1 on January 1 2018 Carter Corporation wishes to issue 40000

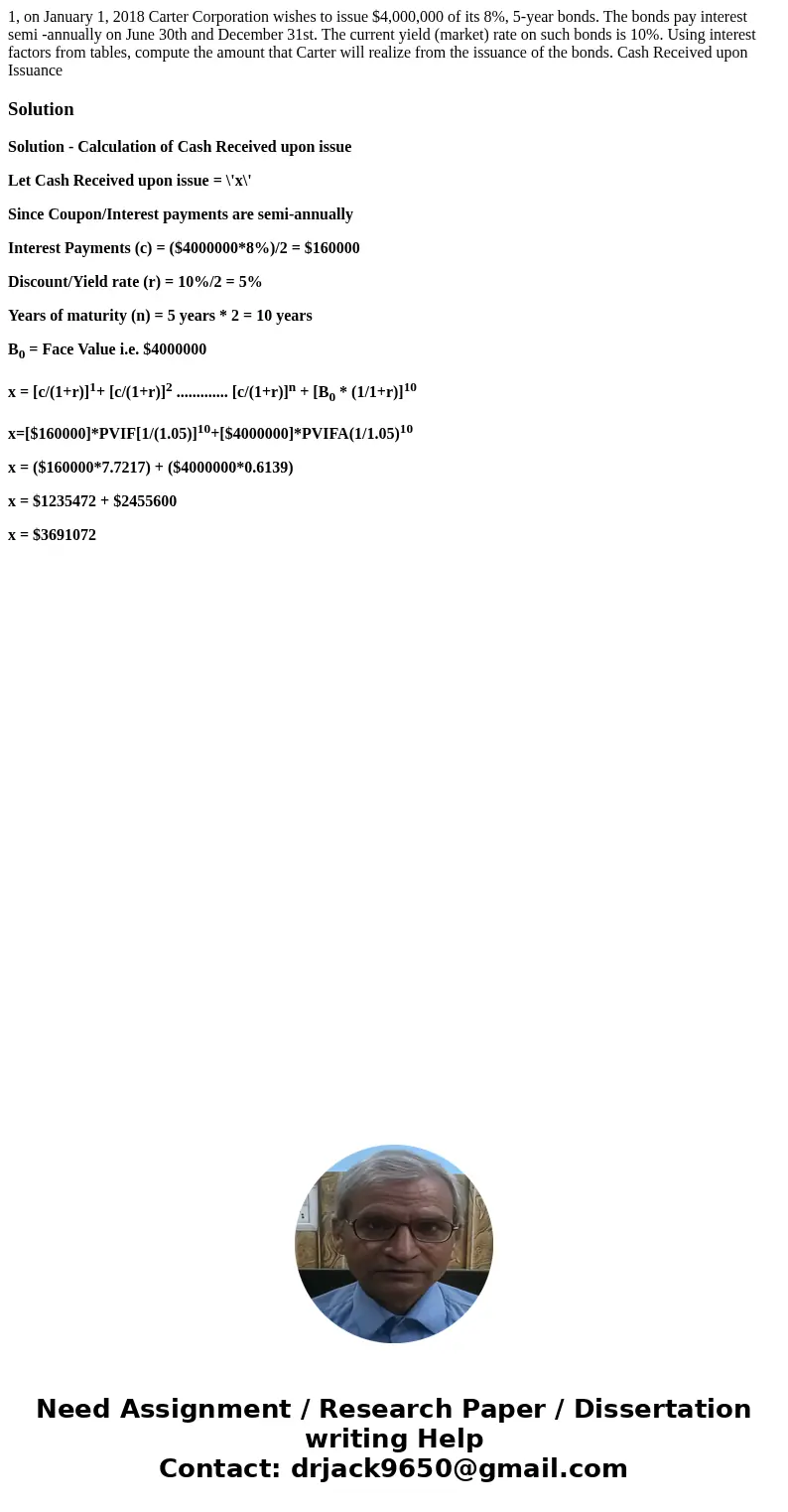

1, on January 1, 2018 Carter Corporation wishes to issue $4,000,000 of its 8%, 5-year bonds. The bonds pay interest semi -annually on June 30th and December 31st. The current yield (market) rate on such bonds is 10%. Using interest factors from tables, compute the amount that Carter will realize from the issuance of the bonds. Cash Received upon Issuance

Solution

Solution - Calculation of Cash Received upon issue

Let Cash Received upon issue = \'x\'

Since Coupon/Interest payments are semi-annually

Interest Payments (c) = ($4000000*8%)/2 = $160000

Discount/Yield rate (r) = 10%/2 = 5%

Years of maturity (n) = 5 years * 2 = 10 years

B0 = Face Value i.e. $4000000

x = [c/(1+r)]1+ [c/(1+r)]2 ............. [c/(1+r)]n + [B0 * (1/1+r)]10

x=[$160000]*PVIF[1/(1.05)]10+[$4000000]*PVIFA(1/1.05)10

x = ($160000*7.7217) + ($4000000*0.6139)

x = $1235472 + $2455600

x = $3691072

Homework Sourse

Homework Sourse