You are trying to set up a portfolio that consists of a corp

You are trying to set up a portfolio that consists of a corporate bond fund and a common stock fund. The following information about the annual return(per $1000) of each of these investments under different economic conditions is available, along with the probability that each of these economic conditions will occur.

Probability State of the Economy Coroporate Bonds Common Stocks

.10 Recession -$30 -$150

.15 Stagnation $50 -$20

.35 Slow Growth $90 $120

.30 Moderate Growth $100 $100

.10 High Growth $110 $250

A. Commute the expected return for corporate bond and common stocks

B. Compute the standard deviation for each fund.

C. Which would you invest?Why?

Solution

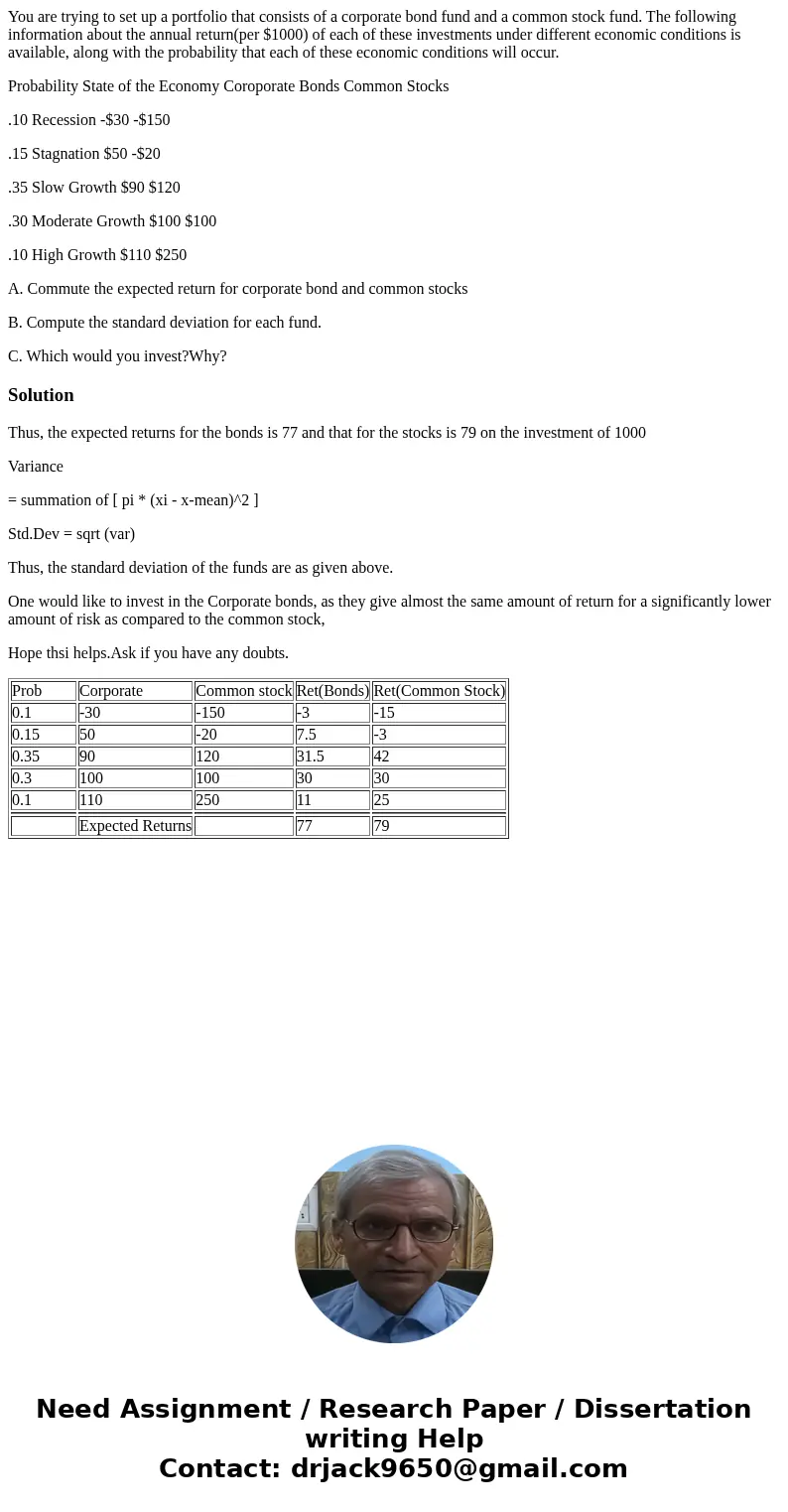

Thus, the expected returns for the bonds is 77 and that for the stocks is 79 on the investment of 1000

Variance

= summation of [ pi * (xi - x-mean)^2 ]

Std.Dev = sqrt (var)

Thus, the standard deviation of the funds are as given above.

One would like to invest in the Corporate bonds, as they give almost the same amount of return for a significantly lower amount of risk as compared to the common stock,

Hope thsi helps.Ask if you have any doubts.

| Prob | Corporate | Common stock | Ret(Bonds) | Ret(Common Stock) |

| 0.1 | -30 | -150 | -3 | -15 |

| 0.15 | 50 | -20 | 7.5 | -3 |

| 0.35 | 90 | 120 | 31.5 | 42 |

| 0.3 | 100 | 100 | 30 | 30 |

| 0.1 | 110 | 250 | 11 | 25 |

| Expected Returns | 77 | 79 |

Homework Sourse

Homework Sourse