A 200 million five year inverse floater currently priced at

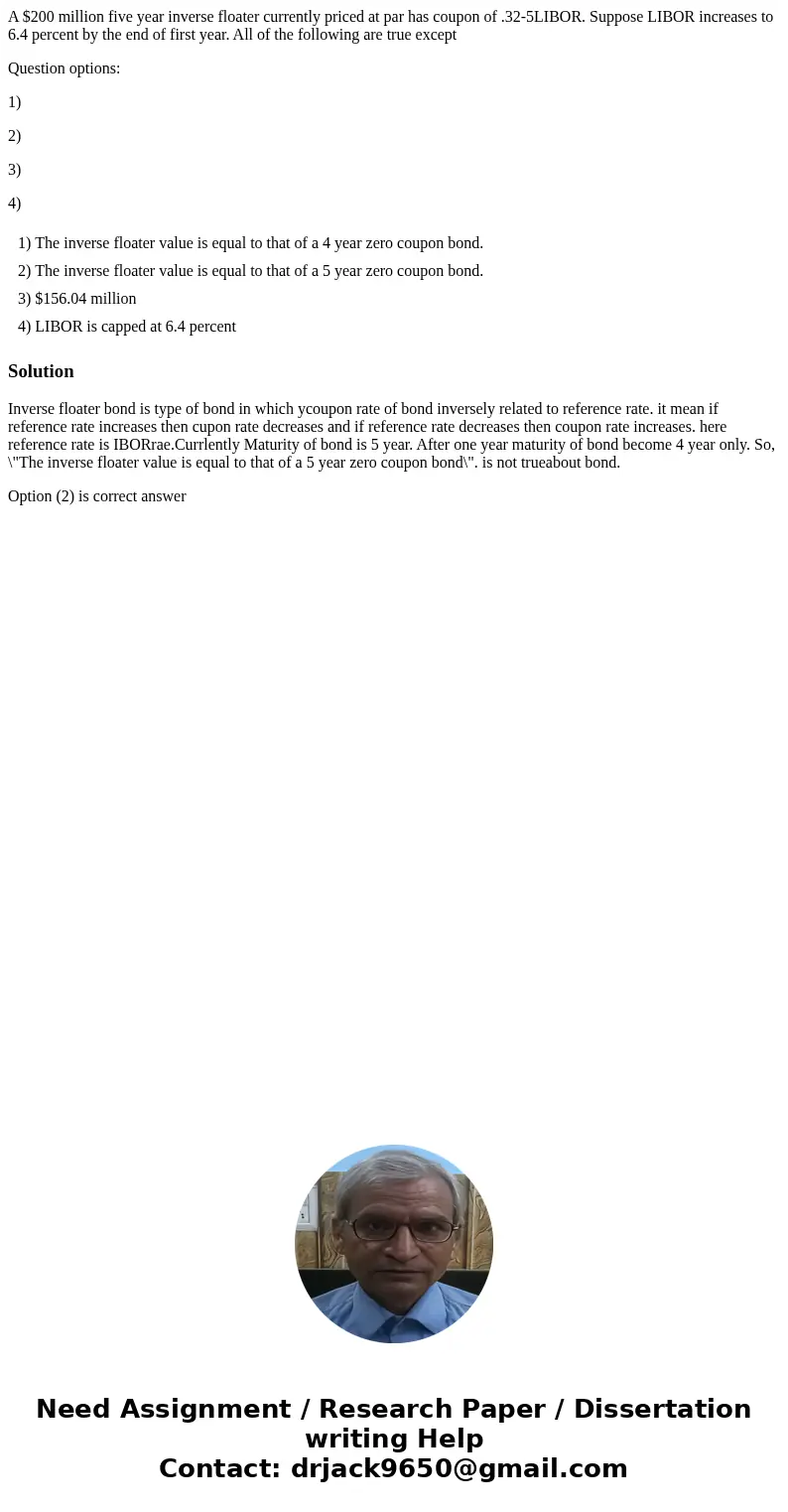

A $200 million five year inverse floater currently priced at par has coupon of .32-5LIBOR. Suppose LIBOR increases to 6.4 percent by the end of first year. All of the following are true except

Question options:

1)

2)

3)

4)

| |||

| |||

| |||

|

Solution

Inverse floater bond is type of bond in which ycoupon rate of bond inversely related to reference rate. it mean if reference rate increases then cupon rate decreases and if reference rate decreases then coupon rate increases. here reference rate is IBORrae.Currlently Maturity of bond is 5 year. After one year maturity of bond become 4 year only. So, \"The inverse floater value is equal to that of a 5 year zero coupon bond\". is not trueabout bond.

Option (2) is correct answer

Homework Sourse

Homework Sourse