Find 1 Direct Labor Cost 2 Manufacturing Overhead Cost 3 Pri

Find:

1) Direct Labor Cost

2) Manufacturing Overhead Cost

3) Prime Cost

4) Conversion Cost

5) Total Manufacturing Cost

6) Period Expenses

E1-8 Classifying and Calculating Costs [LO 1-4] The following information is available for Wonderway, Inc., for 2015: Factory rent Company advertising Wages paid to laborers Depreciation for president\'s vehicle Indirect production labor Utilities for factory Production supervisor\'s salary President\'s sala Direct materials used Sales commissions Factory insurance Depreciation on factory equipment $ 40,000 20,000 82,000 8,000 1,800 36,000 30,000 60,000 34,500 7,500 12,000 26,000 rVSolution

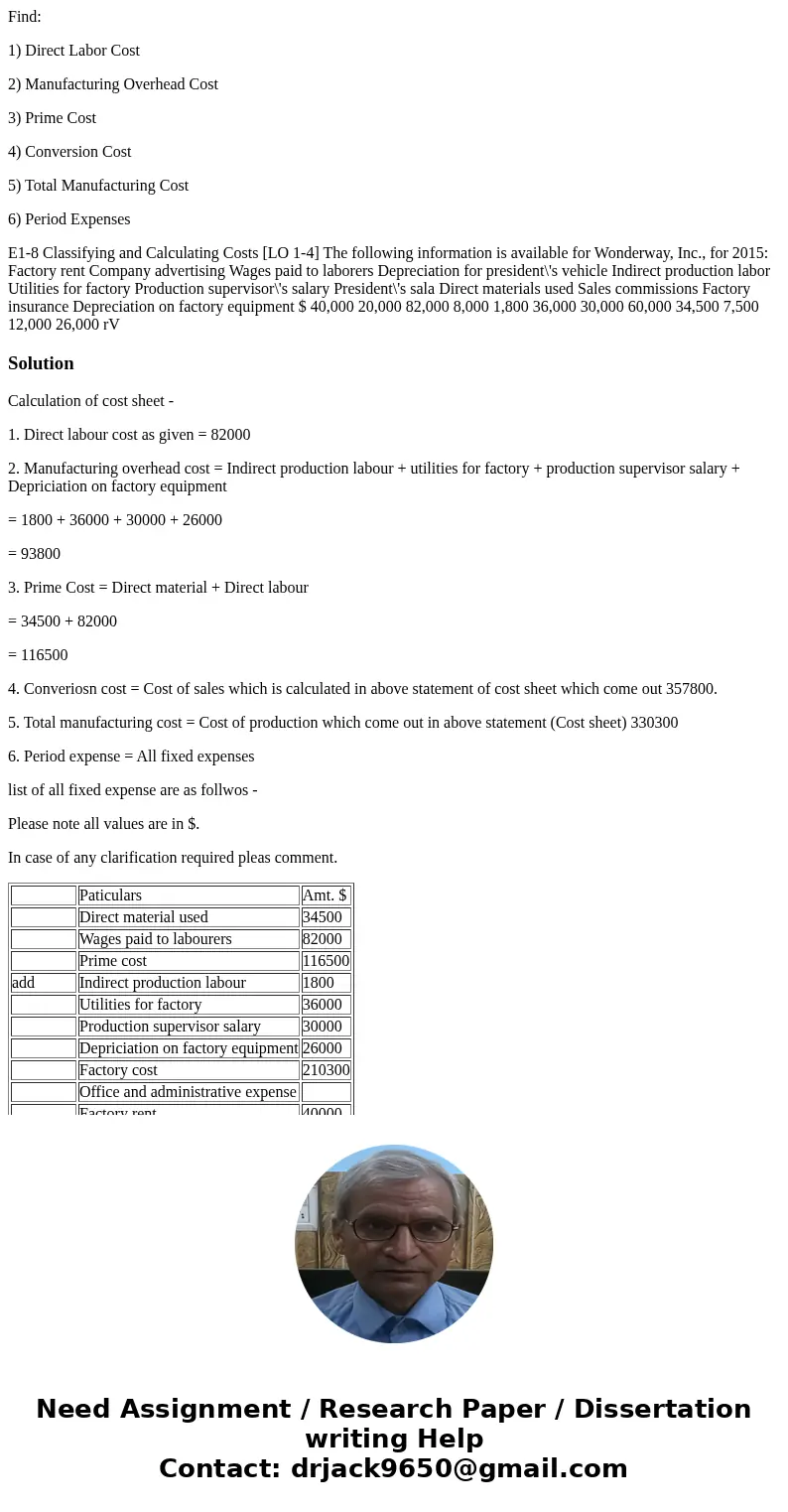

Calculation of cost sheet -

1. Direct labour cost as given = 82000

2. Manufacturing overhead cost = Indirect production labour + utilities for factory + production supervisor salary + Depriciation on factory equipment

= 1800 + 36000 + 30000 + 26000

= 93800

3. Prime Cost = Direct material + Direct labour

= 34500 + 82000

= 116500

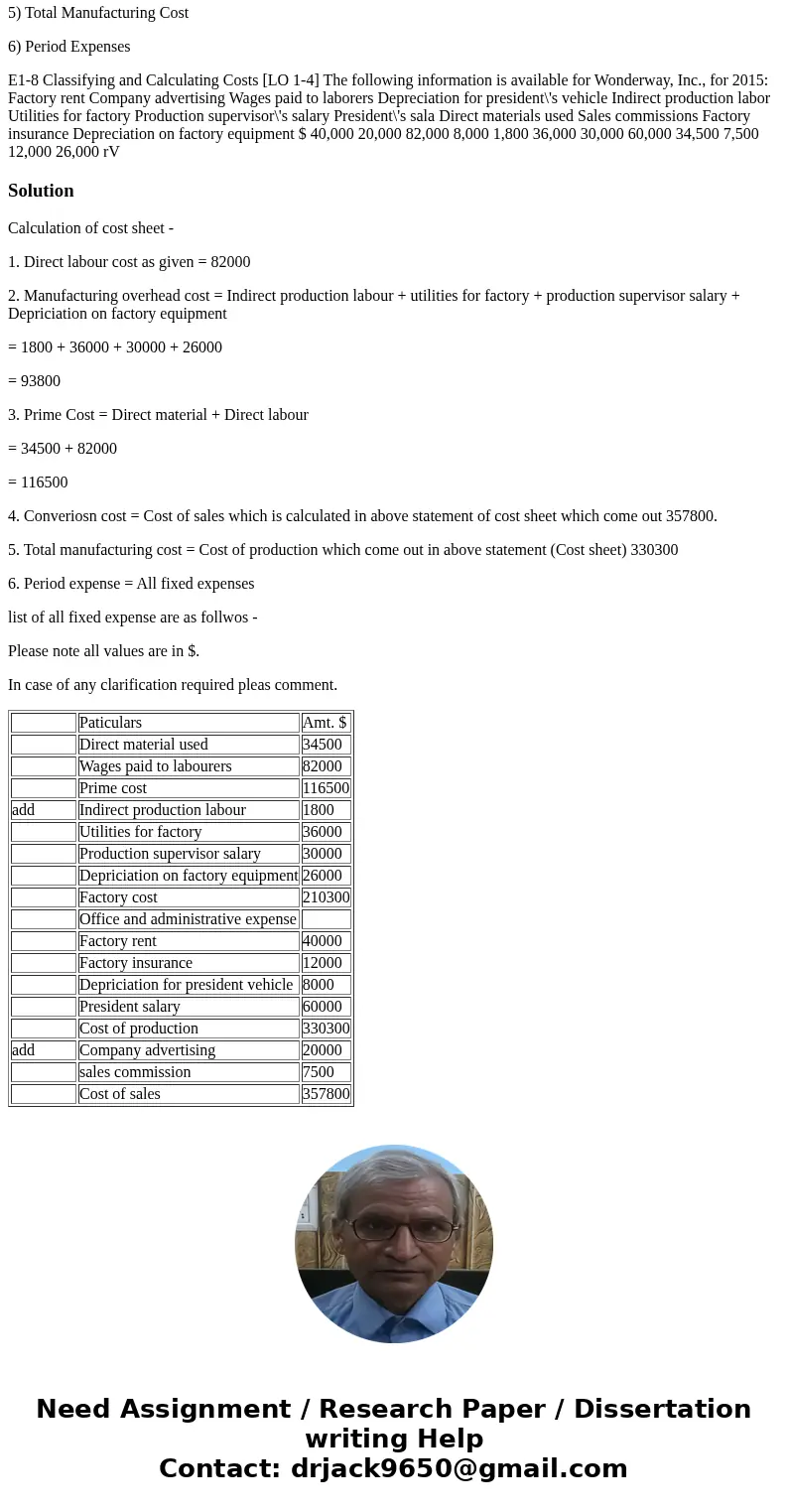

4. Converiosn cost = Cost of sales which is calculated in above statement of cost sheet which come out 357800.

5. Total manufacturing cost = Cost of production which come out in above statement (Cost sheet) 330300

6. Period expense = All fixed expenses

list of all fixed expense are as follwos -

Please note all values are in $.

In case of any clarification required pleas comment.

| Paticulars | Amt. $ | |

| Direct material used | 34500 | |

| Wages paid to labourers | 82000 | |

| Prime cost | 116500 | |

| add | Indirect production labour | 1800 |

| Utilities for factory | 36000 | |

| Production supervisor salary | 30000 | |

| Depriciation on factory equipment | 26000 | |

| Factory cost | 210300 | |

| Office and administrative expense | ||

| Factory rent | 40000 | |

| Factory insurance | 12000 | |

| Depriciation for president vehicle | 8000 | |

| President salary | 60000 | |

| Cost of production | 330300 | |

| add | Company advertising | 20000 |

| sales commission | 7500 | |

| Cost of sales | 357800 |

Homework Sourse

Homework Sourse