Below are five typical investment alternatives rank these fi

Below are five typical investment alternatives, rank these five from lowest risk to highest risk and explain your reasons for the ranking. In addition provide an example of a real investment that represents each alternative. Current stock price or current yield of the credit investment.

Large-company stocks

Small-company stocks

Long-term corporate bonds

U.S. Treasury Bills

Long-term Government Bonds(20-30year)

Solution

Security

Rank(lowest to highest)

Reason

US treasury Bills

1

U S treasury Bill are short term securities issued by Federal bank so here government backing is there so degree of risk is very low

Long term government Bonds

2

U S Government bonds are long term securities issued by Federal bank so here government backing is there and degree of risk is very higher incomparison to treasury bills because it has maturity period more than treasury bill

Long term Corporate bonds

3

Long term corporate bonds are long term securities issued by corporate houses so here default risk is higher in comparison to US treasury bonds and bills so here degree of risk is higher. But as long term corporate bonds are more safe in terms of fixed income in the form of interest and repayment of principal.

Large company stock

4

Large company stocks are more risk than corporate bonds as there is no guarantee of returns and principal amount and investment in large company stock is more risky

Small company Stock

5

Small company stocks are having highest form of risk than corporate bonds and large company stocks as there is no guarantee of returns and prinicple amount and investment in small company stock is more risky due to uncertainty of returns.

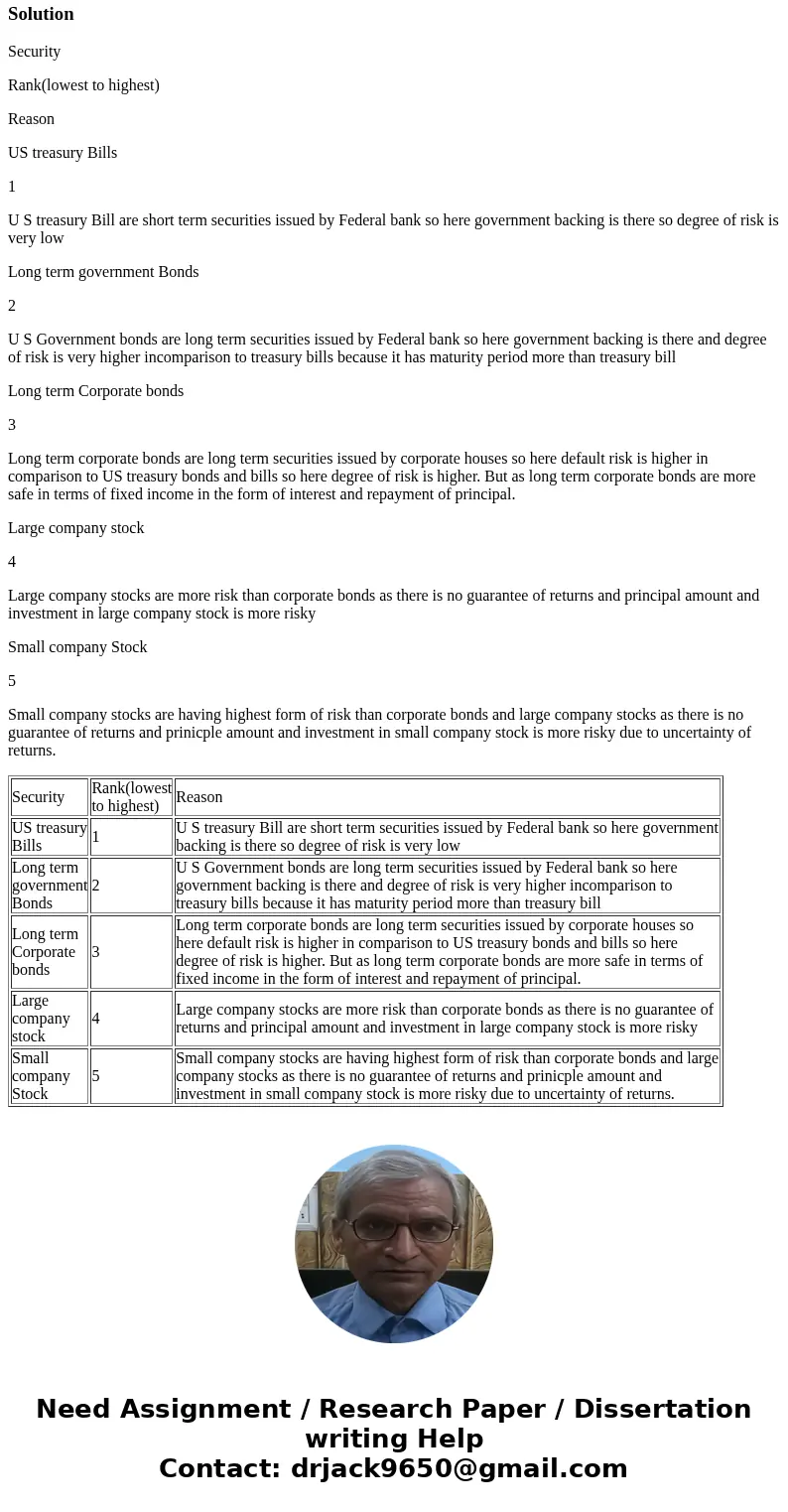

| Security | Rank(lowest to highest) | Reason |

| US treasury Bills | 1 | U S treasury Bill are short term securities issued by Federal bank so here government backing is there so degree of risk is very low |

| Long term government Bonds | 2 | U S Government bonds are long term securities issued by Federal bank so here government backing is there and degree of risk is very higher incomparison to treasury bills because it has maturity period more than treasury bill |

| Long term Corporate bonds | 3 | Long term corporate bonds are long term securities issued by corporate houses so here default risk is higher in comparison to US treasury bonds and bills so here degree of risk is higher. But as long term corporate bonds are more safe in terms of fixed income in the form of interest and repayment of principal. |

| Large company stock | 4 | Large company stocks are more risk than corporate bonds as there is no guarantee of returns and principal amount and investment in large company stock is more risky |

| Small company Stock | 5 | Small company stocks are having highest form of risk than corporate bonds and large company stocks as there is no guarantee of returns and prinicple amount and investment in small company stock is more risky due to uncertainty of returns. |

Homework Sourse

Homework Sourse