You are an investor with a large sum of money or a company l

You are an investor with a large sum of money (or a company looking for an investment), and buying either Home Depot or shares of stock in Home Depot. Determine, based on the company’s financials and its future business prospects, whether you will invest in this company or not.

Home Depot Profitability Ratios

Home Depot

in millions

Net Income

Net Sales

Stock Holders\' Equity

Assets

2015

7,009

2015

88,519

2015

6,316

2015

41,973

2016

7,957

2016

94,595

2016

4,333

2016

42,966

2017

8,630

2017

100,904

2017

1,454

2017

44,529

Average Assets

43,156

Retrieved from (The Home Depot, Inc. (IS), 2018) (The Home Depot, Inc, 2018) (The Home Depot, Inc. (CF), 2018)

Home Depot

Profit Margin

Return on Equity

Return on Assets

2015

7.92%

110.97%

16.24%

2016

8.41%

183.64%

18.44%

2017

8.55%

593.54%

20.00%

Industry

Profit Margin

Return on Equity

Return on Assets

6.50%

52.73%

13.61%

Industry ratios provided by Csimarket.com.

Home Depot Debt Management Ratios

Home Depot

in millions

Total Assets

Total Debt

Stock Holders\' Equity

2015

41,973

2015

35,657

2015

6,316

2016

42,966

2016

38,633

2016

4,333

2017

44,529

2017

43,075

2017

1,454

Retrieved from (The Home Depot, Inc. (IS), 2018) (The Home Depot, Inc, 2018) (The Home Depot, Inc. (CF), 2018

Home Depot

Debt Ratio

Debt to Equity Ratio

Equity Multiplier

2015

84.95%

5.65

6.65

2016

89.92%

8.92

9.92

2017

96.73%

29.63

30.63

Industry

Debt Ratio

Debt to Equity Ratio

Equity Multiplier

85.30%

0.14

5.04

Industry ratios provided by Csimarket.com.

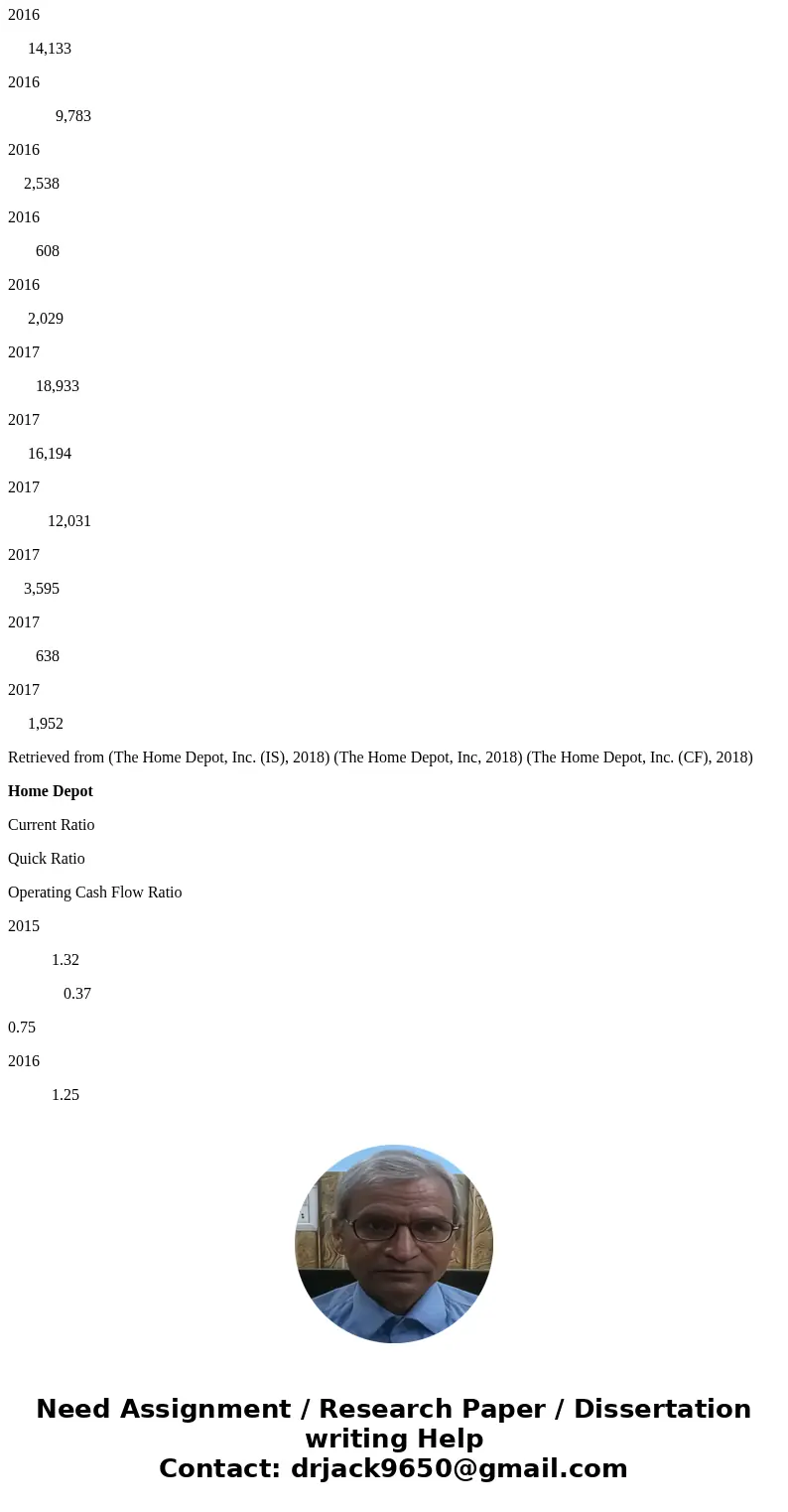

Home Depot Liquidity Ratios

Home Depot

in millions

Current Assets

Current Liabilities

Operating Cash Flow

Cash

Marketable Securities

Accounts Receivable

2015

16,484

2015

12,524

2015

9,373

2015

2,216

2015

569

2015

1,890

2016

17,724

2016

14,133

2016

9,783

2016

2,538

2016

608

2016

2,029

2017

18,933

2017

16,194

2017

12,031

2017

3,595

2017

638

2017

1,952

Retrieved from (The Home Depot, Inc. (IS), 2018) (The Home Depot, Inc, 2018) (The Home Depot, Inc. (CF), 2018)

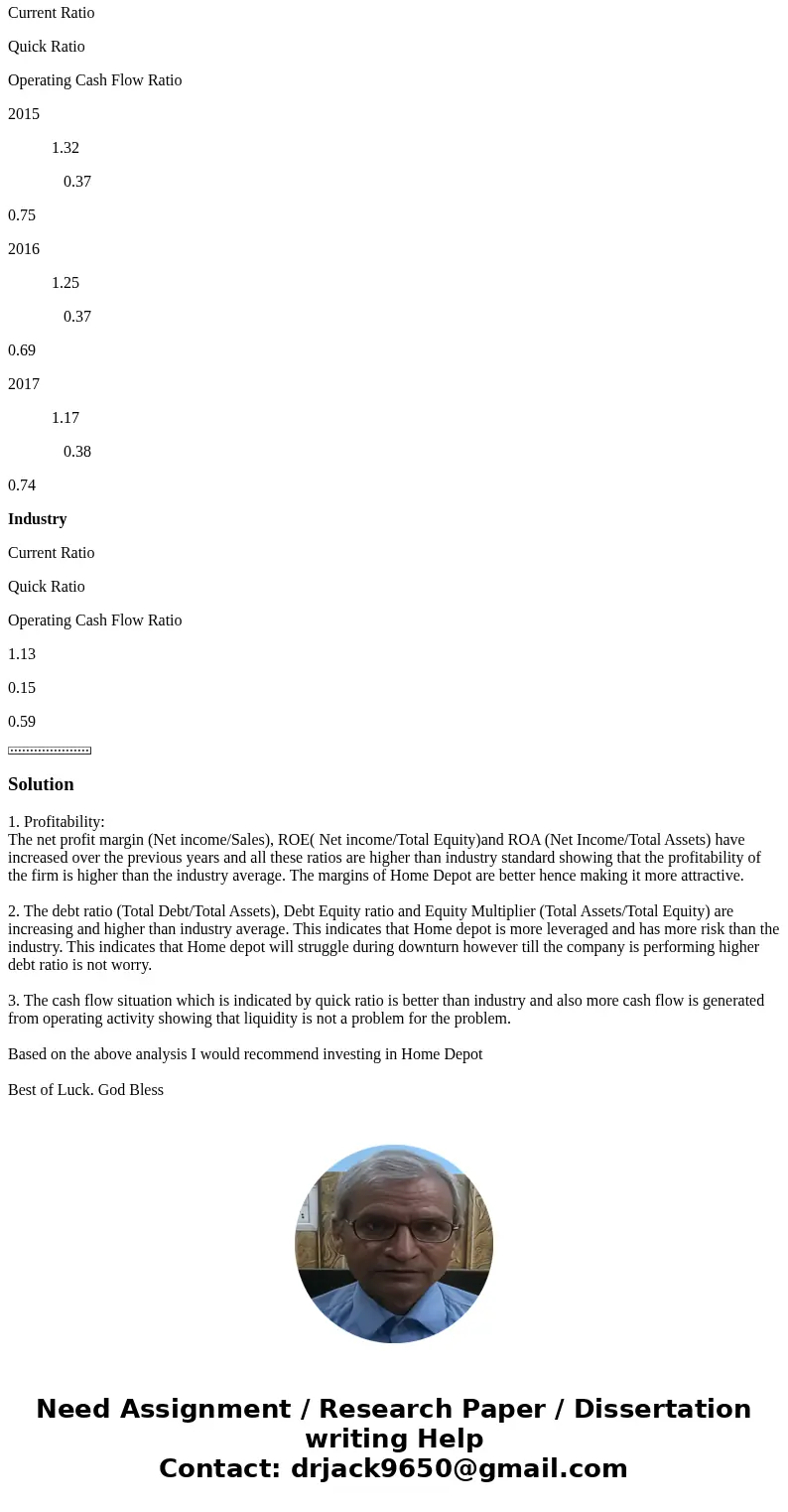

Home Depot

Current Ratio

Quick Ratio

Operating Cash Flow Ratio

2015

1.32

0.37

0.75

2016

1.25

0.37

0.69

2017

1.17

0.38

0.74

Industry

Current Ratio

Quick Ratio

Operating Cash Flow Ratio

1.13

0.15

0.59

Solution

1. Profitability:

The net profit margin (Net income/Sales), ROE( Net income/Total Equity)and ROA (Net Income/Total Assets) have increased over the previous years and all these ratios are higher than industry standard showing that the profitability of the firm is higher than the industry average. The margins of Home Depot are better hence making it more attractive.

2. The debt ratio (Total Debt/Total Assets), Debt Equity ratio and Equity Multiplier (Total Assets/Total Equity) are increasing and higher than industry average. This indicates that Home depot is more leveraged and has more risk than the industry. This indicates that Home depot will struggle during downturn however till the company is performing higher debt ratio is not worry.

3. The cash flow situation which is indicated by quick ratio is better than industry and also more cash flow is generated from operating activity showing that liquidity is not a problem for the problem.

Based on the above analysis I would recommend investing in Home Depot

Best of Luck. God Bless

Homework Sourse

Homework Sourse