SHAWN MERRY, CPA Trial Balance March 31, 2018 Account Title Debit 5 11,000 16,500 Credit Accounts Receivable Office Supplies Land Furniture 400 30,000 Accounts Payable Unearned Revenue Merry, Capital Merry. Withdrawals Service Revenue Salaries Expense Rent Expense Total $ 3,800 52,300 8,200 5,600 800 64,300 64,300 During April, the business completed the following transactions: Apr. 4 Collected $2,500 cash from a client on account 8 13 14 15 Performed tax services for a client on account, $5,400 Paid $3,000 on account. Purchased furniture on account, $3,600 Merry contributed his personal automobile to the business in exchange 18 19 20 21 24 for capital. The automobile had a market value of $9,500. Purchased office supplies on account, $900 Received $2,700 for tax services performed on April 8 Merry withdrew cash of $6,500. Received $5,700 cash for consulting work completed. Received $2.400 cash for accounting services to be completed next month. Paid office rent, $600. Paid employee salary, $1,700. 27 28

Solution

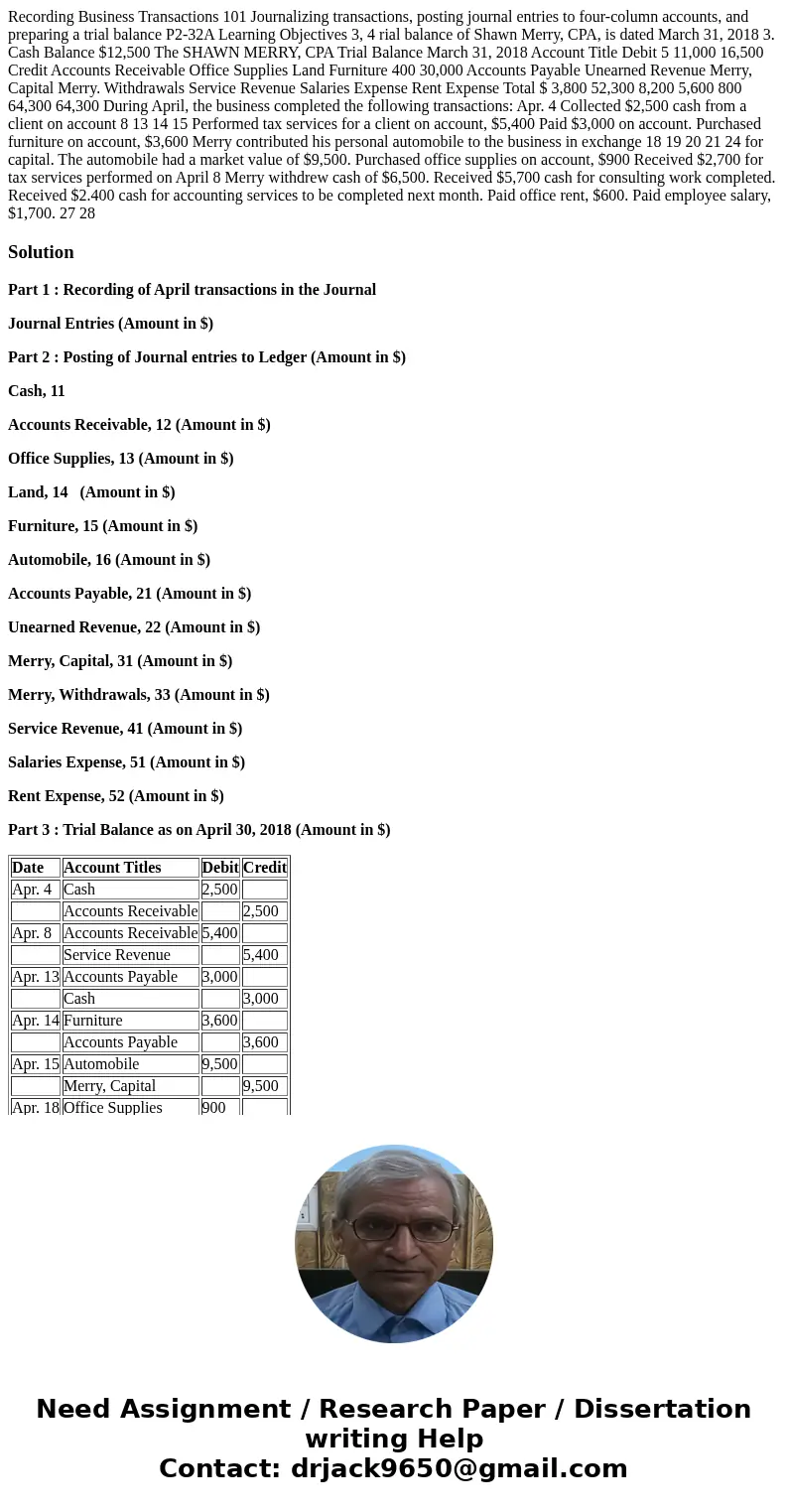

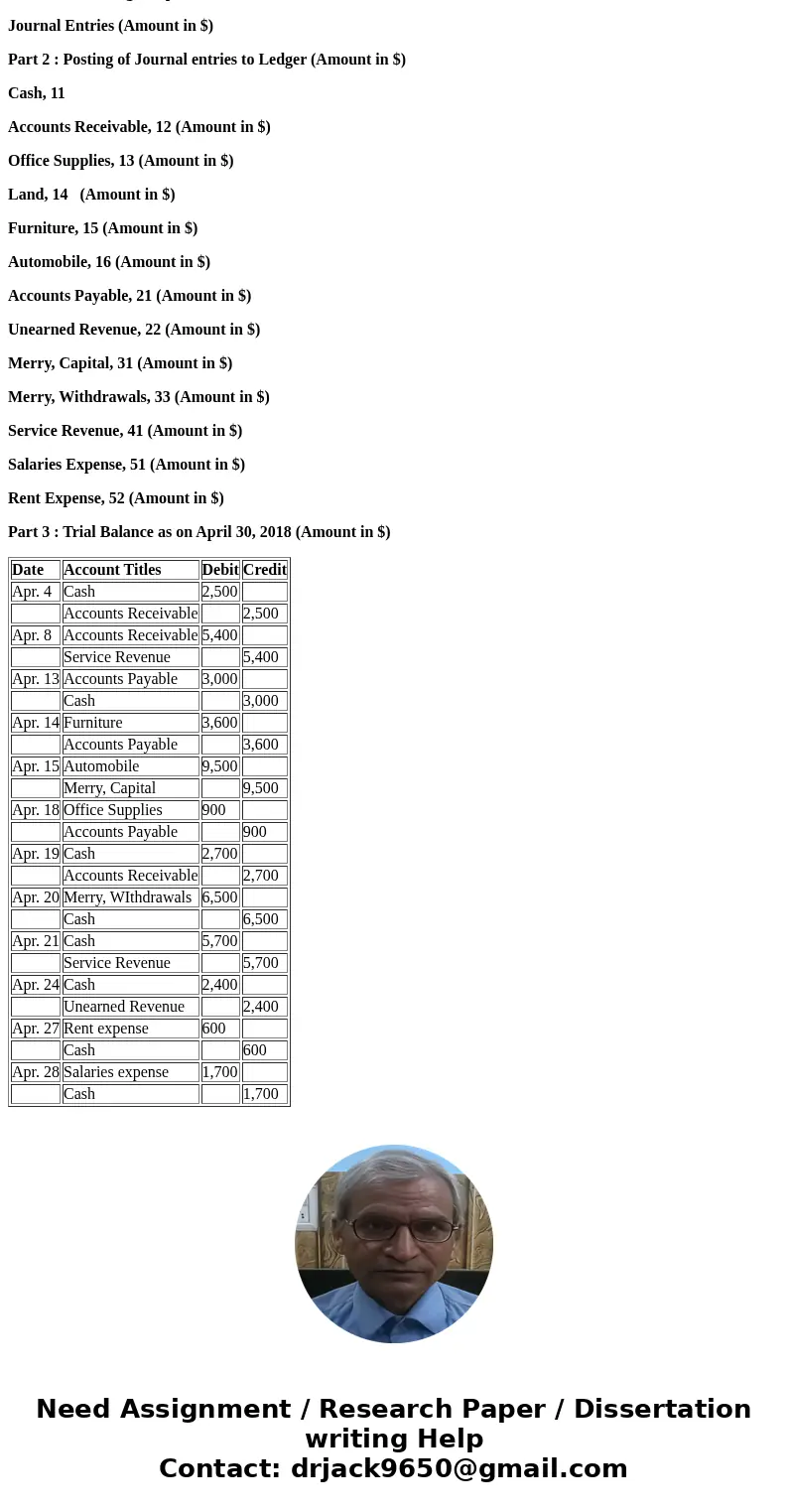

Part 1 : Recording of April transactions in the Journal

Journal Entries (Amount in $)

Part 2 : Posting of Journal entries to Ledger (Amount in $)

Cash, 11

Accounts Receivable, 12 (Amount in $)

Office Supplies, 13 (Amount in $)

Land, 14 (Amount in $)

Furniture, 15 (Amount in $)

Automobile, 16 (Amount in $)

Accounts Payable, 21 (Amount in $)

Unearned Revenue, 22 (Amount in $)

Merry, Capital, 31 (Amount in $)

Merry, Withdrawals, 33 (Amount in $)

Service Revenue, 41 (Amount in $)

Salaries Expense, 51 (Amount in $)

Rent Expense, 52 (Amount in $)

Part 3 : Trial Balance as on April 30, 2018 (Amount in $)

| Date | Account Titles | Debit | Credit |

| Apr. 4 | Cash | 2,500 | |

| Accounts Receivable | 2,500 | ||

| Apr. 8 | Accounts Receivable | 5,400 | |

| Service Revenue | 5,400 | ||

| Apr. 13 | Accounts Payable | 3,000 | |

| Cash | 3,000 | ||

| Apr. 14 | Furniture | 3,600 | |

| Accounts Payable | 3,600 | ||

| Apr. 15 | Automobile | 9,500 | |

| Merry, Capital | 9,500 | ||

| Apr. 18 | Office Supplies | 900 | |

| Accounts Payable | 900 | ||

| Apr. 19 | Cash | 2,700 | |

| Accounts Receivable | 2,700 | ||

| Apr. 20 | Merry, WIthdrawals | 6,500 | |

| Cash | 6,500 | ||

| Apr. 21 | Cash | 5,700 | |

| Service Revenue | 5,700 | ||

| Apr. 24 | Cash | 2,400 | |

| Unearned Revenue | 2,400 | ||

| Apr. 27 | Rent expense | 600 | |

| Cash | 600 | ||

| Apr. 28 | Salaries expense | 1,700 | |

| Cash | 1,700 |

Homework Sourse

Homework Sourse