The business uses the following accounts Cash Accounts Recei

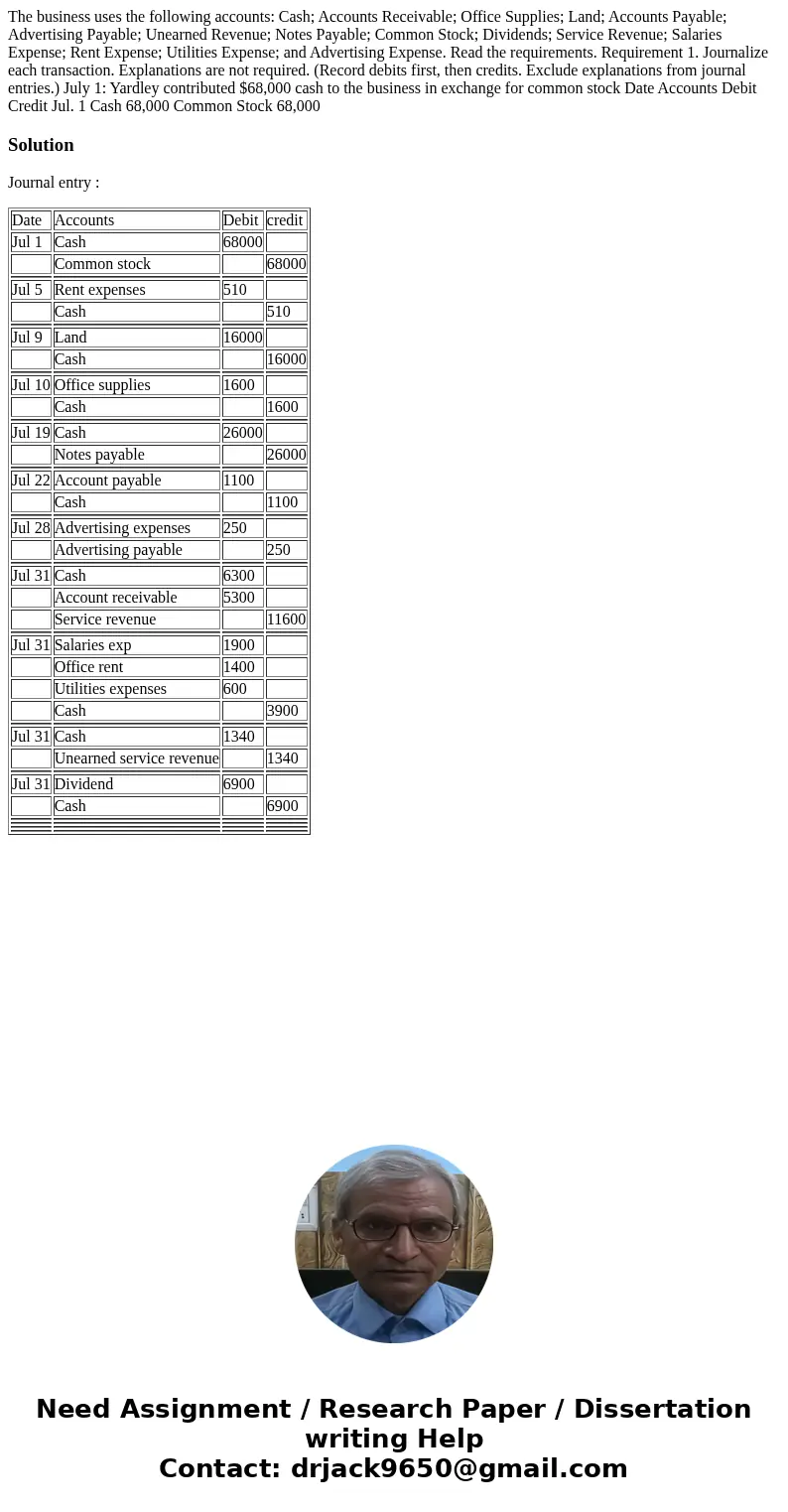

The business uses the following accounts: Cash; Accounts Receivable; Office Supplies; Land; Accounts Payable; Advertising Payable; Unearned Revenue; Notes Payable; Common Stock; Dividends; Service Revenue; Salaries Expense; Rent Expense; Utilities Expense; and Advertising Expense. Read the requirements. Requirement 1. Journalize each transaction. Explanations are not required. (Record debits first, then credits. Exclude explanations from journal entries.) July 1: Yardley contributed $68,000 cash to the business in exchange for common stock Date Accounts Debit Credit Jul. 1 Cash 68,000 Common Stock 68,000

Solution

Journal entry :

| Date | Accounts | Debit | credit |

| Jul 1 | Cash | 68000 | |

| Common stock | 68000 | ||

| Jul 5 | Rent expenses | 510 | |

| Cash | 510 | ||

| Jul 9 | Land | 16000 | |

| Cash | 16000 | ||

| Jul 10 | Office supplies | 1600 | |

| Cash | 1600 | ||

| Jul 19 | Cash | 26000 | |

| Notes payable | 26000 | ||

| Jul 22 | Account payable | 1100 | |

| Cash | 1100 | ||

| Jul 28 | Advertising expenses | 250 | |

| Advertising payable | 250 | ||

| Jul 31 | Cash | 6300 | |

| Account receivable | 5300 | ||

| Service revenue | 11600 | ||

| Jul 31 | Salaries exp | 1900 | |

| Office rent | 1400 | ||

| Utilities expenses | 600 | ||

| Cash | 3900 | ||

| Jul 31 | Cash | 1340 | |

| Unearned service revenue | 1340 | ||

| Jul 31 | Dividend | 6900 | |

| Cash | 6900 | ||

Homework Sourse

Homework Sourse