Governmental and not for profit accounting Preston Village e

Governmental and not for profit accounting.

Preston Village engaged in the following transactions:

• It issued $20 million in bonds to purchase a new municipal office building. The proceeds were recorded in a capital projects fund.

• It acquired the building for $20 million.

• It recognized, as appropriate, $300,000 of depreciation on municipal vehicles.

• It transferred $2,060,000 from the general fund to a debt service fund.

• It paid $60,000 in interest on long-term debt and repaid $2 million of principal on the same long-term debt.

• It sold for $5 million village land that had been acquired for $4 million.

The proceeds were recorded in the general fund. Instructions: Answer the following question based on the transactions outlined above.

1. Prepare journal entries to reflect how the transactions would be reflected in government-wide statements (which are prepared on a full accrual basis).

2. How can governments justify preparing two sets of financial statements, each on a different basis?

Solution

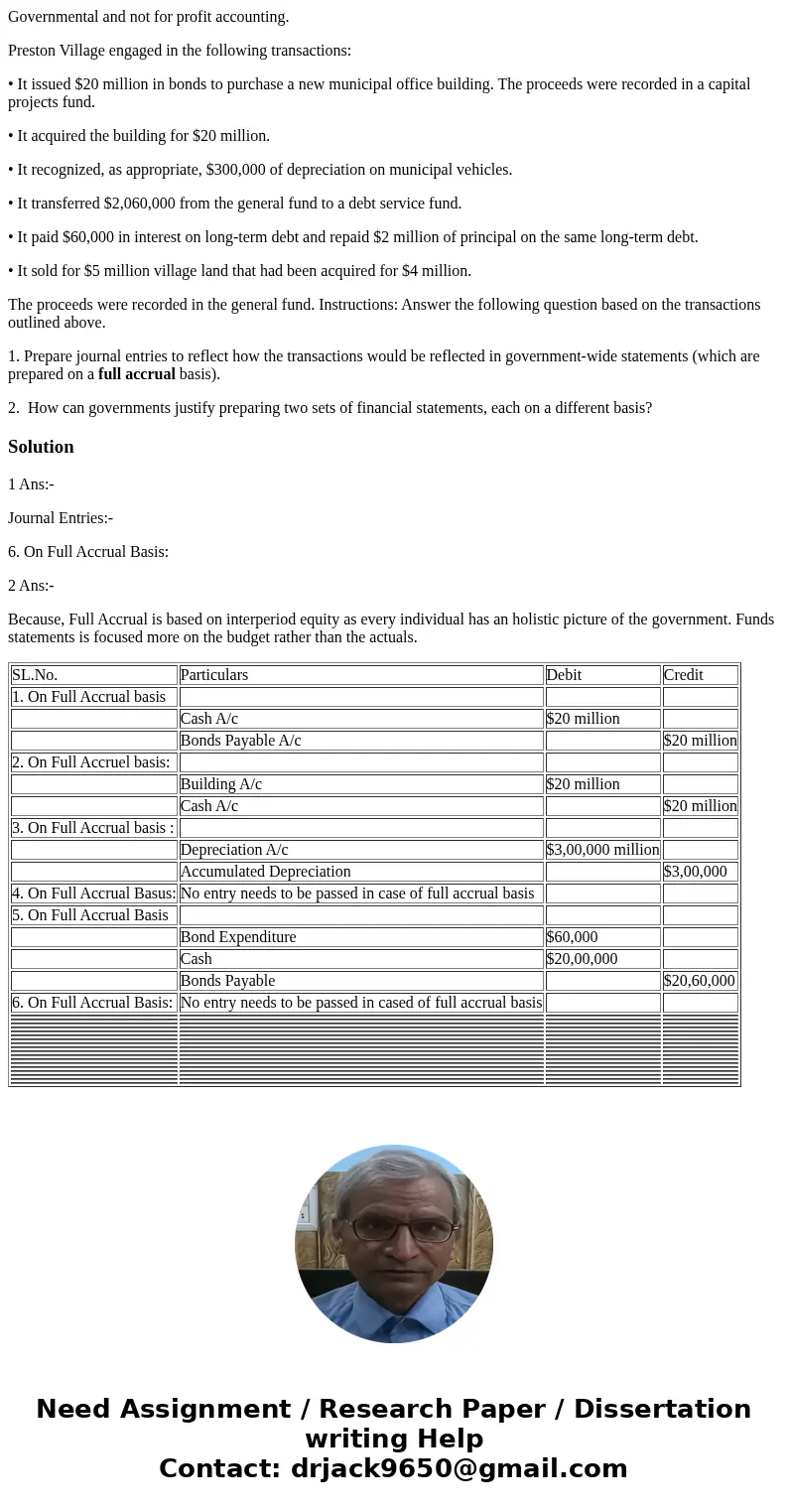

1 Ans:-

Journal Entries:-

6. On Full Accrual Basis:

2 Ans:-

Because, Full Accrual is based on interperiod equity as every individual has an holistic picture of the government. Funds statements is focused more on the budget rather than the actuals.

| SL.No. | Particulars | Debit | Credit |

| 1. On Full Accrual basis | |||

| Cash A/c | $20 million | ||

| Bonds Payable A/c | $20 million | ||

| 2. On Full Accruel basis: | |||

| Building A/c | $20 million | ||

| Cash A/c | $20 million | ||

| 3. On Full Accrual basis : | |||

| Depreciation A/c | $3,00,000 million | ||

| Accumulated Depreciation | $3,00,000 | ||

| 4. On Full Accrual Basus: | No entry needs to be passed in case of full accrual basis | ||

| 5. On Full Accrual Basis | |||

| Bond Expenditure | $60,000 | ||

| Cash | $20,00,000 | ||

| Bonds Payable | $20,60,000 | ||

| 6. On Full Accrual Basis: | No entry needs to be passed in cased of full accrual basis | ||

Homework Sourse

Homework Sourse