Instructions Eddie Edwards and Phil Bell own and operate The

Solution

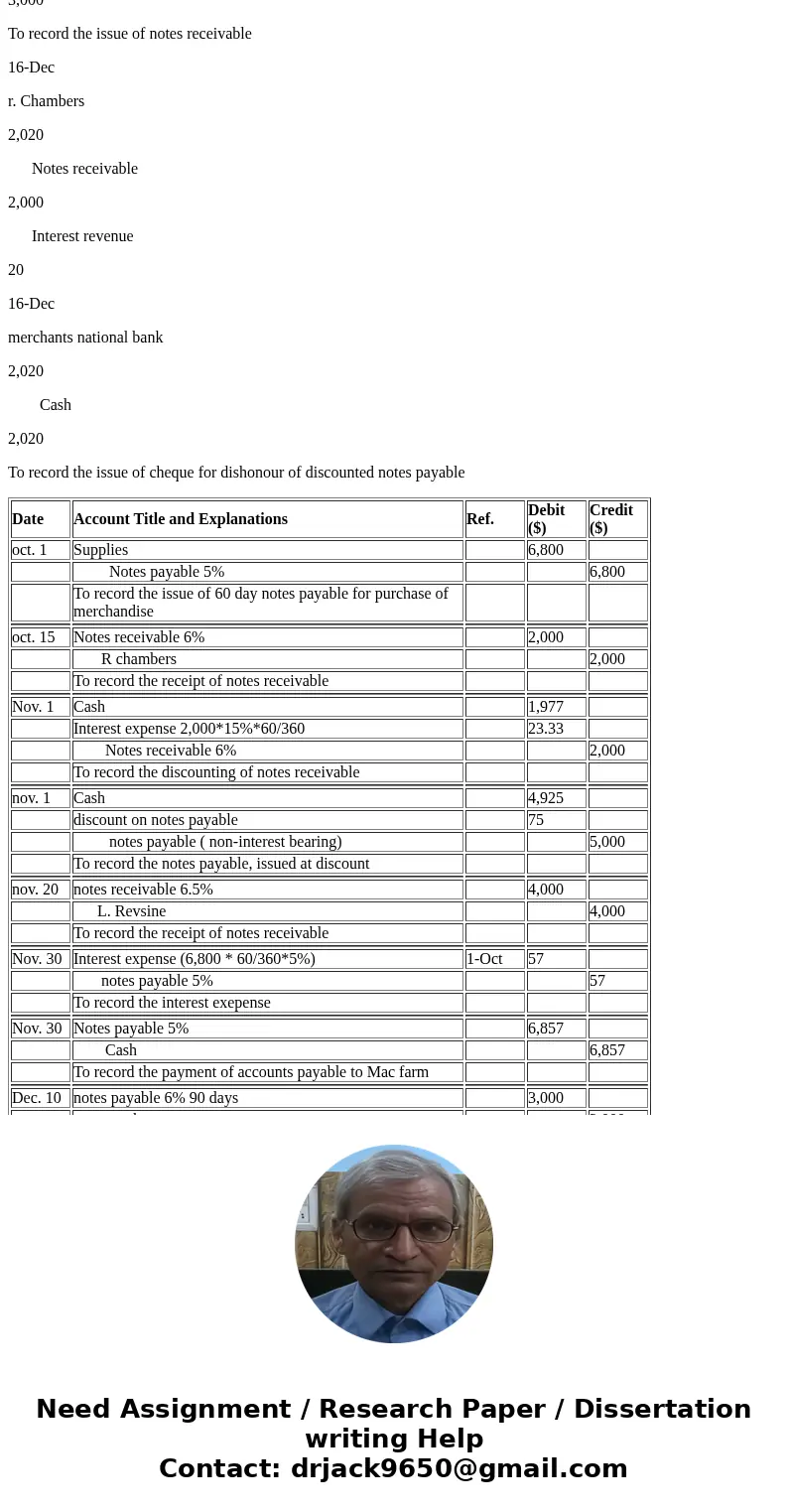

Journalise the following transactions:

General journal

Date

Account Title and Explanations

Ref.

Debit ($)

Credit ($)

oct. 1

Supplies

6,800

Notes payable 5%

6,800

To record the issue of 60 day notes payable for purchase of merchandise

oct. 15

Notes receivable 6%

2,000

R chambers

2,000

To record the receipt of notes receivable

Nov. 1

Cash

1,977

Interest expense 2,000*15%*60/360

23.33

Notes receivable 6%

2,000

To record the discounting of notes receivable

nov. 1

Cash

4,925

discount on notes payable

75

notes payable ( non-interest bearing)

5,000

To record the notes payable, issued at discount

nov. 20

notes receivable 6.5%

4,000

L. Revsine

4,000

To record the receipt of notes receivable

Nov. 30

Interest expense (6,800 * 60/360*5%)

1-Oct

57

notes payable 5%

57

To record the interest exepense

Nov. 30

Notes payable 5%

6,857

Cash

6,857

To record the payment of accounts payable to Mac farm

Dec. 10

notes payable 6% 90 days

3,000

remak tractors

3,000

To record the issue of notes receivable

16-Dec

r. Chambers

2,020

Notes receivable

2,000

Interest revenue

20

16-Dec

merchants national bank

2,020

Cash

2,020

To record the issue of cheque for dishonour of discounted notes payable

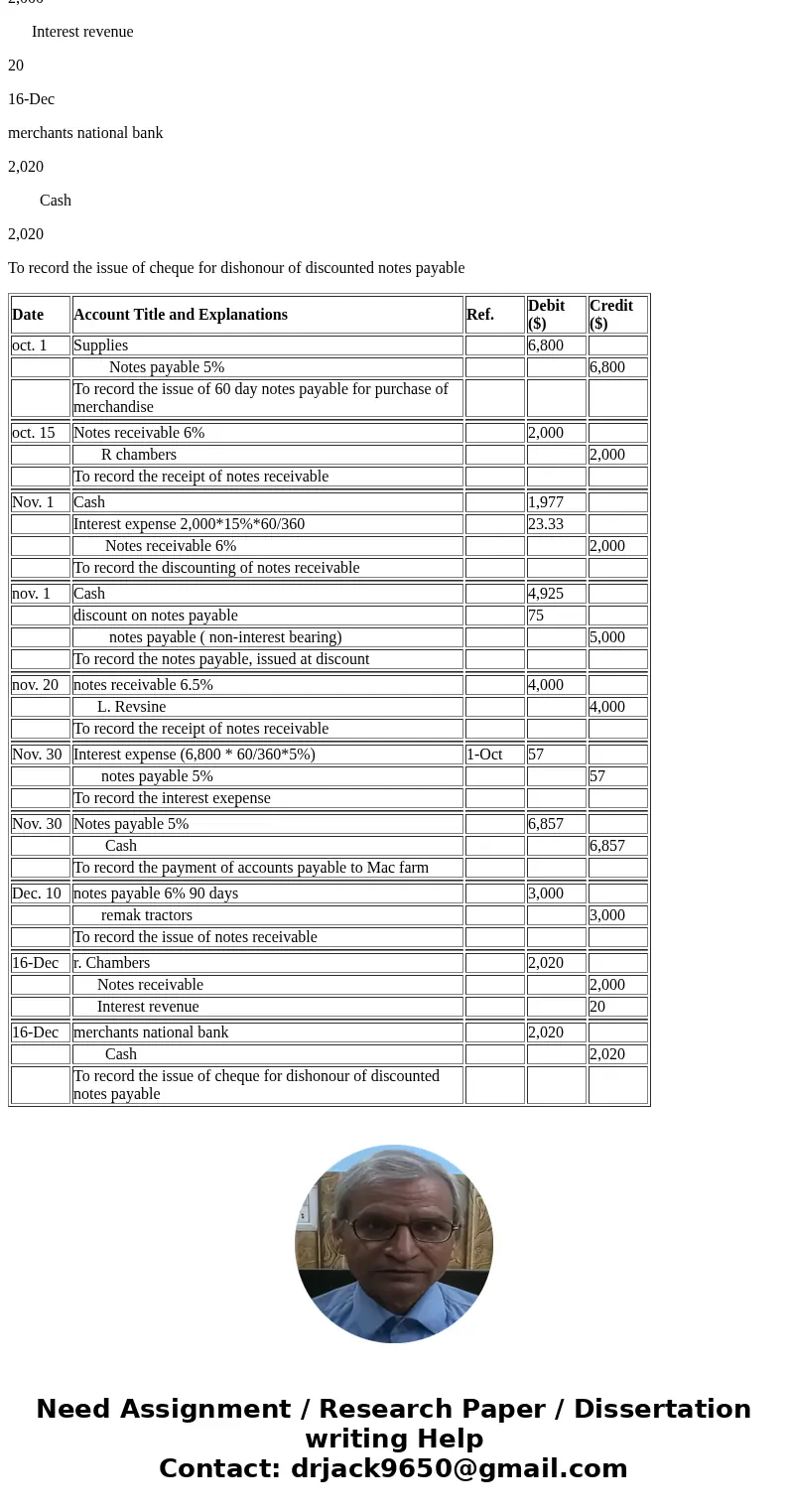

| Date | Account Title and Explanations | Ref. | Debit ($) | Credit ($) |

| oct. 1 | Supplies | 6,800 | ||

| Notes payable 5% | 6,800 | |||

| To record the issue of 60 day notes payable for purchase of merchandise | ||||

| oct. 15 | Notes receivable 6% | 2,000 | ||

| R chambers | 2,000 | |||

| To record the receipt of notes receivable | ||||

| Nov. 1 | Cash | 1,977 | ||

| Interest expense 2,000*15%*60/360 | 23.33 | |||

| Notes receivable 6% | 2,000 | |||

| To record the discounting of notes receivable | ||||

| nov. 1 | Cash | 4,925 | ||

| discount on notes payable | 75 | |||

| notes payable ( non-interest bearing) | 5,000 | |||

| To record the notes payable, issued at discount | ||||

| nov. 20 | notes receivable 6.5% | 4,000 | ||

| L. Revsine | 4,000 | |||

| To record the receipt of notes receivable | ||||

| Nov. 30 | Interest expense (6,800 * 60/360*5%) | 1-Oct | 57 | |

| notes payable 5% | 57 | |||

| To record the interest exepense | ||||

| Nov. 30 | Notes payable 5% | 6,857 | ||

| Cash | 6,857 | |||

| To record the payment of accounts payable to Mac farm | ||||

| Dec. 10 | notes payable 6% 90 days | 3,000 | ||

| remak tractors | 3,000 | |||

| To record the issue of notes receivable | ||||

| 16-Dec | r. Chambers | 2,020 | ||

| Notes receivable | 2,000 | |||

| Interest revenue | 20 | |||

| 16-Dec | merchants national bank | 2,020 | ||

| Cash | 2,020 | |||

| To record the issue of cheque for dishonour of discounted notes payable |

Homework Sourse

Homework Sourse