Sage Co is building a new hockey arena at a cost of 2370000

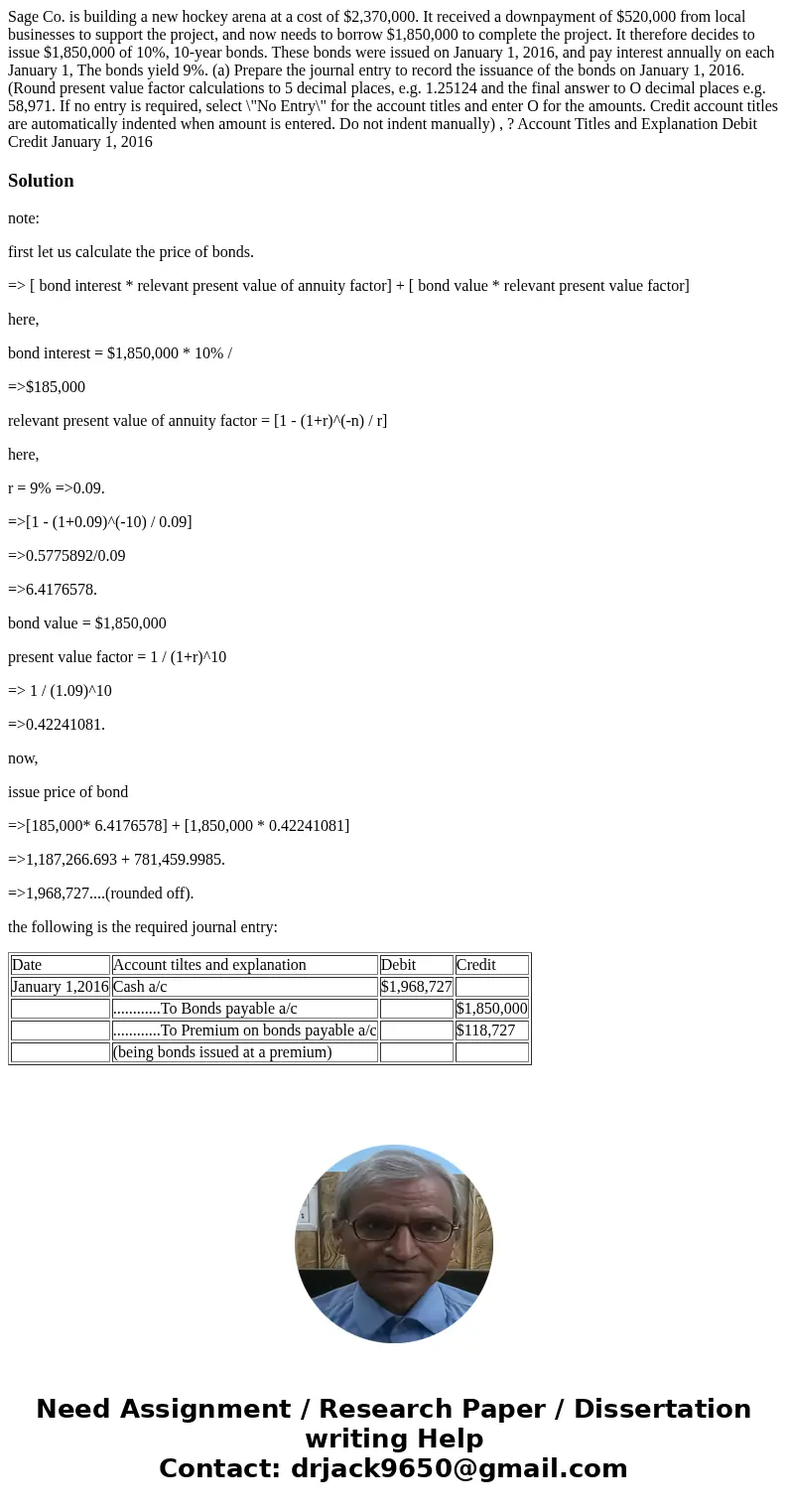

Sage Co. is building a new hockey arena at a cost of $2,370,000. It received a downpayment of $520,000 from local businesses to support the project, and now needs to borrow $1,850,000 to complete the project. It therefore decides to issue $1,850,000 of 10%, 10-year bonds. These bonds were issued on January 1, 2016, and pay interest annually on each January 1, The bonds yield 9%. (a) Prepare the journal entry to record the issuance of the bonds on January 1, 2016. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answer to O decimal places e.g. 58,971. If no entry is required, select \"No Entry\" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually) , ? Account Titles and Explanation Debit Credit January 1, 2016

Solution

note:

first let us calculate the price of bonds.

=> [ bond interest * relevant present value of annuity factor] + [ bond value * relevant present value factor]

here,

bond interest = $1,850,000 * 10% /

=>$185,000

relevant present value of annuity factor = [1 - (1+r)^(-n) / r]

here,

r = 9% =>0.09.

=>[1 - (1+0.09)^(-10) / 0.09]

=>0.5775892/0.09

=>6.4176578.

bond value = $1,850,000

present value factor = 1 / (1+r)^10

=> 1 / (1.09)^10

=>0.42241081.

now,

issue price of bond

=>[185,000* 6.4176578] + [1,850,000 * 0.42241081]

=>1,187,266.693 + 781,459.9985.

=>1,968,727....(rounded off).

the following is the required journal entry:

| Date | Account tiltes and explanation | Debit | Credit |

| January 1,2016 | Cash a/c | $1,968,727 | |

| ............To Bonds payable a/c | $1,850,000 | ||

| ............To Premium on bonds payable a/c | $118,727 | ||

| (being bonds issued at a premium) |

Homework Sourse

Homework Sourse