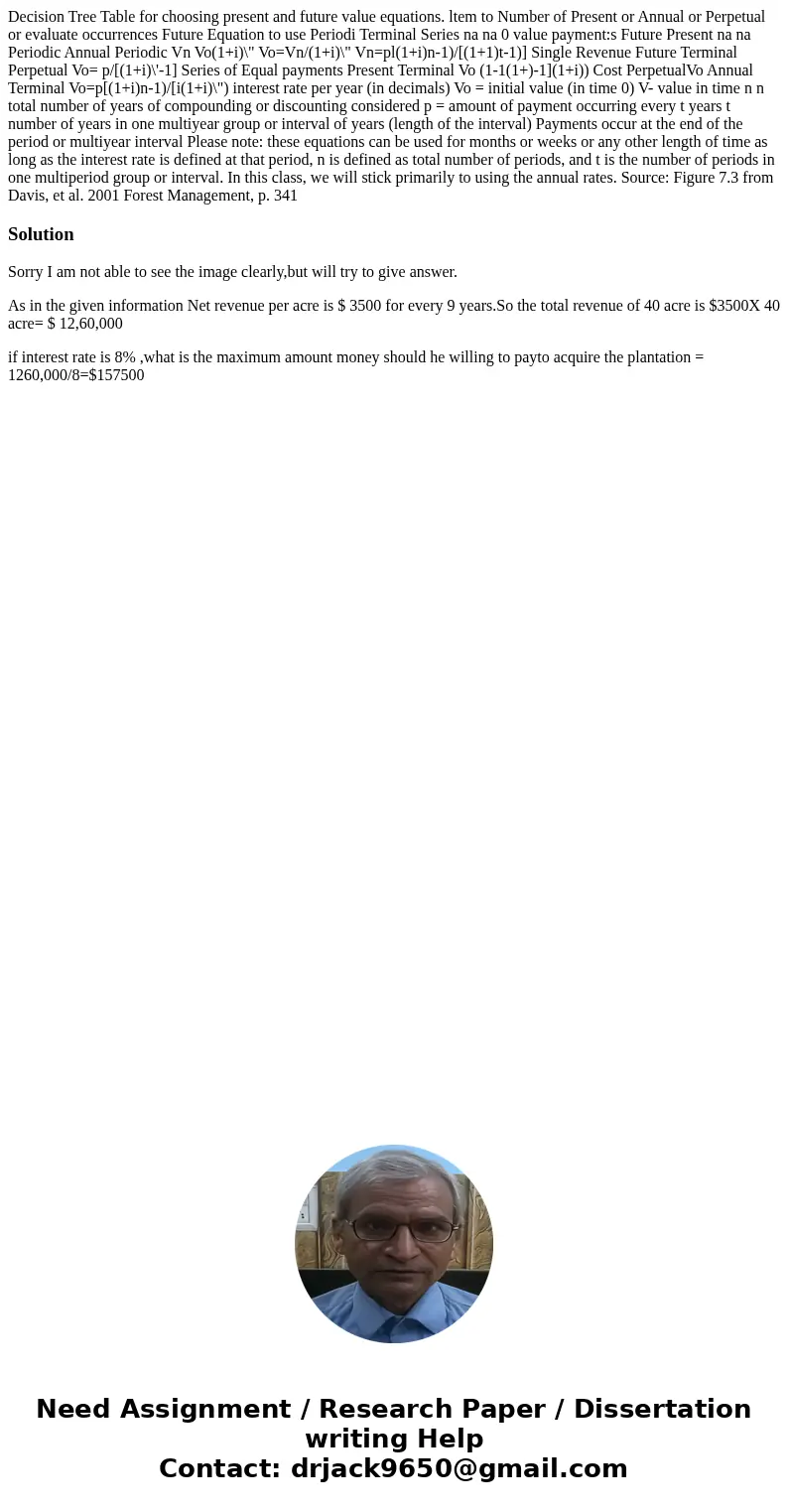

Decision Tree Table for choosing present and future value eq

Decision Tree Table for choosing present and future value equations. ltem to Number of Present or Annual or Perpetual or evaluate occurrences Future Equation to use Periodi Terminal Series na na 0 value payment:s Future Present na na Periodic Annual Periodic Vn Vo(1+i)\" Vo=Vn/(1+i)\" Vn=pl(1+i)n-1)/[(1+1)t-1)] Single Revenue Future Terminal Perpetual Vo= p/[(1+i)\'-1] Series of Equal payments Present Terminal Vo (1-1(1+)-1](1+i)) Cost PerpetualVo Annual Terminal Vo=p[(1+i)n-1)/[i(1+i)\") interest rate per year (in decimals) Vo = initial value (in time 0) V- value in time n n total number of years of compounding or discounting considered p = amount of payment occurring every t years t number of years in one multiyear group or interval of years (length of the interval) Payments occur at the end of the period or multiyear interval Please note: these equations can be used for months or weeks or any other length of time as long as the interest rate is defined at that period, n is defined as total number of periods, and t is the number of periods in one multiperiod group or interval. In this class, we will stick primarily to using the annual rates. Source: Figure 7.3 from Davis, et al. 2001 Forest Management, p. 341

Solution

Sorry I am not able to see the image clearly,but will try to give answer.

As in the given information Net revenue per acre is $ 3500 for every 9 years.So the total revenue of 40 acre is $3500X 40 acre= $ 12,60,000

if interest rate is 8% ,what is the maximum amount money should he willing to payto acquire the plantation = 1260,000/8=$157500

Homework Sourse

Homework Sourse