You are considering buying a sports car with a list price of

You are considering buying a sports car with a list price of $99,000. The dealer has offered you two payment alternatives: - You can get a $9,000 discount if you pay cash today. - You can buy the car for the list price of $99,000. You need to make a down payment of $39,000. The remainder $60,000 is a \"zero-interest loan\" to be paid back in equal installment over 36 months. Alternatively, your bank is willing to give you a car loan with APR of 10%, compounded monthly. Decide how to finance the car: bank loan, zero-interest loan with the dealer, or cash payment.

Solution

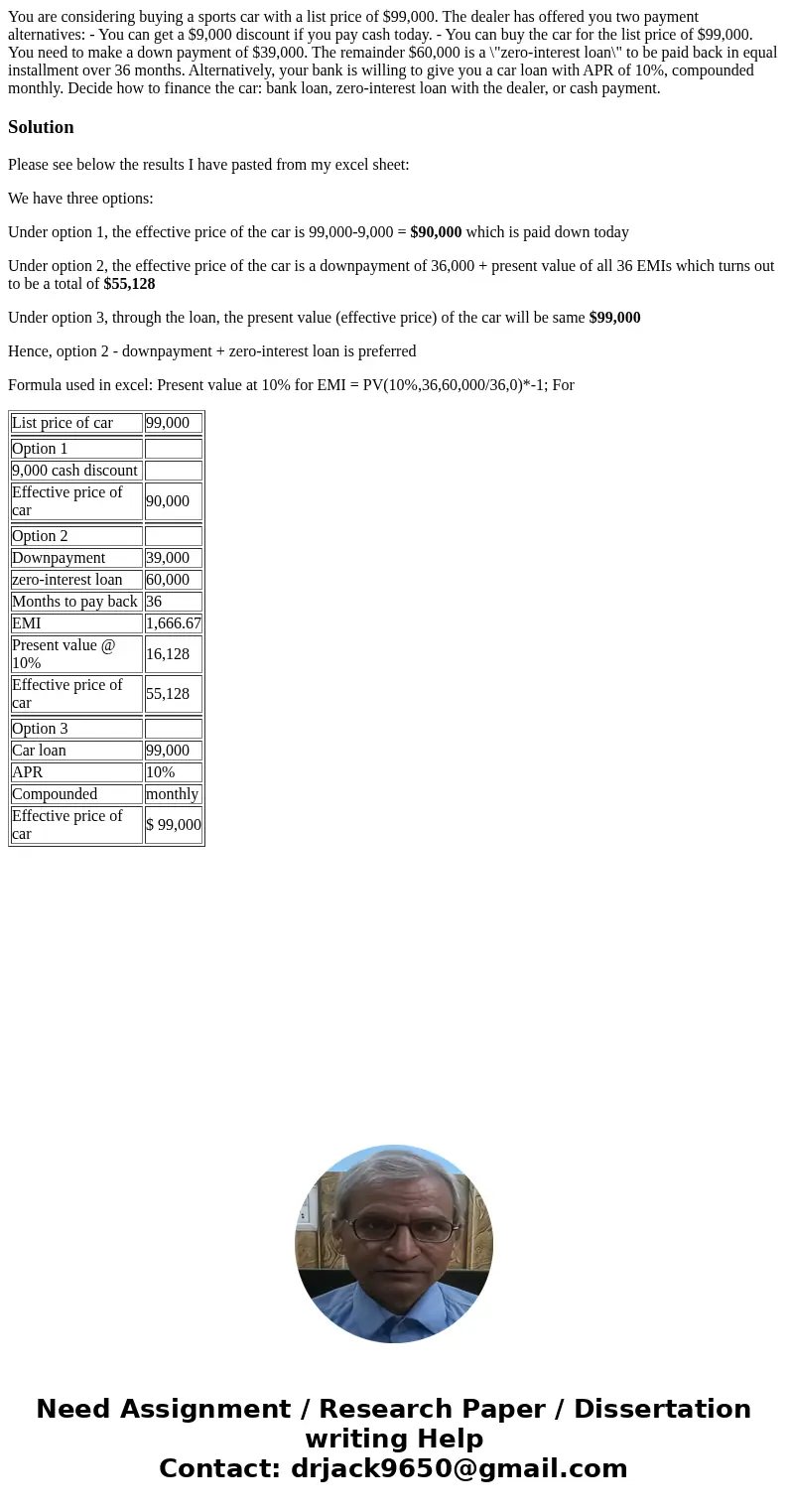

Please see below the results I have pasted from my excel sheet:

We have three options:

Under option 1, the effective price of the car is 99,000-9,000 = $90,000 which is paid down today

Under option 2, the effective price of the car is a downpayment of 36,000 + present value of all 36 EMIs which turns out to be a total of $55,128

Under option 3, through the loan, the present value (effective price) of the car will be same $99,000

Hence, option 2 - downpayment + zero-interest loan is preferred

Formula used in excel: Present value at 10% for EMI = PV(10%,36,60,000/36,0)*-1; For

| List price of car | 99,000 |

| Option 1 | |

| 9,000 cash discount | |

| Effective price of car | 90,000 |

| Option 2 | |

| Downpayment | 39,000 |

| zero-interest loan | 60,000 |

| Months to pay back | 36 |

| EMI | 1,666.67 |

| Present value @ 10% | 16,128 |

| Effective price of car | 55,128 |

| Option 3 | |

| Car loan | 99,000 |

| APR | 10% |

| Compounded | monthly |

| Effective price of car | $ 99,000 |

Homework Sourse

Homework Sourse