Please show solution step by stepSolutiona Computation of Pa

Please show solution step by step

Solution

a.

Computation of Payback Period:

Year

Cash Flow

\'Cum Cash Flow

0

$ (95,000)

$ (95,000)

1

$ 20,000

$ (75,000)

2

$ 25,000

$ (50,000)

3

$ 30,000

$ (20,000)

4

$ 35,000

$ 15,000

5

$ 40,000

$ 55,000

Payback Period = A +B/C

Where,

A = Last period with a negative cumulative cash flow = 3

B = Absolute value of a cumulative cash flow at the end of the period A = $ 20,000

C = Total cash flow during the period after A = $ 35,000

Discounted Payback Period = 3 +?$ (20,000) ?/$ 35,000

= 30 + $ 20,000/$ 30,000

= 3 + 0.57143

= 3.57143 or 3.57 years

b.

Computation of NPV:

Year

Cash Flow(C)

PV Factor calculation

PV Factor (F)

PV (= C x F)

0

$ (95,000)

1/(1+12%)^0

1

($95,000.00)

1

$ 20,000

1/(1+12%)^1

0.892857143

$17,857.14

2

$ 25,000

1/(1+12%)^2

0.797193878

$19,929.85

3

$ 30,000

1/(1+12%)^3

0.711780248

$21,353.41

4

$ 35,000

1/(1+12%)^4

0.635518078

$22,243.13

5

$ 40,000

1/(1+12%)^5

0.567426856

$22,697.07

NPV

$9,080.60

c.

Computation of IRR:

A

B

1

Year

Cash Flow

2

0

$ (95,000)

3

1

$ 20,000

4

2

$ 25,000

5

3

$ 30,000

6

4

$ 35,000

7

5

$ 40,000

8

IRR

15.36%

Excel formula for IRR is “=IRR(B2:B7)

IRR of the project is 15 %

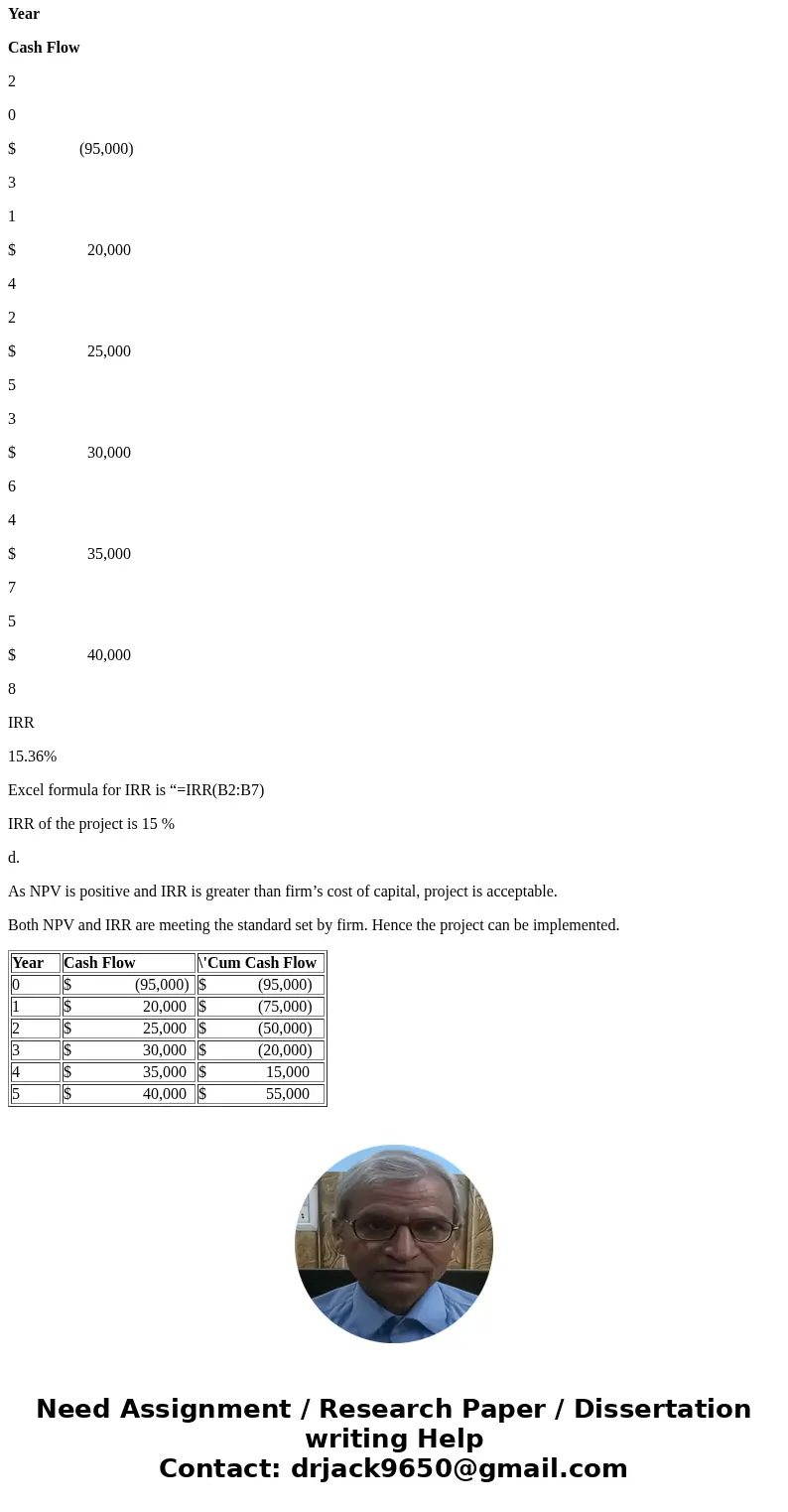

d.

As NPV is positive and IRR is greater than firm’s cost of capital, project is acceptable.

Both NPV and IRR are meeting the standard set by firm. Hence the project can be implemented.

| Year | Cash Flow | \'Cum Cash Flow |

| 0 | $ (95,000) | $ (95,000) |

| 1 | $ 20,000 | $ (75,000) |

| 2 | $ 25,000 | $ (50,000) |

| 3 | $ 30,000 | $ (20,000) |

| 4 | $ 35,000 | $ 15,000 |

| 5 | $ 40,000 | $ 55,000 |

Homework Sourse

Homework Sourse